When publishing our stats for April, I’d mentioned that our spending for May would likely be higher than normal seeing as nearly all our stays would be paid for with cash rather than points.

As a result, I wasn’t very confident about our ability to stay under budget. However, I’d underestimated quite how much we’d end up overspending. The end result isn’t very pretty, so hopefully we can make up for that in the coming months!

Here’s quite how badly we overspent in May, along with our other road trip stats.

Miles Driven

We started May with 197,414 on our car and ended it with our odometer at 199,560. That means we drove 2,146 miles in May which is a little more than the 1,950 miles I’d predicted.

Looking ahead to our mileage during June, it’ll likely be much less. Shae was away for the first week of June and I was away for the first couple of weeks, so there was very little mileage put on the car. By the end of the month we’ll be in Traverse City, MI having driven from Minneapolis via Houghton, MI, so I’ll predict that we’ll be driving 1,250 miles in June.

Money Spent

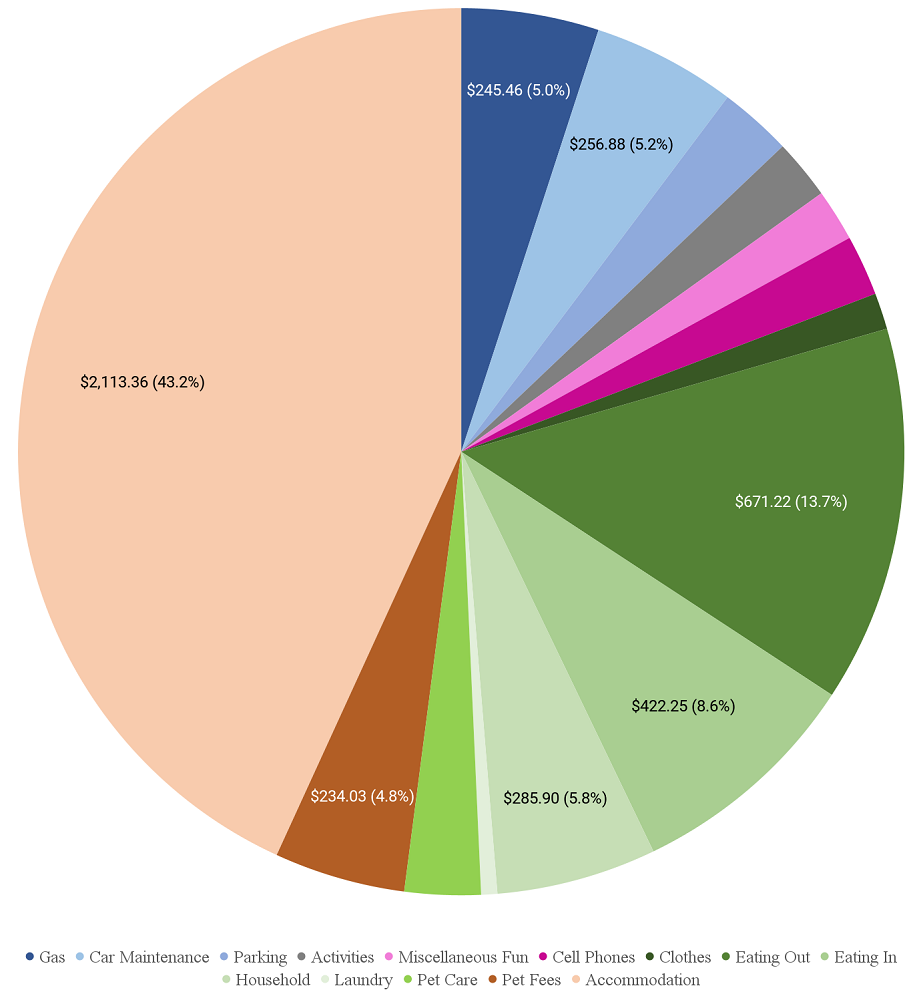

Our daily road trip budget is $125 and so with 31 days in May we had a total budget of $3,875 for the month. By the end of May we’d spent $4,896.22 which means we went $1,021.22 over budget – ouch!

A primary reason for that overspend was how much we spent on accommodation. We spent just over $2,100 which was almost the most we’ve ever spent on hotels and Airbnbs during a single month on the road trip. Our spending in other categories wasn’t excessive compared to normal, but overall it all added up to far more than we’d have liked.

Here’s a breakdown of our spending for May…

…and a chart tracking our spending this year so far.

Looking ahead to our spending for June, I’m almost certain we’ll be overspending again. Once again, that’s due to our spending on accommodation. We’re spending just over two weeks in Minneapolis at the same hotel; we got a great rate there which made it worth paying for a stay rather than trying to redeem points somewhere, but that and a more expensive stay in Houghton, MI at the end of the month means we’re due to spend $2,000+ again.

Accommodation Cost

We stayed in seven different hotels during May – here’s how we paid for them all.

May 1-4: Baymont in Pierre, SD (see my review here). We paid for this stay rather than redeeming points because it only cost $72.73 per night with tax.

May 4-14: Residence Inn Rapid City, SD (see my review here). We booked this as a paid stay because we were able to get a one bedroom suite for $105.91 per night including tax. We paid with a Chase credit card that had a Chase Offer for Marriott loaded to it; the cashback limit on that offer was $75 which is what we earned.

May 14-21: Four Points Deadwood, SD (see my review here). This was another paid stay we booked as I found a fantastic rate a couple of months before our stay – $64.95 per night with tax. When hotels are priced that cheaply, it’s hard to pass up the opportunity!

May 21-22: Quality Inn Bismarck, ND. After finishing up in Deadwood, we moved on to our next state – Minnesota. That would’ve been a long drive, so we stopped overnight in Bismarck. This stay was booked using 10,000 Choice Privileges points which was an excellent deal as we were able to book a two bedroom suite for that.

May 22-25: Holiday Inn Detroit Lakes, MN (see my review here). I had to work on the Tuesday and Wednesday that week, so we decided to stay for a few nights at the Holiday Inn Detroit Lakes which is actually on a lake. We had a great stay and it’s somewhere I’d be happy to return to if we head back to Minnesota in the future. We booked using IHG One Rewards points – two nights were 19,000 points and the other was 20,000 points.

May 25-27: Norman’s One-Stop Motel in Orr, MN. Shae was doing a bear photography experience in Orr that started early in the morning, so we wanted to stay nearby. There were few options available and any that we did initially find were expensive. Thankfully I came across this motel which isn’t on any sites like Expedia and only cost $76.45 per night with tax.

May 27-31: Hyatt Regency Minneapolis-Bloomington (review to come). Shae and I were only going to be in Minneapolis for a few days before going on our respective trips. We wanted to stay somewhere near the airport with a shuttle and the Hyatt Regency was a great choice. Three nights cost 8,000 World of Hyatt points per night, with the other night costing 9,500 points.

Hotel Points Earned

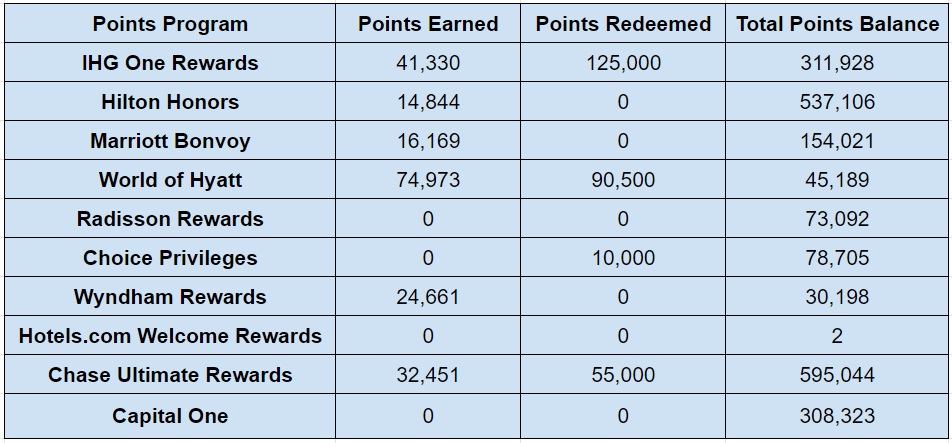

We earned points in most of the hotel programs last month, although not to a particularly significant extent. The most points we “earned” was with Hyatt, although most of those were actually transferred in from Chase Ultimate Rewards and so it was more a case of just shifting points around.

Most of the other points we earned were a result of credit card spend, while our IHG earnings were mostly due to the 10% points rebate we get on award stays thanks to having the old IHG Select credit card.

- IHG One Rewards – 41,330

- Hilton Honors – 14,844

- Marriott Bonvoy – 16,169

- World of Hyatt – 74,973

- Radisson Rewards – 0

- Choice Privileges – 0

- Wyndham Rewards – 24,661

- Hotels.com Rewards Credits – 0

- Chase Ultimate Rewards – 32,451

- Capital One – 0

Hotel Points Redeemed

We booked a few award stays in May which is why our IHG, Hyatt and Choice balances went down.

- IHG One Rewards – 125,000

- Hilton Honors – 0

- Marriott Bonvoy – 0

- World of Hyatt – 90,500

- Radisson Rewards – 0

- Choice Privileges – 10,000

- Wyndham Rewards – 0

- Hotels.com Rewards Credits – 0

- Chase Ultimate Rewards – 55,000

- Capital One – 0

Total Hotel Points Balances

As a result of those earnings and redemptions, here’s how our total hotel points balances ended up at the end of May:

- IHG One Rewards – 311,928

- Hilton Honors – 537,106

- Marriott Bonvoy – 154,021

- World of Hyatt – 45,189

- Radisson Rewards – 73,092

- Choice Privileges – 78,705

- Wyndham Rewards – 30,198

- Hotels.com Rewards Credits – 2

- Chase Ultimate Rewards – 595,044

- Capital One – 308,323

Here’s all that information in a table:

Hotel Free Night Certificates

We had an IHG certificate about to expire recently, so we redeemed that for a friend who needed a hotel for the night as we couldn’t make use of it ourselves. We also got another Hyatt category 1-4 free night certificate as one of our Hyatt credit card annual fees posted. The Hyatt category 1-7 certificate we had last month expired, but thankfully Hyatt has an unofficial policy that they’ll award 20,000 bonus points if you reach out to them, so that’s what we did and sure enough – 20,000 points got added to Shae’s account a few days later.

- IHG (up to 40,000 points per night) – 2

- Hilton (any property worldwide) – 0

- Marriott (up to 35,000 points per night) – 1

- Marriott (up to 40,000 points per night) – 0

- Hyatt (category 1-4) – 2

- Hyatt (category 1-7) – 0

Blog Stats

May was one of our most prolific months is some time when it came to publishing posts as we managed to get 16 of them done.

- Number of blog posts published – 16

- Page views – 25,473

Final Thoughts

From a spending perspective, our road trip stats for May were appalling as we went more than $1,000 over budget. Most of that was due to accommodation costs though rather than overspending in other areas, so that’s a tiny bit of a silver lining.

[…] at all optimistic about our chances of staying under budget for the month. We’d already gone far over budget in May – primarily due to higher than average spending on accommodation – and June was due to […]