We’re now into year four of our road trip, but the first month was spent not doing much in terms of the road trip. Shae and I left New Orleans on January 2 and started heading west towards New Mexico.

We took our time making our way across the country though, stopping for much of the month in Texas. We kept things fairly low key, although did get to enjoy a little bit more of what Austin had to offer, particularly food-wise (more about that in an upcoming post).

The fact we didn’t do that many activities meant that portion of our budget stayed fairly low, but we did eat out a little more than normal, so did that push us over budget or did we manage to rein in our spending despite that? Read on to find out.

Miles Driven

2021 started with our car having racked up 150,402 miles. By the end of January the odometer reading was 152,203 miles which means we drove 1,801 miles in the first month of the year. I’d predicted that we’d drive 1,650 miles, so I wasn’t too far off that estimate.

Our mileage should be much lower in February. We’re currently spending two weeks self-quarantining in New Mexico; we don’t have COVID to the best of our knowledge – the two week self-quarantine is just what’s required by New Mexico for anyone visiting. That means we’re not driving anywhere, plus we’re only moving one time during February. As a result I’ll predict that we’ll drive no more than 750 miles in February.

Money Spent

Heading into January, I wasn’t convinced we’d be able to stay under budget. At the start of the month we didn’t have all our accommodation planned out, so if we ended up having more paid stays than normal then we’d likely overspend.

In the end we used points to book our hotel stays for almost 2/3 of the month which reduced our overall accommodation spending. Austin had all kinds of good places to eat though, so that meant the eating out portion of our budget was high at more than $600 (ouch!).

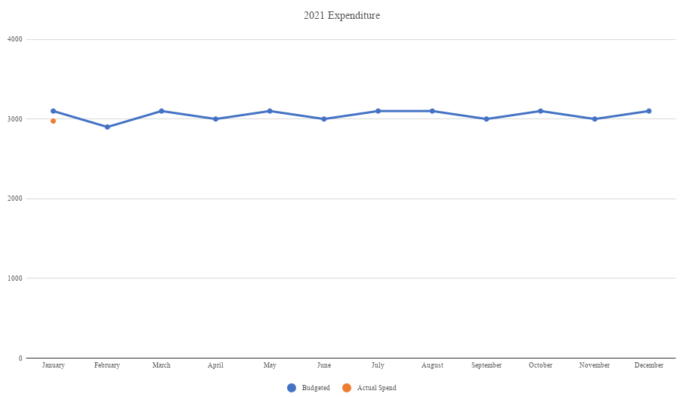

With 31 days in January, our daily budget of $100 meant we had $3,100 to play with. By the end of the month we’d spent $2,974.37 which means we stayed $125.63 under budget.

Shae and I got a big assist from the hotels we stayed at though. We’d expected to pay $405 in pet fees which was higher than normal. Thankfully only one hotel ended up charging a fee, so we ended up paying just $149.25 – more than $250 less than expected.

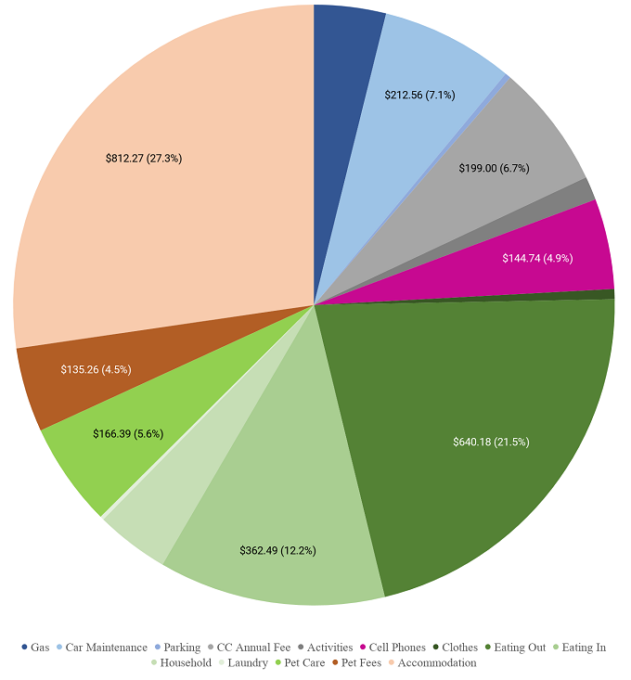

Here’s a breakdown of our spending from last month…

…and here’s a chart of our spending so far this year.

Looking ahead to February’s budget, things could be quite tight. We’re spending the entire month in Airbnbs rather than using points for hotel stays, so accommodation is going to take up just over half our budget.

We don’t expect our other expenses to be all that high though. There won’t be too much driving going on, so that’ll reduce our gas spending. The activities we do should mainly be free and outdoors, so that’ll reduce that part of our spending. It looks like there could be some interesting places to eat in the places we’re staying in New Mexico, so there’s still a chance we’ll end up over budget as a result of that.

Accommodation Cost

Although we booked two longer-than-average stays in Houston and Austin, we happened to stay in six different places in January – here’s a breakdown of how we paid for those stays.

January 1-2: Hyatt Centric French Quarter New Orleans, LA. This was paid for with a free night certificate earned from credit card spend, so it was, in effect, free (ignoring opportunity cost).

January 2-14: Homewood Suites Houston-Westchase, TX (here’s my review). This was originally booked as a six night stay, then we added six nights so that Shae had time to visit a couple of museums in Houston for her online virtual field trip classes.

Both these stays were booked using points. It cost 14,000 points per night, but Hilton offers every 5th night free on award stays. That meant two of our nights cost zero points, so we paid a total of 140,000 points for the 12 night stay or an average of 11,667 points per night. 140,000 points might sound like a lot, but it’s actually a great price for 12 nights. You can earn that many points when signing up for a Hilton credit card with a $95 annual fee, so it’s not hard to rack up that many points. Alternatively, Hilton sometimes sells their points for 0.5cpp (cents per point); if you bought 140,000 points during one of those promotions, you’d pay $700. $700 for a 12 night stay works out at $58.33 per night which is still a great price for a one bedroom suite with a full kitchen.

January 14-25: Hyatt House Austin Downtown, TX (here’s my review). When looking at our accommodation options for Austin, I noticed that this hotel was cheaper on Hotels.com than it was on Hyatt’s own website. As a result, I booked directly with Hyatt and submitted a Best Rate Guarantee claim as that meant Hyatt would match the rate and give an additional 20% discount.

The rate I booked with Hyatt came to $137.85 per night including tax, but the Best Rate Guarantee claim meant that cost was slashed to only $73.92 per night including tax – a discount of more than 45%.

January 25-29: Candlewood Suites Abilene, TX. We booked this stay using points as it was only 10,000 points per night. We got the 4th night free thanks to having the IHG Premier credit card and also get a 10% points rebate from having the IHG Select credit card. That means the net cost was 27,000 points, or 6,750 points per night.

We had a terrible experience at the hotel due to incredibly rude staff and both staff and guests not wearing masks (there’s a little more about that here). Shae and I therefore decided to leave after one night and move on to New Mexico early. We submitted a complaint to ask for the points back for the nights we didn’t stay and are waiting to hear back from IHG to see if that happens.

January 26-31: Homewood Suites Albuquerque Uptown, NM. There won’t be a review for this hotel unfortunately – seeing as we started self-quarantining when arriving in New Mexico, we didn’t want to wander the hotel to take photos of their breakfast, amenities, etc.

We booked the stay using points. It cost 21,000 points per night for our stay, but once again we were able to take advantage of Hilton’s 5th night free benefit on award stays. That meant our total cost was 84,000 points or an average of 16,800 points per night.

January 31: Airbnb in Bloomfield, NM. We booked a 22 night stay at this property, with only the first night falling in January. It’s a 3 bedroom home which costs $63.64 per night, so very reasonable. We paid for it with Airbnb gift cards bought at a discount, so our net cost per night was $53.07 per night.

Hotel Points Earned

We earned a decent number of points in January. I earned Spire elite status with IHG Rewards at the end of 2020 and chose 25,000 bonus points as my choice benefit for doing that. Our Hilton and Marriott balances got a nice boost too, mainly from credit card referrals.

Here’s a breakdown of everything we earned:

- IHG Rewards – 45,686

- Hilton Honors – 38,206

- Marriott Bonvoy – 76,150

- World of Hyatt – 12,049

- Radisson Rewards – 0

- Choice Privileges – 0

- Wyndham Rewards – 5,182

- Hotels.com Rewards Credits – 0

- Chase Ultimate Rewards – 7,201

- Capital One – 1,170

Hotel Points Redeemed

We only redeemed points with two hotel loyalty programs in January 2021. The 30,000 points with IHG was for our aborted stay in Abilene I mentioned above, while the Hilton redemptions were for the second set of six nights in Houston (the first set of six nights was accounted for in December’s stats) and then the five nights in Albuquerque.

- IHG Rewards – 30,000

- Hilton Honors – 132,440

- Marriott Bonvoy – 0

- World of Hyatt – 0

- Radisson Rewards – 0

- Choice Privileges – 0

- Wyndham Rewards – 0

- Hotels.com Rewards Credits – 0

- Chase Ultimate Rewards – 0

- Capital One – 0

Total Hotel Points Balances

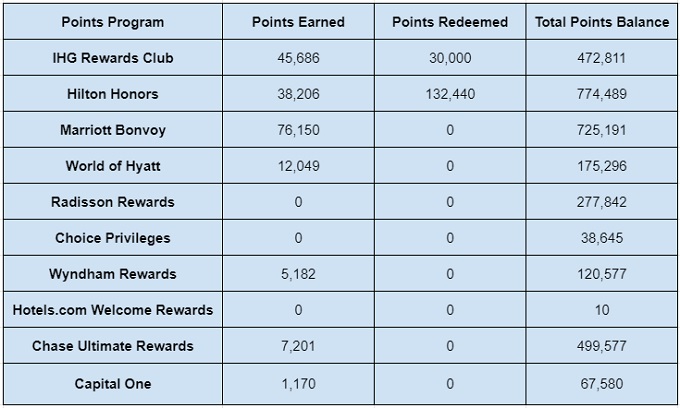

Despite redeeming a good number of points in January, we also earned a good number which replenished our overall totals – here’s a breakdown of our points balances across the different hotel programs or points which can be redeemed towards hotel stays.

- IHG Rewards – 472,811

- Hilton Honors – 774,489

- Marriott Bonvoy – 725,191

- World of Hyatt – 175,296

- Radisson Rewards – 277,842

- Choice Privileges – 38,645

- Wyndham Rewards – 120,577

- Hotels.com Rewards Credits – 10

- Chase Ultimate Rewards – 499,577

- Capital One – 67,580

Here’s all that information in table format:

Hotel Free Night Certificates

Although we booked some stays using points last month, we didn’t redeem any of our free night certificates. We didn’t earn any new certificates in January either, so there’s no change in the number of certificates we have on our accounts.

- IHG (up to 40,000 points per night) – 3

- Hilton (any property worldwide) – 3

- Marriott (up to 35,000 points per night) – 10

- Marriott (up to 40,000 points per night) – 2

- Hyatt (category 1-4) – 3

- Hyatt (category 1-7) – 1

Walking

Last year I decided to share my progress with jogging. After about a month or two, my jogging went by the wayside so I was planning on leaving off that section starting in 2021.

At the start of the year I knew I wanted to get more exercise, but didn’t want to commit to jogging if I wasn’t going to have the motivation to keep it up. To pick a goal that would be more achievable, I decided that I’d start moving more by walking an average of two miles per day.

I didn’t decide to do that until January 4, but I did well with keeping that up until we had to self-quarantine in New Mexico. Over the course of 22 days I walked at least 45.18 miles, or an average of 2.05 miles per day. That’s based on specifically tracking that activity in an app on my phone – I would’ve walked more than that overall as I don’t have a Fitbit which tracks steps/distance throughout the day.

Blog Stats

I didn’t publish as many posts in January as I was hoping. Although I was much less busy than I was in November and December when I was working on GC Galore, I think I’d gotten a little burned out and so I took advantage of having more downtime by not doing anything at all.

As a result, we only published 11 posts on the blog in January, although the number of page views we received was significantly higher than the month before. I think a couple of our posts must’ve been shared on social media as a couple of them saw much more traffic than normal.

- Number of blog posts published – 11

- Page views – 25,689

Final Thoughts

January 2021 was a pretty good month stats-wise. We stayed under budget, slightly increased our overall points balances and got more page views than the previous month.

I’m hopeful that February will be equally good, but I’m particularly looking forward to our self-quarantine being over so that we can explore New Mexico as it seems like there’s a lot of interesting stuff to see here.

[…] That means we drove a total of 748 miles in February. That’s particularly pleasing because last month I predicted that we’d drive 750 miles, so I think that’s the closest my monthly mileage prediction […]