Wow, a lot has changed since last month’s stats post. Back when I wrote that, we were looking forward to my parents visiting from the UK and were planning on spending time seeing all of Utah’s National Parks, the Grand Canyon, Rocky Mountains and more.

That wasn’t to be as their trip had to be cancelled due to COVID-19. That ended up affecting all aspects of our stats for March compared to how I thought things would turn out at the start of last month. We drove fewer miles, our spending was different and it had a healthy effect on our hotel points balances.

With all that change though, did we manage to stay under budget, or did some of our unexpected expenses mean we went over budget? Keep reading to find out.

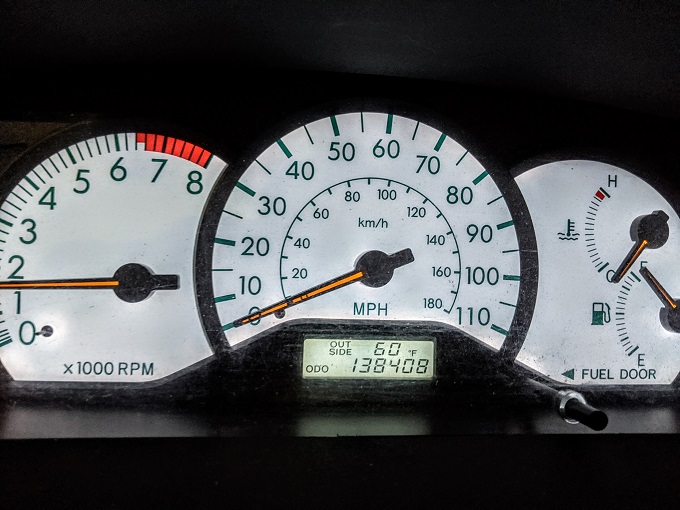

Miles Driven

We started March with 136,649 miles on the clock, while by the end of the month our odometer reading was 138,408 which means we drove 1,759 miles.

I’d predicted at the start of last month that we’d drive 2,875 miles during March. That was based on how much I thought we’d drive, but in the end we spent the last couple of weeks of March holed up in Albuquerque, so we drove much less than expected.

We’ll be driving even less during April. We’re staying in Albuquerque until mid-month, then we’re heading to Pueblo, CO where we’ll be staying in place for a month. Other than driving to the grocery store and possibly hiking (provided the trails aren’t busy), we’ll be staying at the Airbnb we’ve booked there. With it only being a few hundred miles from Albuquerque to Pueblo, I don’t think we’ll be driving much more than 650 miles in April, if that.

Money Spent

At the beginning of March, I was somewhat optimistic that we’d managed to stay under budget, although we knew we had vet bills and car maintenance bills coming up.

My parents having to cancel their trip ended up affecting our budget too. We’d mainly booked Airbnbs to stay in while they were here and were going to share the cost. With them no longer visiting, we cancelled those properties, but it meant we had to find somewhere else to stay.

We managed to get a great rate at the Candlewood Suites Albuquerque, although the per-night cost was still a little more than we’d originally anticipated. I therefore figured we might end up going over budget a little by the end of the month, but knew that not going anywhere or doing anything would reduce our expenses in other ways.

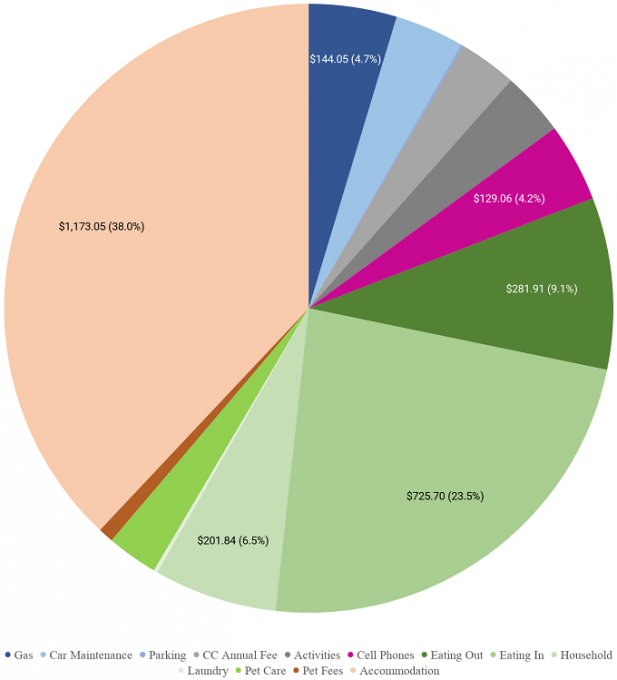

Our budget for March was $3,100 because we budget for $100 per day on the road trip. By the end of March we’d spent $3,088.15, so we were $11.85 under budget.

Being under budget, no matter by how little, is always something I love to see. We would’ve spent even less, but we somehow spent $725.70 on groceries last month which is abnormally high. Part of that is because we stocked up on groceries seeing as we’d finally have a proper kitchen for a few weeks. Some of what was allocated to grocery spending probably should have been allocated against other categories like household items, laundry, pet care, etc. While we carefully keep track of our spending, I don’t go through grocery receipts with a fine tooth comb to allocate each penny to the correct category – if we bought it at a grocery store, I just enter it as grocery shopping.

Our eating out expenditure was the second lowest we’ve had so far on the road trip, so that helped balance out some of our grocery spending.

Here’s a breakdown of our costs last month…

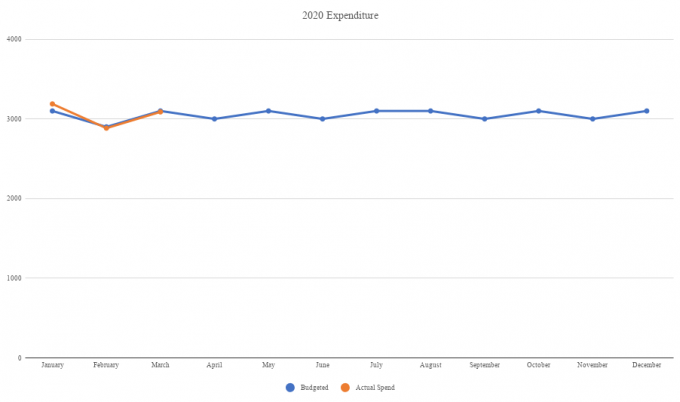

…along with a chart tracking our spend for the year so far.

Looking ahead to our budget for April, I’m hoping we’ll have a similar result to last month. Our accommodation spending will be higher by a few hundred bucks because I think this will be the first month on the road trip where we didn’t redeem any hotel points whatsoever.

Our grocery spending will hopefully be lower as we currently have enough food to see us through to the middle of the month. We won’t be doing much in Colorado that’ll cost us money other than supporting some of the local restaurants there by getting take out. Our gas costs will be next to nothing compared to normal, so all that should stand us in good stead for staying within our budget.

Accommodation Cost

On last month’s stats post, Dan from Points With A Crew commented that it’d be interesting to see a more detailed breakdown of our accommodation costs for the month.

Here’s how March’s accommodation costs looked:

March 1-10: Hyatt Place Tucson Central, AZ booked using points. It’s a category 1 property in the World of Hyatt program which costs 5,000 points per night, so those 10 nights cost us a total of 50,000 World of Hyatt points.

March 11-15: Country Inn & Suites Tucson Airport, AZ booked using points. This is a category 2 property in the Radisson Rewards program which costs 15,000 points per night, so those 5 nights cost us a total of 75,000 Radisson Rewards points.

March 16-18: Holiday Inn Express & Suites Henderson, NV booked with cash. (n.b. We’d booked this as my parents were flying into Las Vegas. Before their trip was cancelled, we’d arranged for our mail forwarding service to send our mail to this hotel, so we still needed to head there.)

The three nights cost the following amounts including tax:

- $149.22

- $139.55

- $149.22

- Total = $437.99

That’s more than we’d normally pay for three nights of accommodation, but seeing as our accommodation for the first two weeks of the month were free using points, we had a bit more leeway in our budget. IHG had a decent promotion running during our stay, so I knew we’d earn a good number of points from the stay too.

March 19-31: Candlewood Suites Albuquerque booked with cash. This ended up being cheaper than I initially thought it would be when looking at hotel search results. This property had a ‘Buy two nights, get third night free’ promotion going on, with that rate not showing up in the main search results on IHG’s website. Instead, you only saw the lower rate when clicking through to this specific property, so I’m glad I did.

The great thing about this rate is that it wasn’t only the third night that was free – every third night you booked was free. I booked us in for 24 nights which means that eight of those nights were free. That reduced our average nightly cost to $63.77 including tax which was great value seeing as that was for a one bedroom suite (a studio suite would’ve been even cheaper than that, but we wanted the extra space).

In return, we should earn a decent number of points because of IHG’s latest promotion. I also clicked through to IHG from TopCashback (my referral link) before making the reservation as they were offering 8% cashback on IHG bookings at the time. The 8% cashback is calculated based on the pre-tax room rate, so that should net us $107.52 cashback once it becomes payable. That would therefore decrease the average nightly rate by $4.48.

Points Earned

March 2020 was one of our best months on the road trip for earning hotel points, despite the fact that half the month was spent in hotels using points. There are a few reasons why we managed to rack up so many.

First, although most of the places we were due to stay with my parents were Airbnbs, we’d booked a few nights in Hyatt Places along the way. Cancelling those meant we got a bunch of World of Hyatt points credited back to our accounts.

Second, we earned some IHG Rewards Club points from the stay in Henderson mentioned earlier. Third, Shae received 80,000 Ultimate Rewards points which was the signup bonus on the Chase Ink Business Preferred card which she’d applied for a couple of months ago.

Finally, I did some manufactured spending while we were in Louisiana during February, so the points from that activity was credited to our accounts in March.

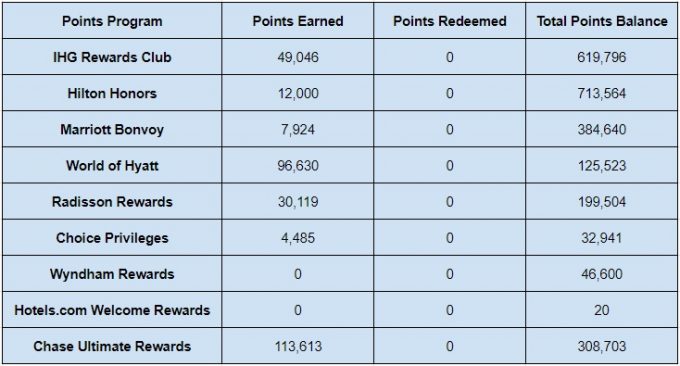

As a result, here’s a breakdown of how many points we earned last month:

- IHG Rewards Club – 49,046

- Hilton Honors – 12,000

- Marriott Bonvoy – 7,924

- World of Hyatt – 96,630

- Radisson Rewards – 30,119

- Choice Privileges – 4,485

- Wyndham Rewards – 0

- Hotels.com Welcome Rewards Credits – 0

- Chase Ultimate Rewards – 113,613

Points Redeemed

Although the first two weeks of March were spent in hotels using points, those were booked a month or two beforehand, so those redemptions were included in the stats for past months.

We didn’t end up redeeming any points in March, so the list below was easy to complete:

- IHG Rewards Club – 0

- Hilton Honors – 0

- Marriott Bonvoy – 0

- World of Hyatt – 0

- Radisson Rewards – 0

- Choice Privileges – 0

- Wyndham Rewards – 0

- Hotels.com Welcome Rewards Credits – 0

- Chase Ultimate Rewards – 0

Total Points Balances

With us earning a ton of points, getting loads back from cancelling points bookings and not redeeming any for future stays, our total hotel points balances grew healthily in March 2020.

It was particularly pleasing to see our Chase Ultimate Rewards balance go from under 200,000 to over 300,000. We tend to transfer those points to Hyatt for award nights costing 5,000 points per night, so that’s a lot of future free nights 🙂

The fact that we’re almost back up to 2.5 million points is also very pleasing as that means we’ve been able to maintain how many we have over the last couple of years. That’ll be helpful in keeping our accommodation costs lower in future years when we visit more expensive states like California.

Here’s how many points we had in each program at the end of last month:

- IHG Rewards Club – 619,796

- Hilton Honors – 713,564

- Marriott Bonvoy – 384,640

- World of Hyatt – 125,523

- Radisson Rewards – 199,504

- Choice Privileges – 32,941

- Wyndham Rewards – 46,600

- Hotels.com Welcome Rewards Credits – 20

- Chase Ultimate Rewards – 308,703

Here’s all the points information in table format for those that find it easier to read in that way:

Blog Stats

We saw a significant drop in people visiting our site during March, presumably because very few people are traveling and so they’re simply not searching online for the things we’ve written about. That’s thankfully had very little negative financial impact for reasons I’ll explain in a post later this week about how the COVID-19 fallout is affecting us.

It’s obviously disappointing knowing that far fewer people are reading the posts we’ve spent so much time writing over the last few years, but traffic will hopefully rebound in the coming weeks, months and years.

For now, here’s where things stood last month:

- Number of blog posts published – 16

- Page views – 12,618 (that’s a drop of ~41% across the month, but it was much worse during the final two weeks of March)

Final Thoughts

March was disappointing because we had to cancel my parents’ trip to the US. From a stats standpoint though, it went well. We stayed marginally under budget and greatly increased our points balances. Website traffic fell off a cliff, but that’s hopefully only temporary.

Thanks for the breakdown ;-). That was quite the promo at the Candlewood Suites Albuquerque!

I know, right?! Shae signed up for the IHG Premier card when it was offering 40x for the first year on IHG stays, so that, 4x from the current promo and 100% bonus for Spire status should mean our IHG accounts get a nice boost this month 🙂

This is a great breakdown of points balances after everything that happened to you this month. Last month was my first time reading your monthly statistics. The second time through made alot more sense for me.

Albuquerque is a great place to visit.

Check out Petroglyph National Park. Its not a far drive. I think trails are open.

That’s good to know about Petroglyph National Park – thanks! It looks like it’s only 15 minutes away, so we might have to take a trip there this week. I hadn’t realized it had any trails, so that would be a great opportunity to get out outside.