Putting together our stats each month can be a bit depressing at times.

Our travel budget is $100 per day which includes everything – accommodation, gas, food, activities, hotel pet fees, cellphone bill, etc. In the first year of our road trip, we ended up spending an average of $108.82 per day.

Put like that, it doesn’t sound terrible – after all, $8.82 isn’t very much. But that was an average overspend of $8.82 every single day. That means by the end of 2018, we’d overspent by more than $3,200. If you’re interested, you can find each month’s stats here which includes details about each month’s spending and how it ended up so high.

We were determined to do better during year 2 of our road trip and just finished up the first month of the new year. Did last year’s habit of overspending continue, or did we manage to get back on track? Read on to find out more.

Miles Driven

We ended 2018 with our odometer reading 107,021. By the end of January, we had 109,137 miles on the clock which means we drove 2,116 miles in January. I predicted last month that we’d drive 2,100 miles, so I’m pretty pleased with how close that guess was 🙂

Seeing as I’ve done well with guessing how many miles we’ll drive for the last couple of months, I’ll give it another go for February. It’s a little harder this month as we’ll be spending more time on the road because we’re heading to Washington D.C. after leaving Kansas (our 50 state road trip isn’t the most efficient route you could take!)

Given how far that drive is, I’m estimating we’ll be putting 3,200 miles on the car during February. That might be an overestimate as it’ll depend on where we stay when we’re in the D.C. area. If we stay in D.C. itself, we probably won’t be driving much. We might be staying with friends who live just outside of D.C. though; if so, we’ll likely be doing more driving back and forth. That adds a little bit of hassle, but it’d be free accommodation which will help with our budget.

Money Spent

I’m pleased to say that we caned our budget last month. With a budget of $100 per day, we had $3,100 to play with in January.

We spent about half the month in hotels we paid for using points, while the rest of the month was mostly spent at low-cost Airbnb properties. Thanks to our low accommodation costs, we managed to restrict our spending to $2,594.27. That means we were under budget by $505.73 which is a fantastic result.

Even our food expenditure was more reasonable compared to normal. We spent a total of ~$620 on eating in and out last month which, while more than many people on a strict budget would spend, is less than how much we normally spend. During 2018, we spent an average of ~$850 per month on groceries and eating out, so hopefully we can maintain this lower spend throughout the year.

I’m not convinced we’ll be as successful as staying $500 under budget during February, especially considering how much we’ll need to spend on gas driving back east. We only have our accommodation sorted out up to February 20, so it’ll partly depend on if we use points, pay for accommodation or stay with friends at the end of the month. To be honest, I’ll be happy if we simply stay on budget.

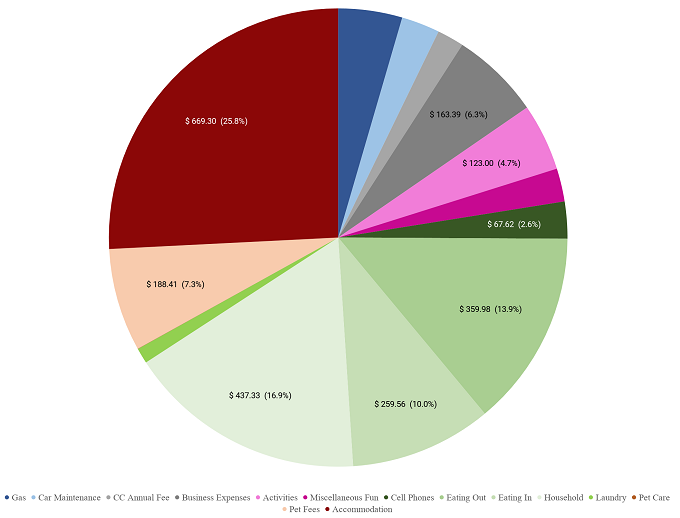

As always, here’s a breakdown of our spending from last month…

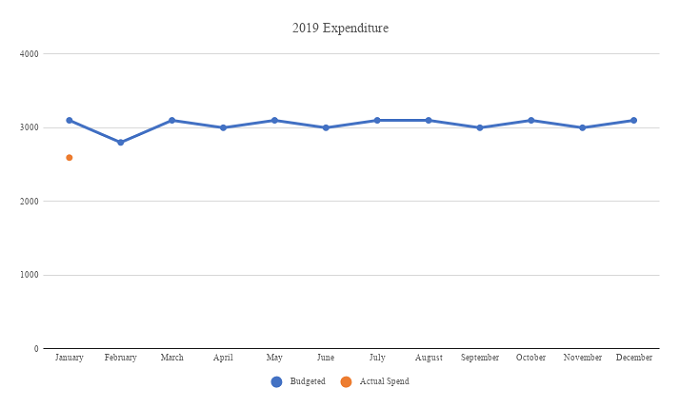

…along with a chart tracking our overall spending over the course of this year.

Points Earned

Seeing as we only had one paid hotel stay in January, we didn’t earn many points last month. We did get a decent chunk of points from Marriott, but most of those were bonus points from a couple of different credit cards.

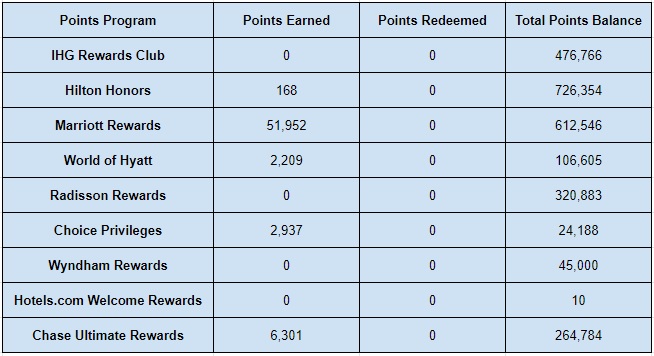

Here’s a breakdown of how many points we earned last month:

- IHG Rewards Club – 0

- Hilton Honors – 168

- Marriott Rewards – 51,952

- World of Hyatt – 2,209

- Radisson Rewards – 0

- Choice Privileges – 2,937

- Wyndham Rewards – 0

- Hotels.com Welcome Rewards Credits – 0

- Chase Ultimate Rewards –6,301

Points Redeemed

Although we had several stays booked on points in January, those reservations were all made during December. As a result, we didn’t end up redeeming any points last month which makes the following section nice and easy to complete.

- IHG Rewards Club – 0

- Hilton Honors – 0

- Marriott Rewards – 0

- World of Hyatt – 0

- Radisson Rewards – 0

- Choice Privileges – 0

- Wyndham Rewards – 0

- Hotels.com Welcome Rewards Credits – 0

- Chase Ultimate Rewards – 0

Total Points Balances

Based on the points we earned in January, here were our total hotel points balances at the end of last month.

- IHG Rewards Club – 476,766

- Hilton Honors – 726,354

- Marriott Rewards – 612,546

- World of Hyatt – 106,605

- Radisson Rewards – 320,883

- Choice Privileges – 24,188

- Wyndham Rewards – 45,000

- Hotels.com Welcome Rewards Credits – 10

- Chase Ultimate Rewards – 264,784

Here’s all the details of our points in table format seeing as it can be easier to take in that way:

Blog Stats

If you’re interested in knowing how the blog did last month, here are a couple of stats:

- Number of blog posts published – 19

- Page views – 17,121

Final Thoughts

It’s incredibly pleasing to have stayed so far under budget last month. Now that we’ve proven to ourselves that we can do that, we’ll hopefully be able to do it again.

A big factor in our budget each month is our accommodation and hotel pet fee costs though. It’s not always as easy keeping those costs low, so we’ll have to see how low we can keep those throughout the rest of the year.

I really enjoy reading your recaps of the past months. I am continually amazed at how you two have woven everything together to meet all your needs. It seems that you have the blueprint for a fantastic travel book for those who would like to try to roam for any number of years.

Thank you, I’m glad you enjoy these posts 🙂