July had so much potential for our budget. The entire month was being spent in hotels using points, so our accommodation spending would be much lower than normal. That would give us a chance to catch up on some of our budget overspend from earlier this year.

As is often the case though, when these types of opportunities present themselves we don’t end up taking as much advantage of them as we could. There were a few reasons we had higher expenses in other categories to normal, but one of them was more of our fault than others – how much we spent on eating and drinking out!

Here are all our road trip stats for July 2023.

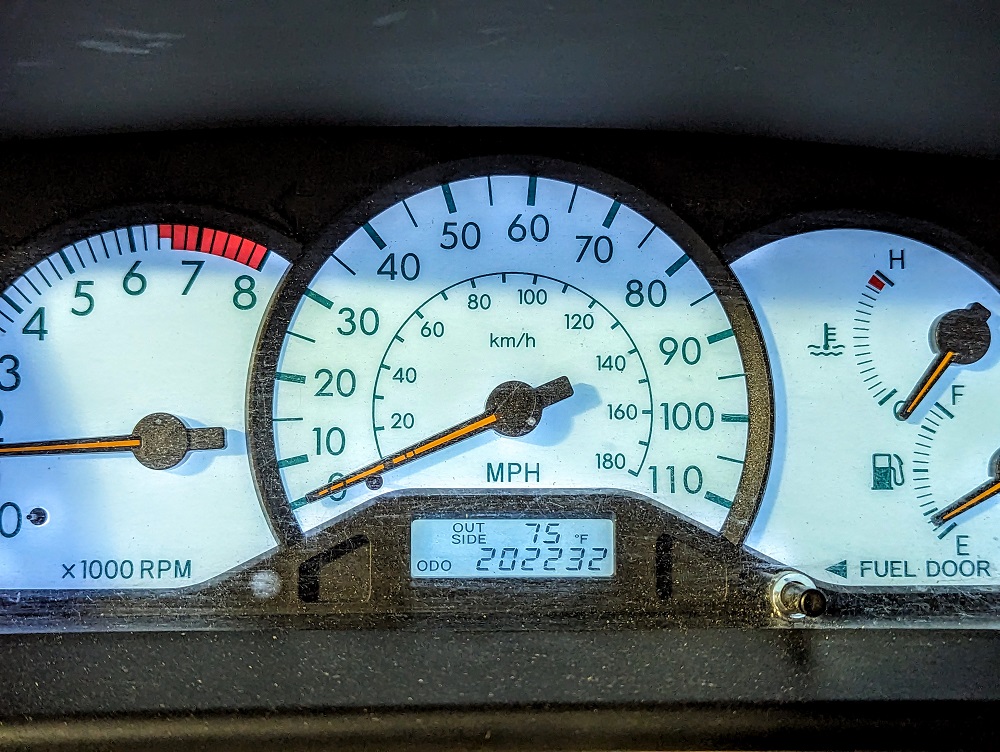

Miles Driven

We started July with 200,767 miles on our car. By the end of the month the odometer reading was at 202,232, so we drove 1,465 miles in July. I’d predicted in last month’s stats post that we’d only drive 975 miles, so I was quite far off with that guess. I must’ve miscalculated when coming up with my estimate last month!

Looking ahead to our mileage for August, it’ll definitely be higher than July’s mileage. I’m going to guess we’ll hit 2,200 miles this month.

Money Spent

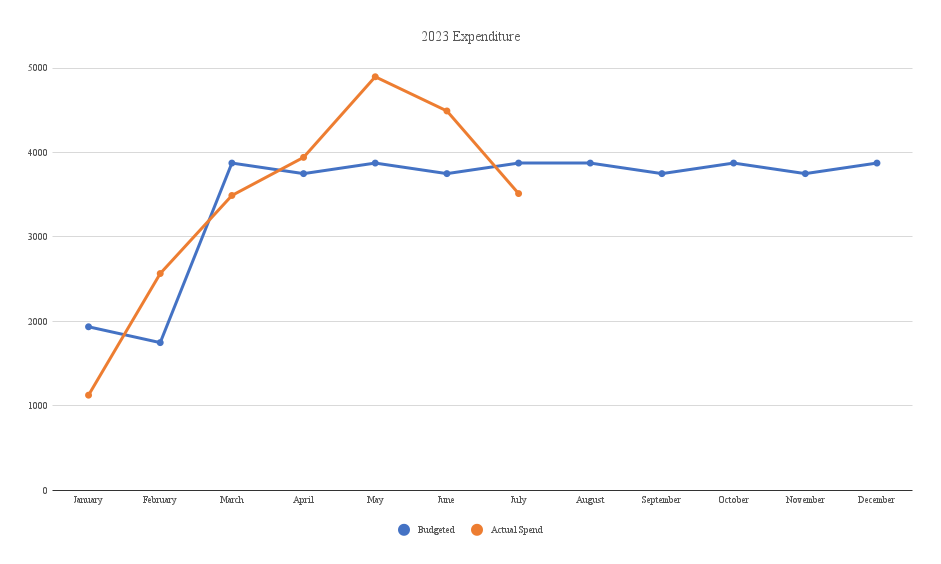

Our road trip budget is $125 per day which has to cover everything – accommodation, gas, hotel pet fees, food, activities, etc. With 31 days in July, our budget for the month was $3,875. By the end of the month we’d spent $3,514.03 which means we stayed under budget by $360.97.

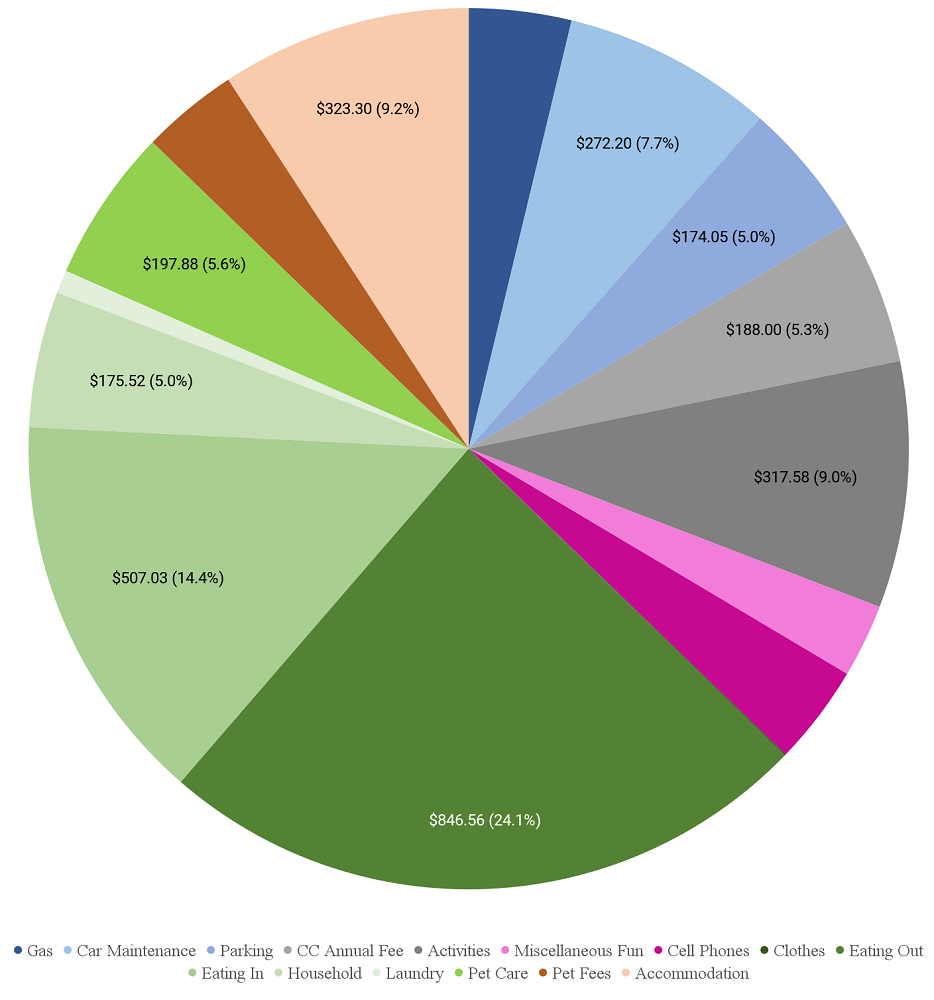

One of the key reasons we weren’t further under budget was how much we spent on eating out and visiting breweries, distilleries, etc. We ended up spending almost $850 in that category which is the third highest amount we’ve spent in that category in any month on the road trip so far.

That wasn’t the only reason we didn’t underspend by as much as we’d hoped. We had to spend almost $175 on parking, mostly due to the downtown hotel we stayed at in Grand Rapids, MI. We spent more on activities than on average and pet care for Truffles was close to $200 (this included grooming, food, etc.).

Ultimately though, any month where we stay under budget is a good month – it’s just a shame it wasn’t as good as it could’ve been.

Here’s a breakdown of our spending in July. Note that even though we didn’t have any paid hotel stays last month, we do have some accommodation expenditure listed. That’s because we’ve bought some hotel points in previous months which we account for over the course of more than one month seeing as those purchased points will be redeemed over the course of a year in many cases.

Here’s a chart showing our spending so far this year.

Looking ahead to our budget for August, I’m not confident about our ability to stay under budget again. Our accommodation spending is due to be slightly above average, but not crazy high. However, we’re in the Finger Lakes region at the moment with lots of wineries nearby and an ice cream shop just across the road from our Airbnb with tons of great flavor options. I therefore think we’re going to be tempted to spend extra on eating and drinking out this month. However, hopefully we can cut costs in other areas so that any overspend doesn’t end up being out of control.

Accommodation Cost

We stayed in six different hotels in July – here’s how we booked them.

July 1-10: Tru by Hilton Traverse City, MI (see my review here). We booked this using Hilton Honors points. It was 30,000 points per night, but we got every 5th night free thanks to a benefit for people who have status with Hilton, so our average cost was 24,000 Hilton points per night.

July 10-20: Homewood Suites Grand Rapids Downtown, MI (see my review here). Homewood Suites is another Hilton brand and we booked with their points. This cost 50,000 points per night, but that 5th night free benefit reduced that to an average of 40,000 Hilton points per night.

July 20-24: Candlewood Suites East Lansing, MI (I won’t be writing a full review of this stay). Candlewood Suites is one of IHG’s hotel brands and if you have the IHG Premier, Traveler or Business credit card you get every 4th night free on award stays. The entire stay was meant to cost 84,000 IHG One Rewards points, although it wasn’t exactly 21,000 points per night as IHG uses dynamic pricing and so the cost changes from night to night.

The 4th night free and a 10% points rebate from still having the old IHG Select credit card made our net cost 15,075 IHG points per night.

July 24-29: Hyatt Place Detroit-Auburn Hills, MI (I won’t be writing a full review of this stay either). We booked this using World of Hyatt points. They have off-peak, standard and peak pricing for their properties. Some nights of our stay were standard and some peak, so with this being a category 1 property that meant we redeemed 5,000 or 6,500 points per night respectively. Our average cost across the five nights was 5,600 Hyatt points per night.

July 29-30: Candlewood Suites Perrysburg, OH (I won’t be writing a full review of this stay either). We’d originally planned to stay in Auburn Hills until July 30. However, we arranged to meet up with some friends who live in Perrysburg, OH (just outside of Toledo) and it wasn’t worth driving all the way back to Auburn Hills that night, only to have to leave for Rochester the next day.

As a result, we changed our checkout date at the Hyatt Place from July 30 to July 29 ahead of time, then booked a one night stay at the Candlewood Suites in Perrysburg. This cost 25,000 points, but the 10% points rebate from my IHG Select credit card will reduce that to 22,500 IHG points.

July 30-August 1: Hyatt Regency Rochester (read my review here). This is a category 1 property in the World of Hyatt program and was at standard pricing throughout our stay, so it cost 5,000 Hyatt points per night.

Hotel Points Earned

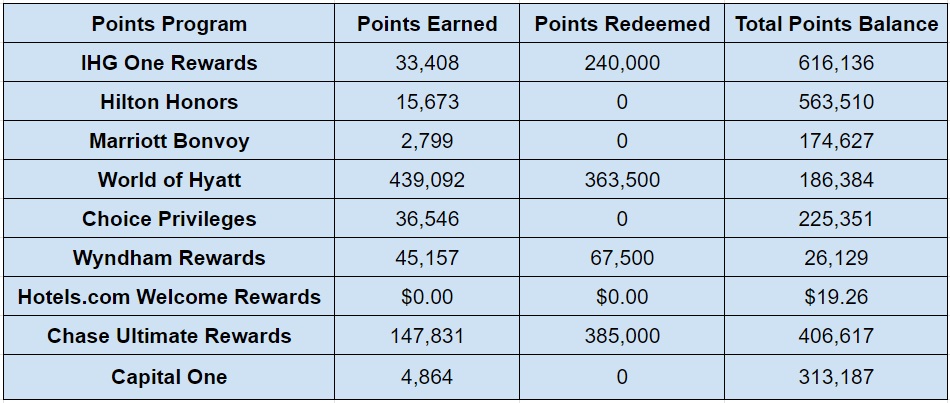

There were quite a few changes to our hotel points balances last month. On the earning side, things weren’t as exciting as they initially appear. Most of the increase in our Hyatt points balances came from cancelled stays and points that were transferred in from our Chase Ultimate Rewards accounts.

As for some of the other increases, many of them came from credit card spend. Our Choice balance went up as Radisson Rewards Americas got fully merged into Choice’s program and those points got converted over. A good chunk of the additional Chase Ultimate Rewards came from me earning the welcome offer on a new Chase Sapphire Preferred card.

Here’s a breakdown of everything we earned:

- IHG One Rewards – 33,408

- Hilton Honors – 15,673

- Marriott Bonvoy – 2,799

- World of Hyatt – 439,092

- Choice Privileges – 36,546

- Wyndham Rewards – 45,157

- Hotels.com OneKey – $0

- Chase Ultimate Rewards – 147,831

- Capital One – 4,864

Hotel Points Redeemed

All of the Chase Ultimate Rewards points that we redeemed in July were transferred to Hyatt, most of which were subsequently used to book upcoming stays. We also redeemed some Wyndham points for a stay next month, as well as some IHG points for a couple of stays this year and one next year on our way up to Alaska.

- IHG One Rewards – 240,000

- Hilton Honors – 0

- Marriott Bonvoy – 0

- World of Hyatt – 363,500

- Choice Privileges – 0

- Wyndham Rewards – 67,500

- Hotels.com OneKey – $0

- Chase Ultimate Rewards – 385,000

- Capital One – 0

Total Hotel Points Balances

As a result of those changes, here’s how our hotel points balances ended at the end of July:

- IHG One Rewards – 616,136

- Hilton Honors – 563,510

- Marriott Bonvoy – 174,627

- World of Hyatt – 186,384

- Choice Privileges – 225,351

- Wyndham Rewards – 26,129

- Hotels.com OneKey – $19.26

- Chase Ultimate Rewards – 406,617

- Capital One – 313,187

Here’s a breakdown of all that information in a table:

Hotel Free Night Certificates

There wasn’t much of a change in how many hotel free night certificates we have. The only update was an additional IHG certificate following the renewal of one of our IHG credit cards.

- IHG (up to 40,000 points per night) – 3

- Hilton (any property worldwide) – 0

- Marriott (up to 35,000 points per night) – 3

- Marriott (up to 40,000 points per night) – 0

- Hyatt (category 1-4) – 2

- Hyatt (category 1-7) – 0

Blog Stats

We did a better job getting posts published in July than we did in June, but we still have a bit of a backlog of things we’ve done over the past month on the road trip that we want to write about.

- Number of blog posts published – 13

- Page views – 28,432

Final Thoughts

July was a fairly good month for our stats seeing as we stayed under budget; it just wasn’t as good as I’d hoped at the start of that month as I’d hoped we’d stay even further under budget.

[…] as we like to bring Truffles with us, although that’s probably a good thing seeing as we went over budget in July despite that! Our time there ended up being an opportunity to catch up on some work, plus we spent […]