Our budget in January was better than I’d initially expected. You can read January’s stats in full here, but to give a quick recap we went over budget by $88.26 in the first month of this year.

The reason that was better than I’d expected is because I thought we’d go over budget by even more than that seeing as more than half our spending went on accommodation which was a higher proportion than normal. I thought a similar thing would happen in February too; although our accommodation costs weren’t due to be quite so high, we did still have quite a few paid stays, pet fees were due to come to $350 and we’d be in New Orleans for Mardi Gras, so I figured our spending during that time might be higher than average.

We ended up getting lucky last month with several hotels neglecting to charge a pet fee for having Truffles with us, while the only hotel that did charge a pet fee ended up having a fee lower than was listed on their website. So did this mean that we managed to stay under budget, or did we still manage to overspend anyway? Read on to find out.

Miles Driven

We started February 2020 with 133,937 miles on our car. By the end of the month it had 136,649 miles on the clock which means we drove 2,712 miles last month.

That’s less than the 3,375 miles I predicted we’d drive which is good because it means we didn’t have to spend as much on gas.

I’ve got no clue how many miles we’ll drive during March. We’re in Tucson, AZ for another 10 days or so, then we head to Las Vegas to pick up my parents who are flying in from the UK to join us on the road trip for 7 weeks. We’ll then be heading up into Utah to hit up all the National Parks there, so I imagine we’ll be doing a reasonable amount of driving during March as we drive back and forth. It hopefully won’t be too much driving though, so I’ll predict we’ll drive 2,875 miles in March – we’ll have to wait and see how close that guess is.

Money Spent

Our road trip budget is $100 per day, so with 2020 being a leap year, we had $2,900 allocated for February. It ended up being a close run thing, but by the end of the month we’d spent $2,884.09, so we were $15.91 under budget. That was completely unexpected as I’d been pretty sure that we’d end up over budget, so it was really pleasing to see that.

To be fair though, we would’ve been over budget if we hadn’t gotten lucky. Like I mentioned earlier, we were due to pay a total of $360 in pet fees in February, but only one out of the four hotels we stayed at charged a pet fee. The one that did charge us had a $75 pet fee listed on their website, but they’d recently reduced that to $60, so that was a bonus too.

We were also fortunate that a new Marriott Amex Offer appeared at the very end of January. Loading that to a couple of our American Express cards meant we saved $95 on a couple of Marriott stays last month. If there hadn’t been that Amex Offer and if we’d been charged for all the pet fees we’d expected, we’d have been closer to $375+ over budget, so we were definitely fortunate to instead end up under budget.

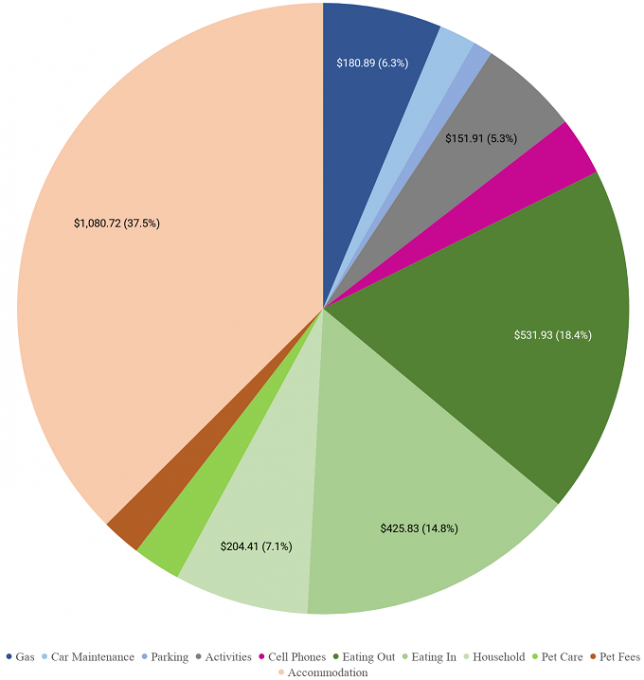

Here’s a breakdown of what we spent money on in February…

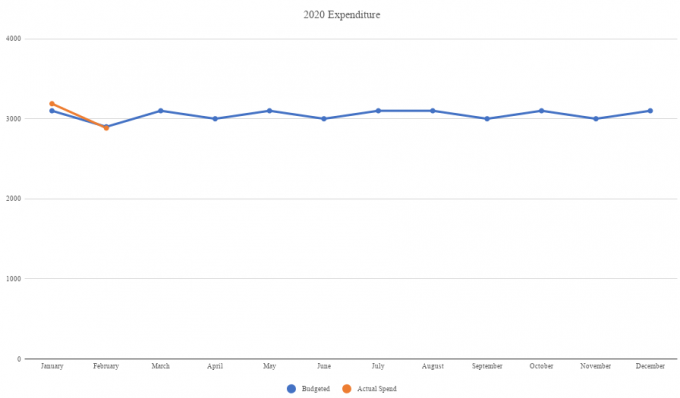

…while here’s a chart showing our overall 2020 spending so far.

At this point in time, things are looking fairly positive for our budget in March. Our accommodation costs aren’t due to be too high as the first half of this month we’re staying in hotels using points, while most of the second half of March will be spent in Airbnbs where we’re splitting the cost with my parents.

Our day-to-day spending will hopefully be lower too as much of our time in the last 10 days of March will be spent at Utah’s National Parks. We bought an annual National Parks pass the other day, so we won’t have any entry fees for them. Having said that, we have to take Truffles to the vet to get some of her annual tests and vaccinations, plus we need to take our car to Jiffy Lube to get our brakes looked at as we think they might need to be replaced. I’m therefore hopeful we’ll manage to stay under budget, but the vet and car bills might push us over.

Points Earned

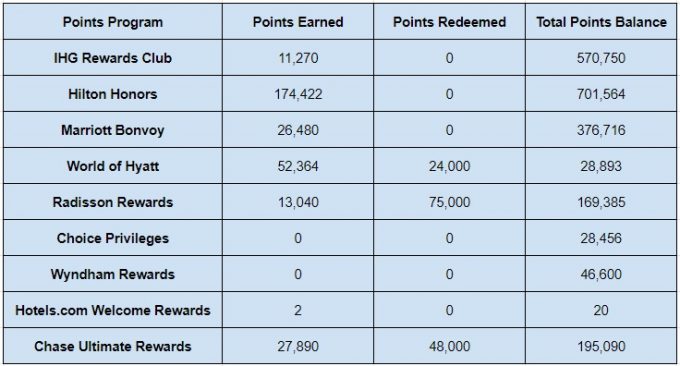

February was a great month on the points-earning front. We had a few paid stays at Marriott brands which helped boost our points with them. A huge chunk was added to our Hilton Honors balance as my 150,000 point signup bonus from the Amex Hilton Aspire card finally posted to my account, while I also earned 20,000 Ultimate Rewards points for referring Shae to one of Chase’s credit cards.

The figures below make it look like we earned a ton of World of Hyatt points too, but that’s a little misleading. Most of those were transferred in from our Chase Ultimate Rewards accounts so those weren’t earned so much as moved around – those Ultimate Rewards redemptions therefore show up in the Points Redeemed section.

Here’s a list of all the points we earned in February 2020:

- IHG Rewards Club – 11,270

- Hilton Honors – 174,422

- Marriott Bonvoy – 26,480

- World of Hyatt – 52,364

- Radisson Rewards – 13,040

- Choice Privileges – 0

- Wyndham Rewards – 0

- Hotels.com Welcome Rewards Credits – 2

- Chase Ultimate Rewards – 27,890

Points Redeemed

As I mentioned above, we transferred a bunch of Ultimate Rewards points to our World of Hyatt accounts, so that’s why so many of those points were redeemed. Other than a couple of Hyatt stays, the only other points we spent last month were some Radisson Rewards points for an upcoming Country Inn & Suites stay.

Here’s a list of the points we redeemed last month:

- IHG Rewards Club – 0

- Hilton Honors – 0

- Marriott Bonvoy – 0

- World of Hyatt – 24,000

- Radisson Rewards – 75,000

- Choice Privileges – 0

- Wyndham Rewards – 0

- Hotels.com Welcome Rewards Credits – 0

- Chase Ultimate Rewards – 48,000

Total Points Balances

Based on all the earning and redeeming listed above, here were our total points balances at the end of February 2020:

- IHG Rewards Club – 570,750

- Hilton Honors – 701,564

- Marriott Bonvoy – 376,716

- World of Hyatt – 28,893

- Radisson Rewards – 169,385

- Choice Privileges – 28,456

- Wyndham Rewards – 46,600

- Hotels.com Welcome Rewards Credits – 20

- Chase Ultimate Rewards – 195,090

Here’s a table listing all that information:

Blog Stats

In case you’re interested in stats about the blog, here’s how many new posts we published last month along with how many page views we had.

- Number of blog posts published – 15

- Page views – 21,259

Final Thoughts

It was really pleasing to end up under budget last month as I’d been pretty sure we’d go over budget. To be fair, we would have overspent if it hadn’t been for some hotels not charging a pet fee.

Despite that, we’re still slightly over budget for the year, so hopefully we’ll manage to keep our spending reined in during March to push us under budget for the year by this time next month.

I always enjoy seeing real life stats like this from people on the road. Very inspiring.

One thought for an additional stat that might be useful and hopefully not a lot of extra work – breaking down by night where your stays came from. Points redeemed / earned, number of hotel cash stays, Airbnb, staying with friends, etc.

That can help put a context on the $1,080 number for 29 nights of accommodation.

Just a thought

That’s a good idea – thanks for the suggestion. I include the cost, points earned/redeemed, etc. in our hotel reviews, but that doesn’t give the full picture of our accommodation costs seeing as we don’t review the Airbnb places we stay at on here.

I’ll have to work out the best way to present that – I’ll do some thinking before next month’s stats 🙂