Our stats for last month are going to be a little different to normal because we paused our road trip for most of August as we traveled overseas to Dubai, Egypt and Jordan to celebrate Shae’s 40th birthday.

It’s mainly our budget which will be a little different as we don’t have a very good way of accounting for the fact that we didn’t incur many road trip expenses in August. The benefit of my makeshift solution is that it’s probably a little more generous than it should be, but there was no ideal option.

Here’s a roundup of all our stats for the 44th month of our road trip – August 2021.

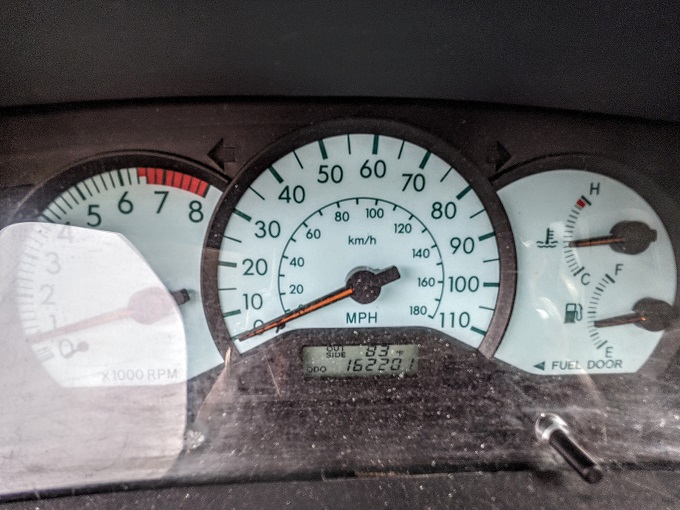

Miles Driven

We started August with 161,850 miles on our car’s odometer. When we took a photo of our car’s reading on September 1, its mileage was 162,201 although that’s not entirely accurate. I didn’t take a photo of our odometer on August 31 which is what I normally do and Shae ended up driving 94 miles before we took the photo below, so our actual end mileage was 162,107.

That means we drove a total of 257 miles last month. I’d predicted we’d drive 250 miles, so that was pretty accurate.

Looking ahead to our mileage for the month of September, we’ll certainly be driving more than last month. We were staying in Denver and visited Rocky Mountain National Park, then moved down to Santa Fe, NM a couple of days ago. We’ll be visiting a few more places in New Mexico this month, so I’ll predict that we’ll drive 1,800 miles in September.

Money Spent

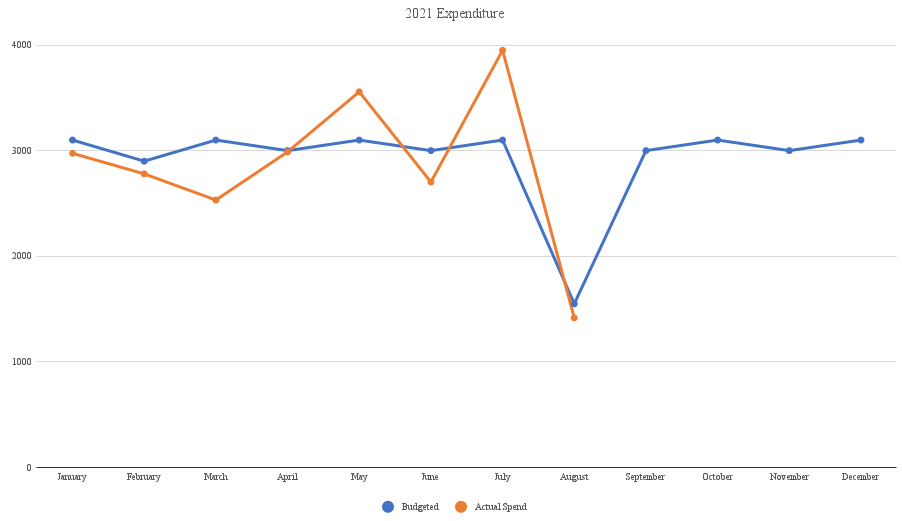

Now for the tricky part. Our road trip budget is $100 per day – that includes accommodation, food, gas, activities, etc. Normally we multiply the number of days in a month by $100 and that’s our budget for the month.

The thing is, we were only in the US for a few days in August and so, in theory, we should only have a budget of a few hundred dollars for the month. When accounting for all our expenses though, that doesn’t work out very neatly. For example, we have our cell phone bill which we still have to pay based on the entire month rather than only a few days. We also have some bills where we’ve paid them in full in previous months, but allocate the cost across several months or the year. Take our auto insurance for instance; we pay each six month bill in full as that’s cheaper than paying it month-to-month, but for the purposes of our budget we allocate that cost to our budget over the course of six months.

There’s therefore no good way to account for our road trip budget when we’re overseas for some or most of a month. Allocating $600 due to only officially being on the road trip for six days isn’t right, but neither is allocating the full $3,100 budget which is what we would’ve had to spend in August had we spend the entire month in the US.

The makeshift solution I cam up with is that for the month of August 2021 we’re going to allocate a reduced budget of $50 per day rather than $100. With 31 days in August, that means our total budget for the month was $1,550. By the end of the month we’d spent $1,416.75, so based on that completely imperfect calculation we were $133.25 under budget.

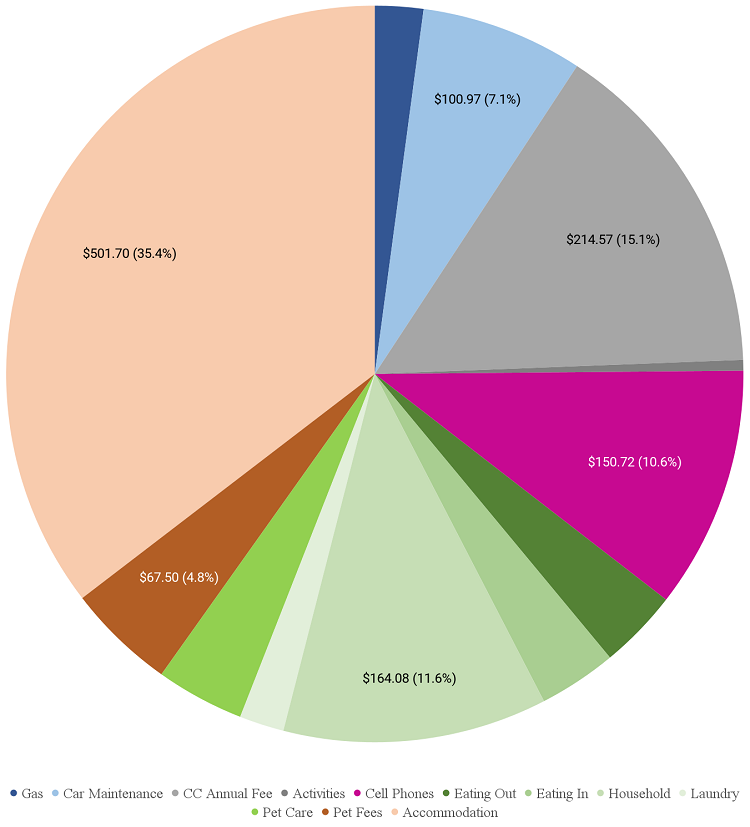

For what it’s worth, here’s a breakdown of our spending for August…

…and a chart tracking our spending for the year so far.

Looking ahead to our spending for September, I’m optimistic that we’ll be able to stay under budget. The majority of our stays for this month have been booked using hotel points, so our accommodation spending will be lower than normal. We’re due to be spending $375 on hotel pet fees in that time, but we’ve found that only about half of the hotels we stay at end up actually charging a fee for having Truffles with us. I’m therefore hopeful that we’ll end up spending less than $375 on pet fees which would help our budget further.

Accommodation Cost

In terms of road trip accommodation costs, here’s a breakdown of what we spent at the beginning and end of August. I’ll be writing a separate post in a couple of weeks breaking down what we spent on our international trip, so I won’t include those other hotel costs here.

August 1-3: Element Denver Park Meadows, CO (here’s my review). This was part of a longer stay that began at the end of June. As that stay was more than 30 days, we didn’t have to pay hotel taxes which means the cost was only our base room rate which was $84.15 per night.

August 28-31: Hyatt Place Denver Tech Center, CO (here’s my review). This cost $92.61 per night including tax, although we paid for it with a card that had a Hyatt Amex Offer loaded to it. That gives 10% back as a statement credit, so our net cost was $83.35 per night.

Hotel Points Earned

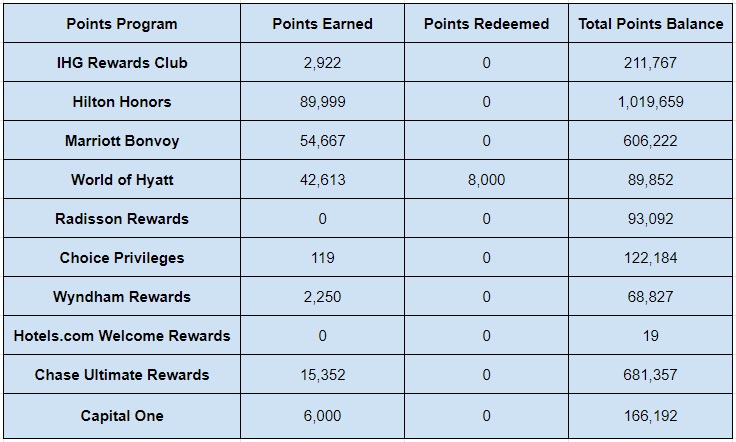

August was a great month for earning hotel points as we had quite a few paid stays on our overseas trip and also earned a bunch of points from credit card spend.

Here’s a breakdown of all the points we earned last month:

- IHG Rewards – 2,922

- Hilton Honors – 89,999

- Marriott Bonvoy – 54,677

- World of Hyatt – 42,613

- Radisson Rewards – 0

- Choice Privileges – 119

- Wyndham Rewards – 2,250

- Hotels.com Rewards Credits – 0

- Chase Ultimate Rewards – 15,352

- Capital One – 6,000

Hotel Points Redeemed

We only made one redemption in August which was 8,000 points for a category 2 Hyatt stay in Amman, Jordan. That makes this breakdown nice and easy:

- IHG Rewards – 0

- Hilton Honors – 0

- Marriott Bonvoy – 0

- World of Hyatt – 8,000

- Radisson Rewards – 0

- Choice Privileges – 0

- Wyndham Rewards – 0

- Hotels.com Rewards Credits – 0

- Chase Ultimate Rewards – 0

- Capital One – 0

Total Hotel Points Balances

Thanks to the fact that we earned so many points and only had one small redemption, our total hotel points balances got a nice boost in August. It’s particularly pleasing that we earned enough Hilton points to push our total balance up over 1 million points with them – I guess we should start redeeming them!

- IHG Rewards – 211,767

- Hilton Honors – 1,019,659

- Marriott Bonvoy – 606,222

- World of Hyatt – 89,852

- Radisson Rewards – 93,092

- Choice Privileges – 122,184

- Wyndham Rewards – 68,827

- Hotels.com Rewards Credits – 19

- Chase Ultimate Rewards – 681,357

- Capital One – 166,192

Here’s a table listing all those details:

Hotel Free Night Certificates

In addition to our points, we have a number of free night certificates with hotel programs. These are earned in a variety of ways – some at renewal on hotel credit cards, others through spending a certain amount on hotel credit cards, others from staying a certain number of nights with a hotel program, etc.

The only difference from last month is that we have an additional Hilton certificate as I upgraded one of my Hilton credit cards to a Hilton Aspire card which offers a free night certificate each year.

- IHG (up to 40,000 points per night) – 3

- Hilton (any property worldwide) – 4

- Marriott (up to 35,000 points per night) – 5

- Marriott (up to 40,000 points per night) – 2

- Hyatt (category 1-4) – 2

- Hyatt (category 1-7) – 1

Jogging

I had great intentions to exercise while we were overseas. I brought my tennis shoes and workout clothes, but ended up jogging in the various hotel fitness rooms a grand total of zero times.

Blog Stats

Unfortunately we had another small drop in page views last month – hopefully it picks back up in September.

- Number of blog posts published – 12

- Page views – 22,431

Final Thoughts

August 2021 was a bit of a weird one for our road trip stats seeing as only a week of it was spent on the road trip. The good thing is that we earned a bunch more hotel points which will save us money down the road.

Why would you not include all you trip expenses….like you blog title says ..Road Trip Stats ….if you counted the points you earned on the trip.then why not the expenses

Loved watching you wonderful trip …I also stayed at Ramses Hilton

PS …love your blog

In this case the expenses we incurred from August 3-28 related to our international travel and so weren’t part of our road trip – we therefore weren’t sticking to our $100 per day budget.

I get your point though about counting the points we earned on the trip. The problem is that if we didn’t include those points, it’d mean we’d have to exclude those points from all our future stats posts which would be a lot of hassle. It’d also mean we could potentially end up with negative points when calculating things that way when we come to redeem those points, so it was just easier to include everything we earned points-wise.

Way to go on crossing the million mark with Hilton! 👏🏾👏🏾👏🏾 Are the bulk of your HH points from hotel stays or from other accrual options like credit card purchases, etc? Loved seeing all the pics from the overseas travel this month!

Thanks! A lot of the points came from both of us signing up for their credit cards. Some points came from paid stays and some from credit card spend. Our Hilton Surpass cards earn 6 points per dollar at grocery stores, so I do some manufactured spending that way to help boost our balances. Here’s more about what Manufactured Spending is: https://frequentmiler.com/manufactured-spending-complete-guide/

I think this month you should do a separate stats post about your side travel. Sure it’s not included with your normal monthly spend but, people are very curious about how you made such a great trip work. And how you may have maximized the use of those miles and points. 🙂

Yep, we’ve got a post like that planned in the next week or two once we’ve finished sharing about everything we got up to 🙂

We have a 12 week stay coming up in San Antonio TX January-March. I have contacted a Town Place Suites there just to find out what the costs points and cash would be. Do you have any suggestions on making this more affordable. We are looking at $74/night cash or 10,000-12,500 pts/night. My thought is to pay for the first month on points then the other two with cash since the long term stay rate is better than the posted rates.

Thank you in advance. Your blog is wonderful!

Thanks! Does the $74 per night includes taxes? If so, when you pay for a stay of 31+ nights in Texas you don’t have to pay the hotel taxes as you’re regarded as a resident. You’d need to arrange that with the hotel though; when we’ve done this a couple of times in the past, we’ve had to wait until the 31st day, then they can reverse the taxes.

If $74 is the pre-tax cost, paying cash for the entire stay works out better value as the points you’d redeem could potentially be redeemed for better value. Having said that, does the cost of 10,000-12,500 points per night take into account the fact that you’d be getting every 5th night free on an award stay? If it doesn’t, using points works out to be a bit better value.

One other thing that might be worth considering is booking an Airbnb seeing as you’d be staying so long. That way you’d have the entire place to yourself and more space. Just doing a quick look, this place is available at a similar cost, although there could be a bunch of suitable places. https://www.airbnb.com/rooms/29284660?adults=2&check_in=2022-01-01&check_out=2022-03-30&display_extensions%5B0%5D=MONTHLY_STAYS&translate_ugc=false&federated_search_id=d3b480a6-9842-4dd0-abe9-9aa8a93c9f3b&source_impression_id=p3_1631748443_Oy2nDKh%2FJHS0kXHM&guests=1