Heading into March 2022, I was pretty pessimistic about our budget for the month. We’d already gone over budget in January and February due to us being in California and its high cost of living.

Much of March was also spent in California, with the majority of our stays being paid for rather than using points. That meant our accommodation costs were higher than normal, plus some of the hotels we were staying at charged for parking.

I hadn’t expected our spending to end up being quite as bad as it ended up though! We went over budget by a lot, so hopefully future months this year in less expensive states will help us recoup some of that.

Here are all our road trip stats for March 2022.

Miles Driven

We started March 2022 with 172,419 miles on the clock, while the end of the month ended with it being at 174,053 miles. That means we drove 1,634 miles in March. I’d predicted we’d drive 1,400 miles, so it’s a shame that it ended up being more than that because of how expensive gas was in California.

We’re likely going to put more mileage than that on our car in April. My parents flew in from the UK a few days ago to join us on the road trip, so we went from Phoenix to Albuquerque and will then be visiting all five National Parks in Utah, then on to Flagstaff, AZ for Sedona and the Grand Canyon. I’m therefore predicting that we’ll drive 2,200 miles in April.

Money Spent

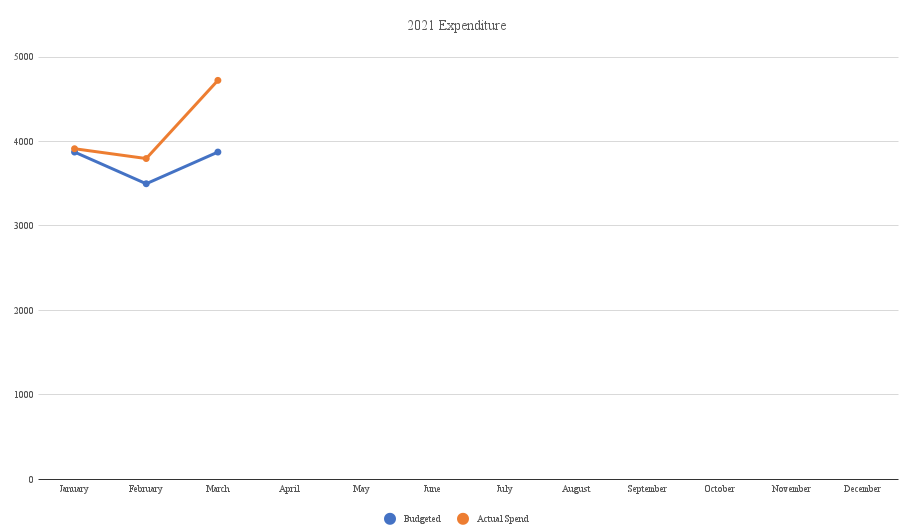

At the start of this year we upped our budget from $100 per day to $125 per day. With 31 days in March, that gave us up to $3,875 to spend if we didn’t want to go over budget.

As mentioned at the start of this post though, we waaaay overspent. By the end of March 2022 we’d spent $4,723.45 which means we were over budget by $848.45. The main reason for that was accommodation, hotel pet fees and hotel parking. That came to close to $2,500, so almost two-thirds of our budget – California is an expensive place to spend a few months!

Other than that, our overall spending wasn’t bad – it was simply hotel costs that killed our budget last month. I’m hoping we’ll just about stay under budget for April, but likely by only a little bit. May to July should be much better though, so hopefully by the end of the summer we’ll have made up ground on our budget based on our overall spending for the year by that point.

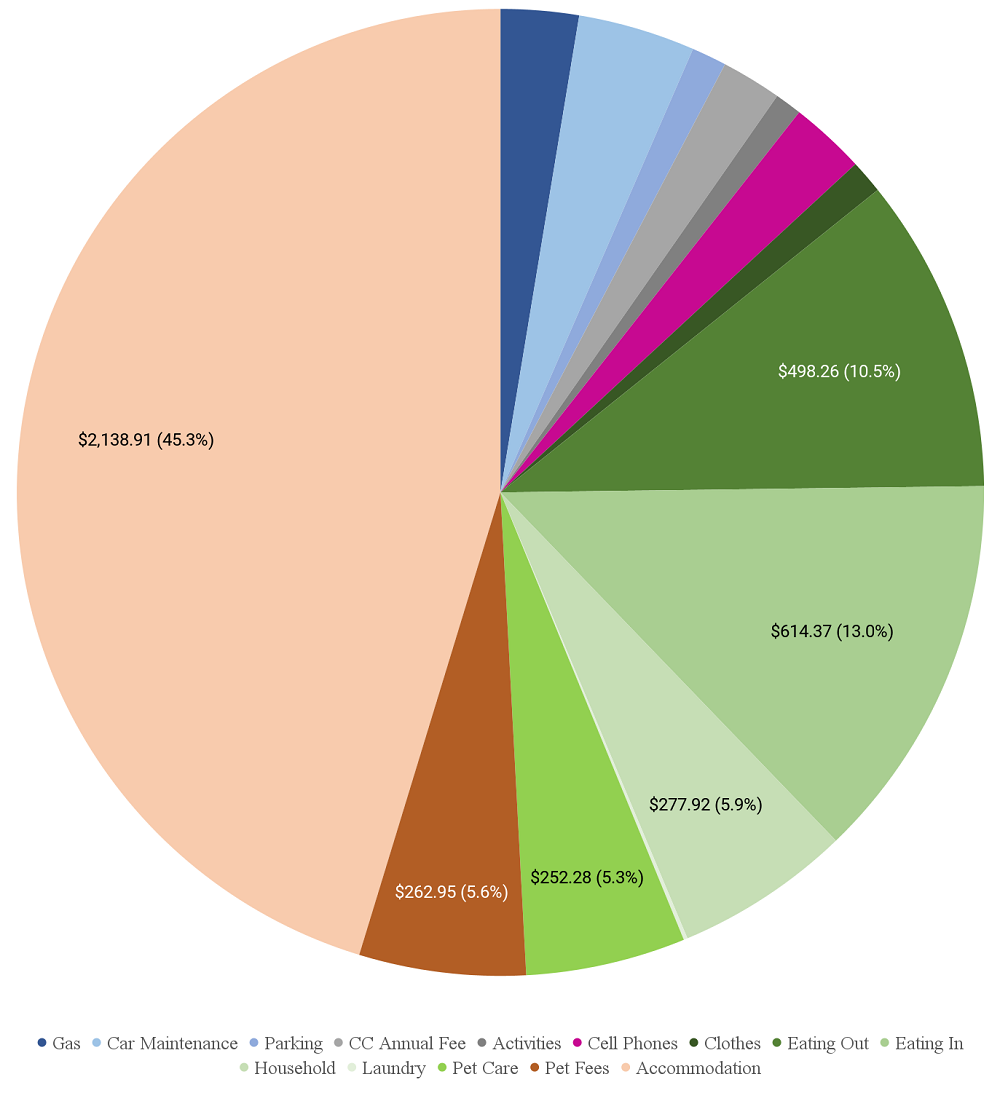

Here’s a breakdown of our spending for March…

…and here’s a chart tracking our overall spending for the year thus far.

Accommodation Cost

Here’s a breakdown of how much our accommodation cost for the month:

March 1-3: InterContinental Mark Hopkins San Francisco, CA (here’s my review). We stayed at this hotel for a total of six nights from the end of February to the beginning of March.

For these final two nights of our stay we used free night certificates, so in theory these two nights were free. However, those certificates come from our Hyatt credits cards that have an annual fee and so aren’t really free. One was from my IHG Select credit card that has a $49 fee and the other from my IHG Premier card which has an $89 fee, so those are the true costs of those two nights.

March 3-6: Hyatt Regency Monterey, CA. We used three category 1-4 free night certificates for this stay, so again in theory these three nights were free. I can’t remember how we earned these certificates though because Hyatt has a number of ways to earn these certificates. You get them when renewing a Hyatt credit card, when spending $15,000 in a year on the credit card and when staying 30 nights at Hyatts in a year. We’ve done all of those and I hadn’t kept track of how exactly those certificates were earned.

March 6-7: Quality Inn Near Hearst Castle in San Simeon, CA. This was just a quick one night stay as we drove down the coast. It was a great choice because it was a decent hotel that only cost $84.73 for the night including tax.

March 7-10: Holiday Inn Express Carpinteria, CA. We stayed here for three nights because we both had to work most of the day on March 8 and 9. It cost us $150.46 per night including tax.

March 10-14: Hyatt House Irvine/John Wayne Airport. This is a category 2 property that was at standard pricing (8,000 points per night) for three nights of our stay our stay and peak pricing (9,500 points) for the other night. That means our four night stay cost a total of 33,500 points.

March 14-21: Fairfield Inn Los Angeles LAX/El Segundo. I managed to find a cheaper rate on another site than the one listed on Marriott’s website. As a result, I submitted a Best Rate Guarantee claim which meant Marriott matched the rate I found elsewhere and gave us another 25% off. That dropped our price to $105.22 per night including tax; that’s higher than we’d normally want to pay for a week-long stay somewhere, but it was our cheapest option at somewhere that didn’t look like we’d be sharing a bed with roaches.

Unfortunately the hotel also charged $18 per night for parking which made it not as good a deal, although it was still cheaper overall than many of our other options.

March 21-28: Airbnb in Kingman, AZ. After leaving California we headed east to Arizona and stayed for a week at this great Airbnb to get caught up on some work stuff before my parents arrived from the UK. This cost $108.82 per night, although paying with discounted Airbnb gift cards reduced that to $97.94 per night.

March 28-31: Homewood Suites Phoenix Metro Center, AZ. We stayed here a total of five nights using points because Hilton gives every 5th night free on award stays if you have any kind of status with them. It cost 30,000 points per night, so the 5th night free benefit meant we paid an average of 24,000 Hilton Honors points per night.

Hotel Points Earned

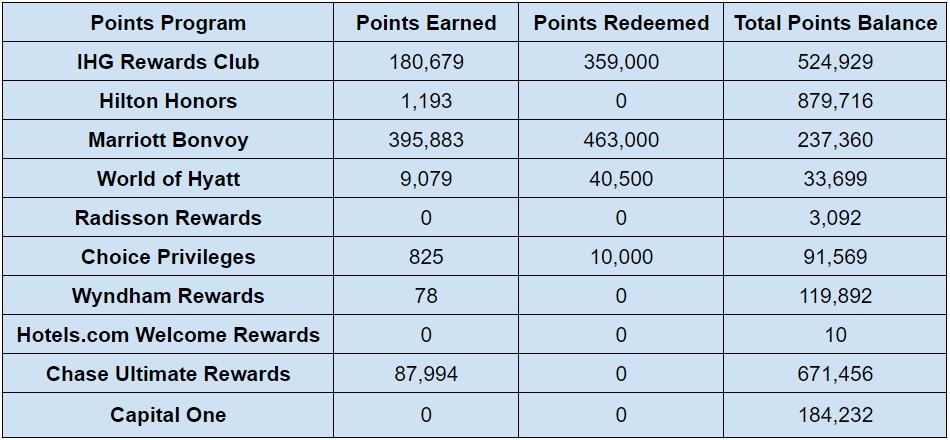

The breakdown of the hotel points we earned in March 2022 looks more impressive than the reality. It shows us earning almost 180,000 IHG Rewards points, but most of those were the result of cancelled and rebooked award stays. The same thing was the case with the increase in Marriott points – we cancelled some stays to rebook them as they were pricing out a little more cheaply now.

The big boost in Chase Ultimate Rewards points was a legit case of them being earned as 75,000 of those were the result of the signup bonus posting from my new Chase Ink Cash credit card.

- IHG Rewards – 180,679

- Hilton Honors – 1,193

- Marriott Bonvoy – 395,883

- World of Hyatt – 9,079

- Radisson Rewards – 0

- Choice Privileges – 825

- Wyndham Rewards – 78

- Hotels.com Rewards Credits – 0

- Chase Ultimate Rewards – 87,994

- Capital One – 0

Hotel Points Redeemed

Seeing as many of the hotel points being “earned” were the result of cancelled and rebooked upcoming stays, we redeemed what looks like a large number of points in March, even though many weren’t new redemptions as such. We did book some new IHG, Marriott, Hyatt and Choice award stays though.

- IHG Rewards – 359,000

- Hilton Honors – 0

- Marriott Bonvoy – 463,000

- World of Hyatt – 40,500

- Radisson Rewards – 0

- Choice Privileges – 10,000

- Wyndham Rewards – 0

- Hotels.com Rewards Credits – 0

- Chase Ultimate Rewards – 0

- Capital One – 0

Total Hotel Points Balances

Based on all those changes, here’s how our total hotel points balances ended up by the end of last month:

- IHG Rewards – 524,929

- Hilton Honors – 879,716

- Marriott Bonvoy – 237,360

- World of Hyatt – 33,699

- Radisson Rewards – 3,092

- Choice Privileges – 91,569

- Wyndham Rewards – 119,892

- Hotels.com Rewards Credits – 10

- Chase Ultimate Rewards – 671,456

- Capital One – 184,232

Here’s a table listing all that information:

Hotel Free Night Certificates

We received a new IHG free night certificate and a new Hilton one in March, both of which were the result of credit card renewals. Here’s how many we now have:

- IHG (up to 40,000 points per night) – 2

- Hilton (any property worldwide) – 7

- Marriott (up to 35,000 points per night) – 1

- Marriott (up to 40,000 points per night) – 1

- Hyatt (category 1-4) – 2

- Hyatt (category 1-7) – 0

Blog Stats

We spent more time working on blog posts last month and so almost doubled the number of posts we wrote from 8 to 15 compared to February.

- Number of blog posts published – 15

- Page views – 20,382

RAGBRAI Update

This month’s training had a bit of a dip. After my 30-mile ride in Palm Springs last month, I found it hard to get any mojo back to get back on my bike with regularity. That changed in San Francisco when I rode across the Golden Gate Bridge just for the fun of it. No real training miles (only 3 miles total) just to do it. It was a great refresh for me and started to get me back on track.

I also invested in new workout clothes (I only had one pair of workout pants left), padded bike undies and clipless pedals and shoes.

The pedals, even though they’re called “clipless”, allow you to clip your shoes to the pedals. I did pretty good on my first test ride with them and my first full ride was a success. Until I arrived back at the Airbnb when I accidently RECLIPPED back in (meaning I was totally out and accidentally ended up reattached to my pedal) and so I literally tipped sideways at zero miles per hour. I hit my knee (that I’d hurt on my fall in December) and got a handlebar to the chest (thankfully the end cap was on so Calliope didn’t take any core samples of my lungs). It also bent part of my bike. After two trips to the bike shop and a new chain, she’s riding great.

Final Thoughts

March 2022 was brutal on our budget, but now that we’re not in California our spending should reduce and we can hopefully catch up.

[…] I’d predicted that we’d drive 2,200 miles last month, so I was waaaay off. Although I’d taken into account that we’d be driving a large loop from Arizona to New Mexico to Utah and then back to Arizona, I don’t think I’d properly accounted for the fact that we’d be doing a lot of driving on top of that from our Airbnbs to all the National Parks in Utah and Arizona. I will say though – it definitely felt like we drove almost 4,000 miles last month! We had an amazing time seeing everything, but it was a lot of time in the car. […]