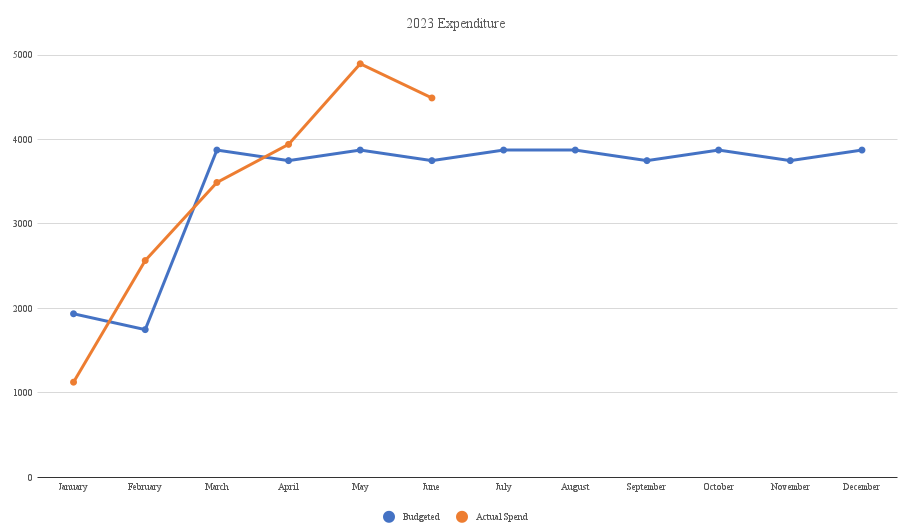

Heading into June, I wasn’t at all optimistic about our chances of staying under budget for the month. We’d already gone far over budget in May – primarily due to higher than average spending on accommodation – and June was due to be much of the same as we were going to be spending quite a lot on hotels again.

Sure enough, we did go over budget. I was at least hopeful that we wouldn’t go more than $1,000 over budget again. Did we manage to limit our spending to achieve that, or was our spending just as bad as the previous month? Read on to find out.

Miles Driven

June began with 199,560 miles on our car’s odometer. By the end of the month it was at 200,767 which means we drove 1,207 miles in June. I’d predicted in the previous month’s stats post that we’d drive 1,250 miles, so that was one of my rare fairly accurate guesses.

This also meant that our car reached a significant milestone last month – 200,000 miles! Here’s the moment it happened:

Looking ahead at our mileage throughout July, I doubt that we’ll be driving even as much as last month. That’s because most of the month is being spent in Michigan, with us heading on to Rochester, NY at the end of the month. We’re about to be spending 10 days in downtown Grand Rapids and so we won’t be driving much while we’re there.

As a result, I’ll predict that we’ll drive 975 miles in July. I haven’t gone through all our past stats posts, but I’m fairly certain that’d be one of the lowest totals so far on the road trip if that’s close to being accurate.

Money Spent

Here’s where things get a little ugly. I’d mentioned earlier that we’d gone over budget – here’s how much that was by. As a reminder, our daily budget on the road trip is $125 which has to cover everything – accommodation, gas, activities, hotel pet fees, food, cell phone bill, etc.

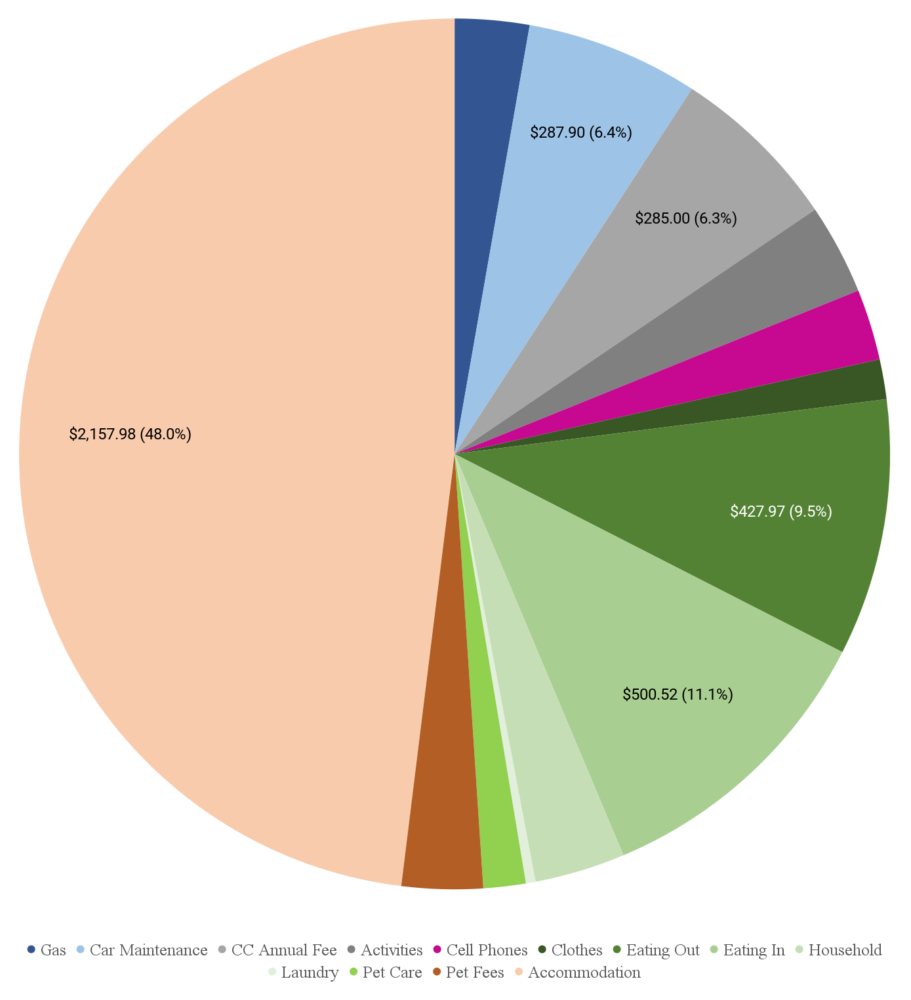

With 30 days in June, that meant our total budget for the month was $3,750. By the end of the month we’d spent $4,491.56 which means we went $741.56 over budget. That’s not as bad as the previous month, but still a substantial amount to be overspending by.

Once again, it was our accommodation spending which hurt us as that came to $2,157.98. Interestingly, that was slightly higher than it was in May which means that we did a better job of reining in our spending in other categories.

Here’s a breakdown of our expenditure last month…

…as well as a chart tracking our spending so far this year.

Accommodation Cost

Despite Shae and I both being away for work trips for the first week of June and so not needing to have any accommodation for the road trip, we still managed to spend a lot. That’s because we had very few award stays and more paid nights than normal.

June 7-8: Hyatt Regency Minneapolis-Bloomington, MN. I’d gotten Shae’s travel dates mixed up and so initially didn’t have a hotel booked for her! Despite me being 12 hours ahead in Japan, she thankfully got hold of me in time to be able to book a hotel for her for the night. We did this using 9,500 World of Hyatt points.

June 8-9: Embassy Suites Minneapolis Airport, MN. I’d thought that Shae was due to be getting into Minneapolis late at night on the 8th, so I’d booked her a hotel near the airport so that she could just go straight to bed. We’d had a Hilton free night certificate that was about to expire, so we ended up using it for this stay which was an appalling use for it seeing as it can be used for any Hilton property worldwide, but it was better than letting it go to waste.

June 9-25: TownePlace Suites MSP Airport/Eagan, MN. This was one of the main reasons our accommodation spending was so high in June. I’d done a successful Best Rate Guarantee (BRG) claim with Marriott for this hotel which reduced the price to $77.13 per night with tax. That was a great rate compared to how much other hotels and Airbnbs were charging, but the 16 night stay meant the total was fairly expensive. Some of this was paid for with Marriott gift cards we’d bought at a discount, so that saved us ~$179.

June 25-30: Holiday Inn Express Houghton-Keweenaw, MI. This was the other main reason our hotel spending was so high last month. We’d wanted to stay in Michigan’s Upper Peninsula (UP), and this was one of the few pet-friendly but somewhat affordable options. Still, at $158 per night with tax, it was still far more expensive than we’d usually pay.

June 30-July 1: Tru Traverse City, MI. We headed to Traverse City next for the Cherry Festival. Despite very high hotel rates for paid stays, we were able to book this for only 30,000 Hilton Honors points per night.

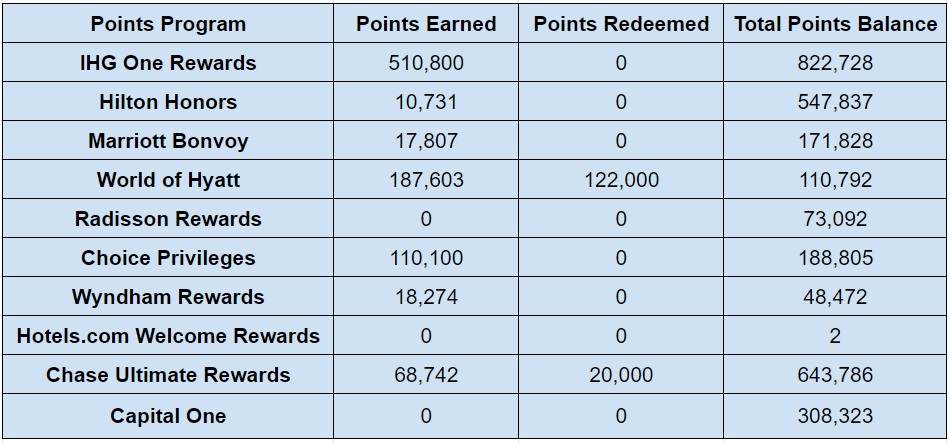

Hotel Points Earned

We had a lot of incoming hotel points in June, but it’s not as exciting as it looks! We bought 500,000 IHG points as they were on sale for 0.5 cents per point (cpp). That cost us $2,500 which we’re accounting for on the budget by spreading out that cost over several months seeing as it’ll take us a while to work through those points. Despite that high cost, it was worth it as we’ll likely get $5,000 of value from those points, if not more.

It’s a similar situation with Choice. Daily Getaways had Choice points on sale for a lower than normal price, so we bought 110,000 of those as they’ll likely come in handy next year in places like Wyoming and Montana. The influx of Hyatt points meanwhile mostly came from a cancelled award stay rather than us actually earning that many points last month.

Here’s a breakdown of all the hotel points we earned/received in June:

- IHG One Rewards – 510,800

- Hilton Honors – 10,731

- Marriott Bonvoy – 17,807

- World of Hyatt – 187,603

- Radisson Rewards – 0

- Choice Privileges – 110,100

- Wyndham Rewards – 18,274

- Hotels.com Rewards Credits – 0

- Chase Ultimate Rewards – 68,742

- Capital One – 0

Hotel Points Redeemed

We made very few award bookings in June, so the only hotel program we spent points with was Hyatt. The 20k Chase Ultimate Rewards points in the list below got transferred to Hyatt which is accounted for among the 187,603 Hyatt points we “earned” in the section above.

- IHG One Rewards – 0

- Hilton Honors – 0

- Marriott Bonvoy – 0

- World of Hyatt – 122,000

- Radisson Rewards – 0

- Choice Privileges – 0

- Wyndham Rewards – 0

- Hotels.com Rewards Credits – 0

- Chase Ultimate Rewards – 20,000

- Capital One – 0

Total Hotel Points Balances

As a result of those changes above, here’s how our points balances finished at the end of June.

- IHG One Rewards – 822,728

- Hilton Honors – 547,837

- Marriott Bonvoy – 171,828

- World of Hyatt – 110,792

- Radisson Rewards – 73,092

- Choice Privileges – 188,805

- Wyndham Rewards – 48,472

- Hotels.com Rewards Credits – 2

- Chase Ultimate Rewards – 643,786

- Capital One – 308,323

And here’s all that information in table format:

Hotel Free Night Certificates

The only change to our hotel free night certificates since last month is that we got a couple more Marriott ones due to a couple of our Marriott credit cards renewing.

- IHG (up to 40,000 points per night) – 2

- Hilton (any property worldwide) – 0

- Marriott (up to 35,000 points per night) – 3

- Marriott (up to 40,000 points per night) – 0

- Hyatt (category 1-4) – 2

- Hyatt (category 1-7) – 0

Blog Stats

I was away for the first couple of weeks of June and was so busy during that time that I didn’t get a chance to publish as many posts as I’d hoped.

- Number of blog posts published – 9

- Page views – 25,737

Final Thoughts

This wasn’t a great month for our road trip stats when it comes to our budget. Going almost $750 over budget was far from ideal, especially as it came hot on the heels of a large overspend the previous month. However, our budget for July is looking a little more healthy and so hopefully we can recoup some of that in the next few weeks.

[…] month the odometer reading was at 202,232, so we drove 1,465 miles in July. I’d predicted in last month’s stats post that we’d only drive 975 miles, so I was quite far off with that guess. I must’ve […]