A couple of weeks ago, I shared how we planned to use the 2.5 million hotel points we’d saved up before leaving on our 50 state road trip.

After publishing that post, I realized it might be helpful to explain how we did that. After all, 2.5 million points is a significant amount of points. Most people would understandably assume they were earned by staying at hotels, perhaps thanks to a lot of business travel.

That’s not the case though. In fact, we hadn’t had that many paid hotel stays over the prior five years. So here’s how we accumulated that many hotel points. Hopefully it’ll give you some ideas for how to get some free or low cost hotel stays of your own.

This post will only be touching on each of the ways we earned these points, as it’d turn into a 20,000+ word essay if I went in depth on each point! I’m planning on expanding on these ideas in the future, so sign up for our weekly email newsletter to make sure you don’t miss out.

1) Credit Card Signup Bonuses

Credit card signup bonuses are how we’ve earned at least a third of our hotel points, although it’s probably a larger proportion than that.

To explain how that works, most credit cards offer a signup bonus. For example, at the time of writing the Hilton Ascend American Express credit card is offering 100,000 Hilton Honors points when spending $2,000 in three months. Considering you earn at least three points per dollar on all spend using that card, meeting the $2,000 minimum spend means you’d end up with at least 106,000 points.

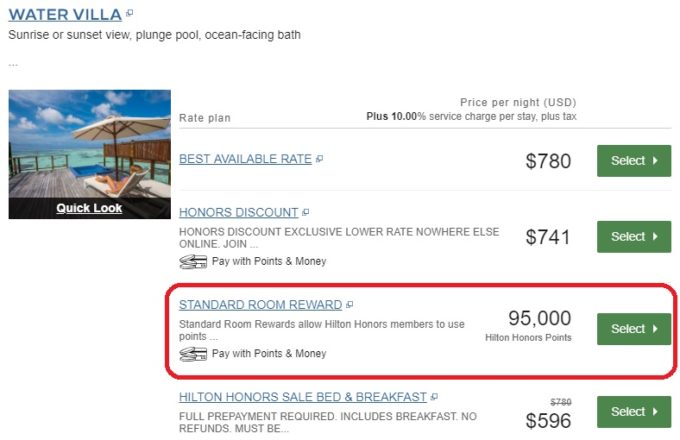

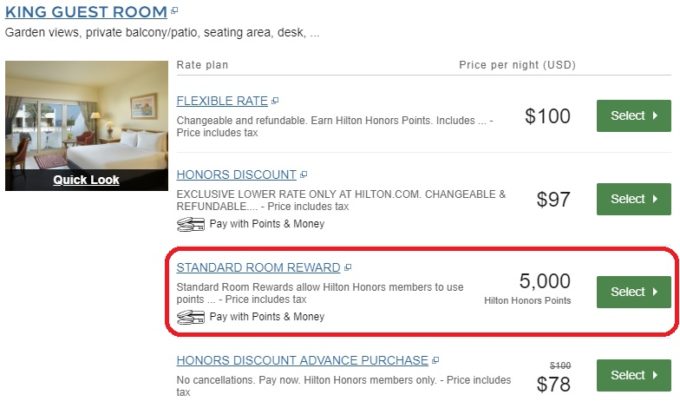

The value of 106,000 points varies based on which Hilton properties you use them at. For example, it’d only get you one night in a water villa at the Conrad Maldives.

At the other end of the spectrum, the Hilton Sharm Waterfalls Resort in Egypt only requires 5,000 points per night at various points throughout the year. The Hilton Ascend credit card comes with Gold status, so you’d also get the 5th night free on award stays. Your 106,000 points could therefore get you 26 nights at this property for free.

Spending 26 nights at the same hotel in Egypt is a niche redemption, so more realistically you could expect to get 2-6 free nights from the signup bonus for this card.

The good thing is that if you have a partner, both of you can get a hotel’s credit card. That means you could end up with 212,000+ Hilton Honors points.

A few important things to bear in mind regarding credit card signup bonuses:

- Only sign up for a credit card if you can pay it off each month. You shouldn’t be applying for cards like this if you’ll be carrying a balance as the interest costs will kill the value of the points you earn.

- Make sure you can meet the minimum spend requirement before applying for a card. There’s no point applying for a card where you have to spend $5,000 in three months to get a signup bonus if you’ve no way of spending an average of $1,667 per month.

- Apply for one card, then refer your partner. Many credit card issuers offer bonus points when referring friends and family. For example, you can often earn 20,000 Hilton Honors points for each person you refer. Be aware that there’s a limit to how many referral points you can earn each year though. If you signed up for the Hilton Ascend card, met the minimum spend, referred your partner and they met the minimum spend, you’d have 232,000+ Hilton Honors points.

For any Brits reading this, I’m afraid these lucrative signup bonuses are only available in the US. The UK sadly has much lower signup bonuses, so it’ll be harder for you to accrue points there using this method.

2) Credit Card Bonus Categories

Nearly all credit cards offer bonus points when spending money in certain categories. Some might offer bonus points when eating out. Others offer bonuses on travel. Others offer bonuses on spend at grocery stores.

Taking advantage of these bonus categories can greatly increase how many points you earn. For example, I tend to put our grocery store spend on one of our Hilton Ascend credit cards. That’s because that card earns 6 Hilton Honors points per dollar spent at grocery stores.

In the post about how we’d be using our hotel points, I explained our average redemption cost at Hilton properties would be 13,333 points per night. That means we earn enough points for a free night for every $2,222 spent at grocery stores.

By comparison, $2,222 of spend on a credit card earning 2% cashback would net you $44.44. That’s not too shabby, especially as $44.44 can be spent on anything rather than being restricted to a hotel chain. However, given that we’re living in hotels and Airbnbs, I value a free hotel night more highly than $44.44.

It can get even better than that though. For example, our stay at the Hampton Inn Enterprise in Alabama had a net cost of 7,550 points per night when taking into account the 5th night free and bonus points earned on the stay.

That means each free night cost the equivalent of $1,258 in spend at the grocery store. For those of you that spend a lot at grocery stores, points can quickly rack up.

We use different cards for different stores. Shae has the Chase Sapphire Reserve which offers 3 Ultimate Rewards points for every dollar spent on travel and dining. That constitutes a significant portion of our expenses nowadays, so we put a lot of spend on that card.

When paying for hotel stays, we often use the hotel chain’s credit card as they usually offer a good bonus. For example, the new IHG Premier credit card offers 10 IHG Rewards Club points when paying for stays at IHG hotels. I value 10 IHG Rewards Club points more highly than 3 Ultimate Rewards points, so that’s why we don’t use the Chase Sapphire Reserve card for stays at IHG properties. Similarly, our Hilton Ascend cards earn 12 points per dollar at all of Hilton’s brands.

3) Hotel Stays

I mentioned at the start of the post that most of our points haven’t come from paid hotel stays. However, some points have and so it’s important to include that here.

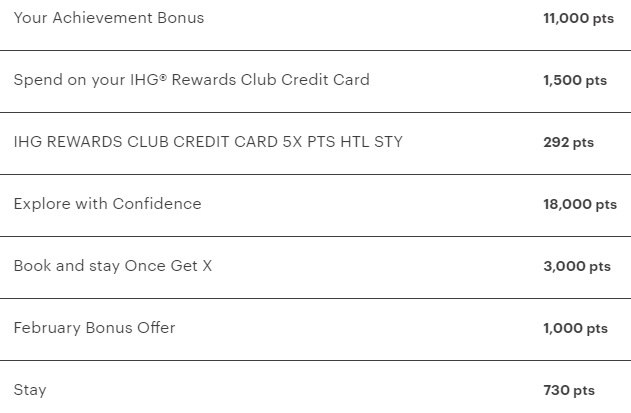

We’ve always tried to maximize hotel promotions as that’s a great way to earn a chunk of points. For example, thanks to a generous IHG Accelerate promotion, we earned over 35,000 IHG Rewards Club points for only $54.

Most hotel promotions aren’t quite as generous as that one, but they’re still worth being aware of.

4) Gift Card Reselling

This isn’t for the faint of heart as there’s some risk involved, but it can be a good way to rack up points. The gist of it is that you buy first-hand gift cards at a discount and then resell them. The aim is to at least break even or, ideally, make a few dollars on each gift card. You also then earn points from your credit card as a bonus.

It’s important to note that you need to buy first-hand gift cards. That’s where you buy brand new gift cards at a discount directly from a retailer (e.g. the retailer themselves, your grocery store, Staples, etc.) rather than buying discounted gift cards from resellers like Raise. Alternatively, it can work when buying full-price gift cards if there are profitable Amex Offers.

For example, there was a great Amex Offer a couple of years ago offering 20% back at Sam’s Club on up to $1,250 of spend. That meant spending the full $1,250 got you a $250 statement credit, a net cost of $1,000.

If you bought $1,250 in Sam’s Club gift cards, you could resell them for about 89% of their value. 89% of $1,250 is $1,112.50, while your net outlay would’ve been $1,000 ($1,250 minus the $250 statement credit). You’d therefore have earned $112.50 profit when reselling the cards, along with 1,000 points on your credit card.

That deal was especially lucrative, but there are frequently deals where you can break even or profit and earn credit card points. I’ll write a post in the future going into more detail.

Edit: I’ve set up a brand new website called GC Galore which lists every discounted gift card deal available. On that site, I’ve produced several guides, including 25+ ways to save money on gift cards and 20+ beginner tips for successful gift card reselling.

Gift card reselling isn’t without its risks though. I’d been reselling gift cards with The Plastic Merchant until they recently went under. We got hit by that as their bounced checks meant we lost ~$1,000. We were fortunate though in comparison to many others. In one Facebook group I’m part of, someone reported that they lost ~$25,000 – ouch!

It’s therefore important to ease into gift card reselling and not risk more than you can afford to lose.

5) Shopping Portals

There are dozens of shopping portals out there that offer cashback, airline miles or hotel points. If you’re not familiar with how these work, you click through from a portal, buy something and earn a certain percentage of what you spend.

Different portals offer different rates, so it’s important to compare rates using Cashback Monitor. For example, at the time of writing Macy’s is offering anything from 1.5% – 10% cashback or 1.5 – 7 miles per dollar.

I don’t think I’ve ever used a hotel’s shopping portal as they generally don’t offer good rates compared to the cashback and airline portals. Having said that, I have often used the Chase Ultimate Rewards shopping portal. That sometimes offers good rates and those points can be transferred to Hyatt for free hotel stays.

6) Buying Points

Hotel chains sell their points year-round and several times a year they offer a discount on how much it costs to buy them. There have been times we’ve bought IHG and Choice points at a good discount which has been worth it as we get far more value than we paid for them when redeeming them for stays.

Final Thoughts

Using the five methods above is how we earned 2.5 million hotel points. It took several years and hard work to reach that balance, so it’s not an overnight success story. However, I hope it gives you some good ideas though for how you can start building up your own points balances.

[…] For comparison, we spent an average of $24.79 per night on hotels and Airbnbs in 2019 thanks to hotel points, discounted gift cards, Amex Offers, […]