When writing up our stats for December 2019, I mentioned at the end of that post that I thought we’d be going over budget in January. The reason why is because, as sometimes happens on the road trip, our accommodation costs were due to be higher than normal.

It turns out that prediction was true, although we managed to stay within our budget for much longer than I’d expected. That means that even though we overspent, it was by less than I feared and so I’m pretty pleased with the end result.

Here’s more about how we did with our budget, along with all our other stats for January 2020.

Miles Driven

We started the year with 132,027 miles on our car, while by the end of January the odometer reading was 133,937. That means that we drove 1,910 miles last month. I predicted in last month’s stats that we’d drive 1,925 miles in January, so that’s as close as I’ve ever been with my guesses – woo-hoo!

We’ll be driving a lot more during February compared to last month as we’re heading west from Louisiana to Arizona. I’m therefore going to guess that we’ll drive 3,375 miles in February – hopefully my guess will be just as close by the time I write next month’s stats post 🙂

Money Spent

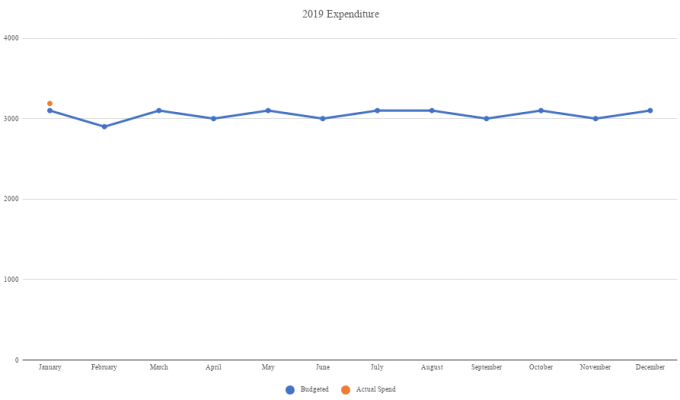

In case you’re new to our 50 state road trip and this stats series, each month we share a lot of our stats including our budget. We’re currently doing our road trip on a budget of $100 per day. This has to include accommodation, gas, activities, food, hotel pet fees, phone bill, etc. With 31 days in January, that means we had a budget of $3,100 last month.

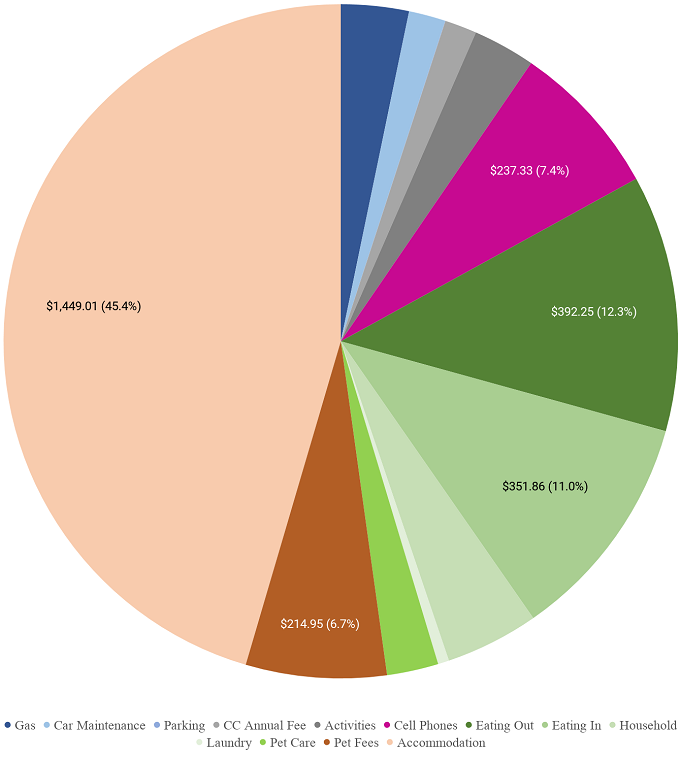

By the end of last month we’d spent $3,188.26 which means we were $88.26 over budget. That’s not too shabby at all considering more than half the budget went towards accommodation and pet fees. We got a little lucky with our pet fee expenses though as the Hyatt Place Biloxi didn’t end up charging us a pet fee. That was due to be $175, so we’d have been more than $250 over budget if they’d charged that.

The amount we spent on eating out came to just under $400 which, for us, is pretty good as our average is closer to $500. We spent ~$100 on gas which was also lower than average. That’s partly because we drove fewer miles than normal, plus we were able to get discounts on our gas by using fuel points and discounted gas gift cards.

Here’s a breakdown of our spending last month…

…along with a chart that’ll track our spending over the course of 2020.

I’ve a feeling that February’s budget will go a similar way to January’s as our accommodation and pet fee costs are due to be fairly similar. We might go a little further over budget though as I can imagine we’ll spend more on eating out and activities seeing as we’ll be in New Orleans for Mardi Gras. Things are, right now, looking a little healthier for March, so hopefully we’ll be back on par at the quarter-year point.

Points Earned

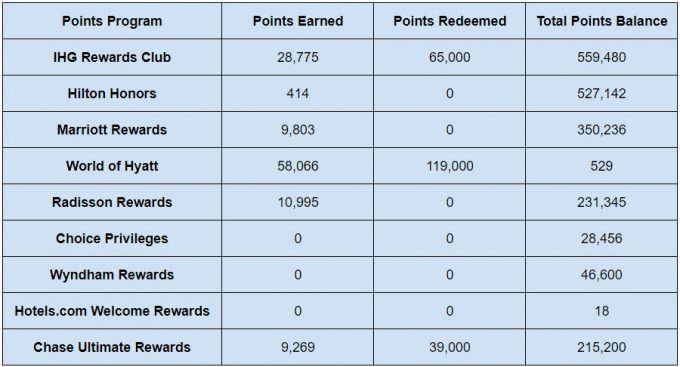

We earned points with a number of different hotel chains last month, some from paid stays and some from spend on hotel credit cards. Our World of Hyatt balance had quite a few points added to it, but most of those came by transferring points from my Chase Ultimate Rewards balance.

Here’s a breakdown of what we earned:

- IHG Rewards Club – 28,775

- Hilton Honors – 414

- Marriott Bonvoy – 9,803

- World of Hyatt – 58,066

- Radisson Rewards – 10,995

- Choice Privileges – 0

- Wyndham Rewards – 0

- Hotels.com Welcome Rewards Credits – 0

- Chase Ultimate Rewards – 9,269

Points Redeemed

I’ve been busy making hotel reservations for some of our upcoming stays recently, so a few of our points balances went down in January. Our World of Hyatt accounts in particular went down quite a bit as we booked 19 nights with points recently.

- IHG Rewards Club – 65,000

- Hilton Honors – 0

- Marriott Bonvoy – 0

- World of Hyatt – 119,000

- Radisson Rewards – 0

- Choice Privileges – 0

- Wyndham Rewards – 0

- Hotels.com Welcome Rewards Credits – 0

- Chase Ultimate Rewards – 39,000

Total Points Balances

Due to all these changes, here’s where our hotel points balances stood at the end of January:

- IHG Rewards Club – 559,480

- Hilton Honors – 527,142

- Marriott Bonvoy – 350,236

- World of Hyatt – 529

- Radisson Rewards – 231,345

- Choice Privileges – 28,456

- Wyndham Rewards – 46,600

- Hotels.com Welcome Rewards Credits – 18

- Chase Ultimate Rewards – 215,200

As always, here’s a table with all of these figures in it in case you find it easier to process the information that way.

Blog Stats

Here are some blog-related stats for those that are interested in this info each month. We published fewer blog posts than normal, but our traffic went up compared to the previous few months, so that was good to see.

- Number of blog posts published – 15

- Page views – 23,986

Final Thoughts

Despite going a little over budget in January, it was still a good result as I’d expected we’d spend more than we did. February looks like it’ll be going the same way, but if we get lucky with hotels not charging us pet fees again then we might just about manage to stay under budget.

[…] budget in January was better than I’d initially expected. You can read January’s stats in full here, but to give a quick recap we went over budget by $88.26 in the first month of this […]