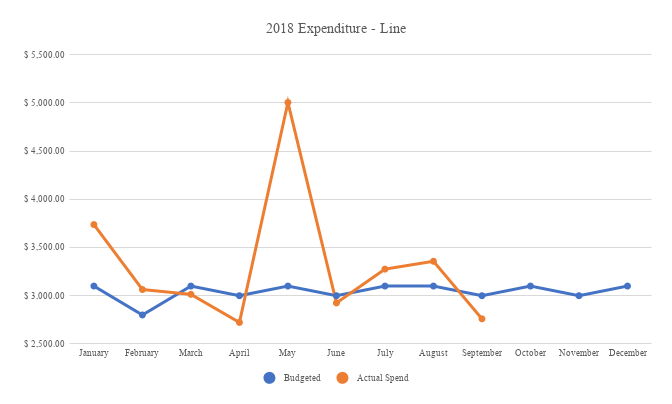

Our ability to stay within our budget in the first year of our 5 year road trip hasn’t been great. We’ve gone over budget more frequently than we’ve stayed under, but I was optimistic that September 2018 would add to our list of under budget months.

That’s because our accommodation expenses were due to be lower than average thanks to significantly lower hotel costs than normal. Most of our stays in September were booked using points, so in theory that should’ve left us with plenty of money left over.

And it did.

The problem was that we then ended up spending more in other categories with that left over money. Our eating out expenses in particular ended up waaaaay higher than expected.

But did we manage to stay under budget nonetheless? Read on to find out.

Miles Driven

We started September with 96,929 miles on our car and ended the month at 99,430 miles. That means we drove 2,501 miles last month.

That’s significantly more miles than I’d been expecting. I’d predicted last month that we’d drive about 1,750 miles, so I was way off with that estimate.

The main reason for the excess mileage is because we took a few longer-than-expected journeys while in Illinois. I drove out to Champaign for a Counting Crows concert, we had a four hour round trip to Hardy’s Reindeer Ranch and something like a three hour round trip to Casey to see some of the world’s largest roadside attractions. That was topped off when leaving Illinois when we drove to the wrong city, so had to drive an additional 170 miles that afternoon to get to the right place.

Despite getting it so wrong last month, I’ll take a guess at how many miles we’ll drive in October. We’re moving on from Oklahoma down to Texas in a couple of days. Most of the month will be spent in Dallas and Austin, so in theory we wouldn’t do all that much driving.

Having said that, Dallas and Austin are surrounded with things to do, so we’ll likely do a lot of driving to get to those. I’m therefore going to predict that we’ll drive 2,500 miles in October. Hopefully I’m wrong as that’ll mean our gas bill is lower!

Money Spent

I mentioned earlier that we’d ended up spending more than we’d been hoping, but did we still stay within our budget?

Well, our budget is $100 per day, so with 30 days in September we had $3,000 to play with. We ended the month having spent $2,755.37, so we were $244.63 under budget. Phew.

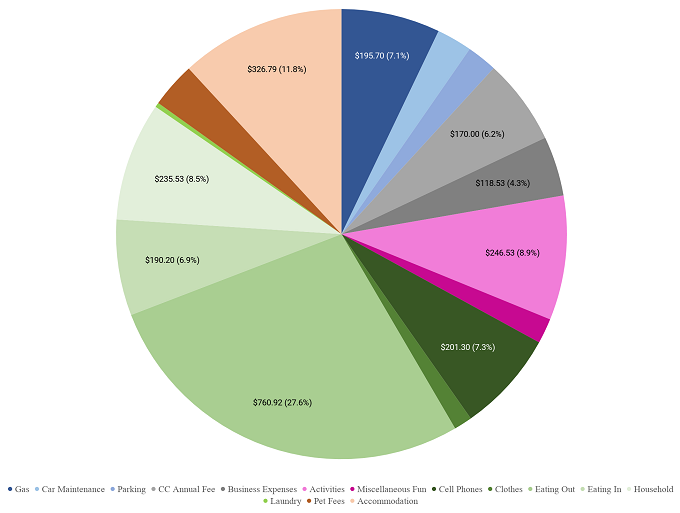

Our largest expense was eating out where we spent $760.92 – ouch! Some of that is due to Shae meeting up with her best friend in Indianapolis for a few days as it meant they ate out a lot. We also spent something like $80 at the Tulsa State Fair eating some fun fair food, so that accounts for more than 10% of that expense.

All our driving meant we spent almost $200 on gas, while we also spent $170 on credit card annual fees (although the free night certificates from those cards make that expense worthwhile).

Our accommodation expenses for October are due to be much higher, so we’ll have to be much stricter with our spending this month to stay on budget.

Here’s a breakdown of all our spending from last month…

…along with an update of how we’ve done throughout the year.

Points Earned

We managed to replenish our hotel points balances a little during September. Although most of our stays last month were paid for using points, we’d booked those stays in previous months and so those redemptions had already been allocated.

I signed up for the new IHG Premier credit card a couple of months ago, so the 80,000 signup bonus points were credited to my IHG Rewards Club account last month. We also earned quite a few Hilton Honors points by people using one of our referral links to get one of the Hilton credit cards.

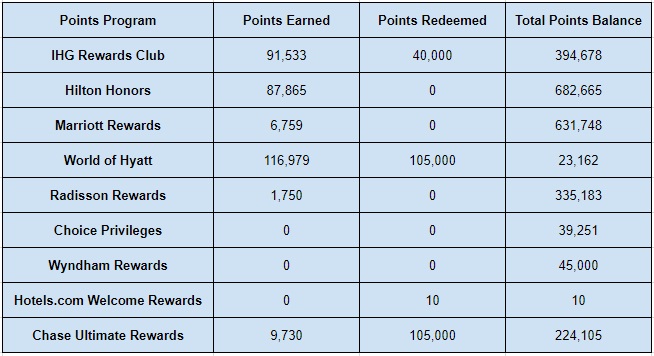

Here’s a list of which hotel loyalty schemes we earned points with last month.

- IHG Rewards Club – 91,533

- Hilton Honors – 87,865

- Marriott Rewards – 6,759

- World of Hyatt – 116,979 (most of these points were transferred over from our Chase Ultimate Rewards balance)

- Radisson Rewards – 1,750

- Choice Privileges – 0

- Wyndham Rewards – 0

- Hotels.com Welcome Rewards Credits – 0

- Chase Ultimate Rewards – 9,730

Points Redeemed

Most of our points in September were redeemed with World of Hyatt. They’re a transfer partner of Chase Ultimate Rewards (UR), so I moved over more than 100,000 UR to book those stays. About half those points were for our 10 nights in Bali next year.

The other redemption was for a five night stay at an IHG property in November. Their credit card that I mentioned above offers the 4th night free on award stays, so those 40,000 points are getting us five nights in a hotel that’s charging 10,000 points per night.

Here’s a list of all the points we spent last month:

- IHG Rewards Club – 40,000

- Hilton Honors – 0

- Marriott Rewards – 0

- World of Hyatt – 105,000

- Radisson Rewards – 0

- Choice Privileges – 0

- Wyndham Rewards – 0

- Hotels.com Welcome Rewards Credits – 10 (10 credits equals a free night)

- Chase Ultimate Rewards – 105,000

Total Points Balances

Based on all the points we earned and redeemed listed above, here are final points balances for the month of September 2018.

- IHG Rewards Club – 394,678

- Hilton Honors – 682,665

- Marriott Rewards – 631,748

- World of Hyatt – 23,162

- Radisson Rewards – 335,183

- Choice Privileges – 39,251

- Wyndham Rewards – 45,000

- Hotels.com Welcome Rewards Credits – 10

- Chase Ultimate Rewards – 224,105

Here’s all that information in table format:

Blog Stats

Here’s how many blog posts we published and how many page views we had during September.

- Number of blog posts published – 21

- Page views – 14,794

Final Thoughts

It’s a relief that we ended under budget, although it’s a little disappointing that we didn’t spend even less given how low our accommodation costs were.

Still, we get to travel full-time and it cost us less than $2,800 in September, so it’s not too shabby an effort!

Leave a Reply