After another month of being $500 over budget, as we headed into October I wasn’t overly optimistic about our ability to stay under budget. I mentioned in last month’s stats post that:

I don’t think we’ll be wildly overspending, but I wouldn’t be surprised if we end up a couple of hundred bucks over budget based on anticipated spending (particularly on accommodation costs).

I’m not always the best when it comes to predictions for our stats, so was this another case where I was way off, either by being too pessimistic about our expected spending or by underestimating how much we’d end up spending? Read on to find out.

Miles Driven

We started October with our car having 206,288 miles on the clock. The month ended with its reading being 208,648 which means we drove 2,360 miles in October. I’d predicted we’d only drive 1,675 miles, so I was quite a way off (like I said, I’m not always great at these predictions!)

Despite not being anywhere close to guessing our correct mileage a month away, I’ll give it another try for November. We’re moving on from Plymouth, MA today and heading down to New Jersey – our newest state. November is a busy time for me work-wise, so we won’t be doing too much while we’re there. Having said that, we will be heading up to New York City for a couple of days mid-month, so that’ll add a little mileage. I’m going to predict that we’ll drive 1,375 miles in November.

Money Spent

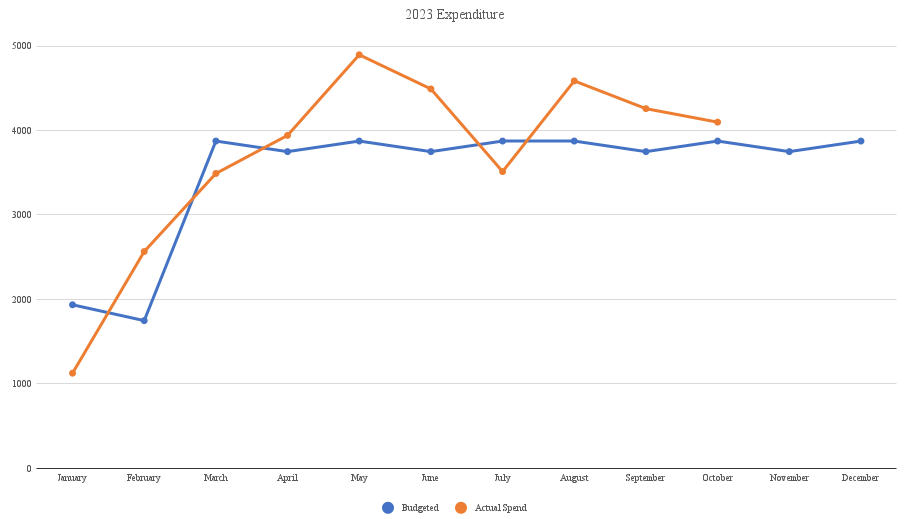

We’ve continued aiming for a budget of $125 per day on the road trip this past year, despite nearly always going over by some degree. October had 31 days which meant over the course of the month we had $3,875 to spend. By the end of the month we’d spent $4,098.67 which means we went $223.67 over budget. That’s disappointing, but it’s still a better result than four of the last five months. It also means my prediction last month that we’d probably go a couple of hundred bucks over budget ended up being accurate for once!

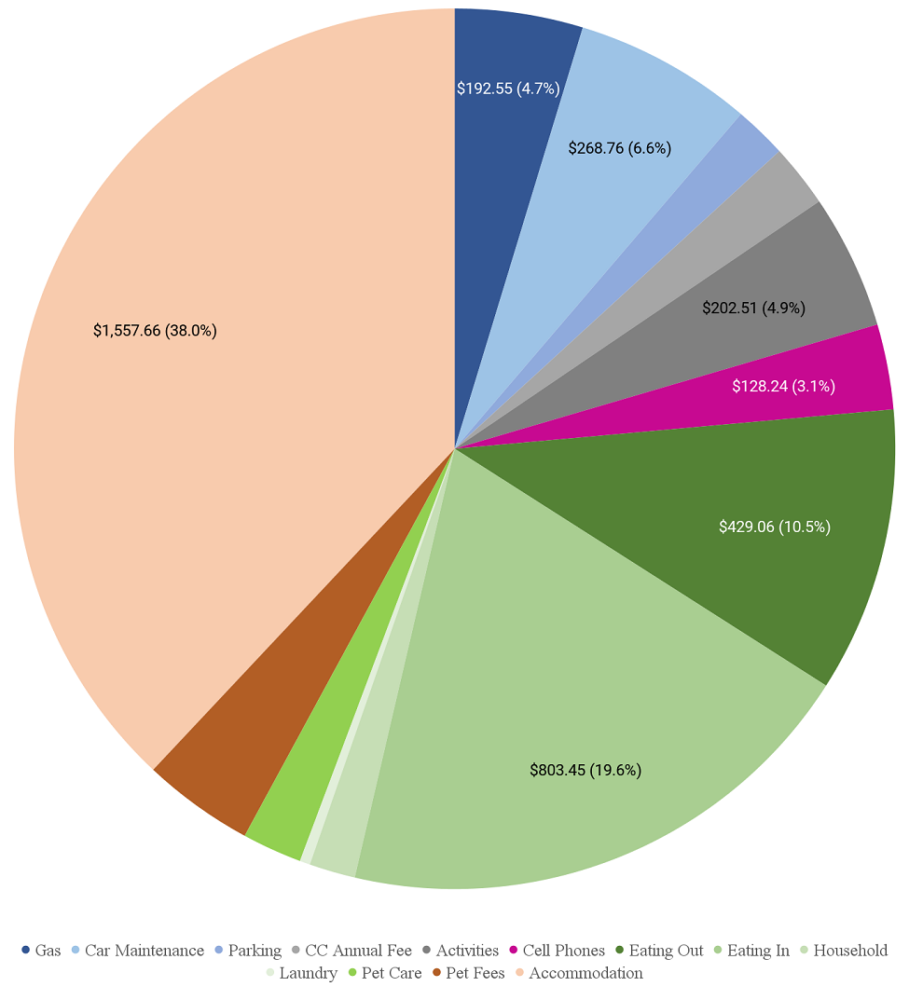

Looking at a breakdown of our spending, it seems like much of that overspend came from the grocery category. We did eat in a lot more while my parents were with us, but it’s still surprising that it was at ~$800; I guess groceries in New England are more expensive than many other parts of the country! Other than that, there isn’t really anything that stands out as a category where we “overspent”, so maybe we’ve just not been realistic with trying to stick with our $125 per month budget.

Here’s a breakdown of our spending from last month…

…along with a chart tracking our (over)spend so far this year.

Looking ahead to our spending for all of November, I hate to get my hopes up but I’m mildly optimistic about us staying under budget this month. Our accommodation spending will be lower than usual which certainly helps. Shae’s had COVID for the past week and so we didn’t end up doing anything, while the next few weeks will be my busiest work period of the year on GC Galore which will also limit how much we spend on activities, eating out, etc.

Accommodation Cost

October 1-5: Vacasa property in Eddington, ME (this one). This cabin had one official bedroom but with a bonus bedroom area in the loft which meant it only cost us 13,500 Wyndham Rewards points per night.

October 5-11: Airbnb in Gray, ME (this one). Although we only needed to stay there for six nights, we booked it as a week-long stay as adding the extra day gave us a discount large enough to make it a little cheaper than booking it as a six night stay. The total was $1,595.10, but by paying with discounted Airbnb gift cards and splitting the cost with my parents who’d joined us for the month, the net cost was $119.63 per night.

October 11-18: Airbnb in Hancock, VT (this one). This was another property we stayed at while my parents were here. The total cost for the week was $1,268.76, but paying with discounted Airbnb gift cards and splitting the cost with my parents again meant it cost us $81.56 per night.

October 18-30: Hyatt House Boston Waltham, MA. This is a category 2 property in the World of Hyatt program which means it costs 6,500, 8,000 or 9,500 points per night depending on if it’s at off-peak, standard or peak pricing. It was at standard pricing for our entire stay, so it cost us 8,000 Hyatt points per night.

October 21-22: Fairfield Inn & Suites Uncasville Mohegan Sun Area, CT. I went to a Switchfoot concert in Connecticut while we were staying at the Hyatt House and so I decided to stay at a hotel near the venue rather than driving back that night. I stayed at a Fairfield Inn which is one of Marriott’s brands and redeemed a free night certificate that was good for up to 35,000 points.

October 24-25: Sheraton Springfield Monarch Place Hotel, MA. A few days later Shae went to see Heather Cox Richardson speak in Springfield, MA. That was going to be a fairly long drive, especially seeing as Truffles would have to wait back at the hotel while she was gone (I was away on a work trip). To make things easier, we booked a one night stay at the Sheraton in Springfield because not only was it pet-friendly, but it was right next door to the event Shae was attending that night too. It would’ve cost 39,000 points, but we redeemed a Marriott free night certificate good for up to 35,000 points and topped it up with 4,000 Marriott Bonvoy points.

October 30-November 1: Hampton Inn Salem, MA. We stayed there over Halloween when rooms were going for almost $800 per night (crazy, I know!) Shae and I obviously weren’t going to pay that; instead we redeemed a free night certificate for one of those nights (received when renewing one of our Hilton Aspire credit cards) and the other with 70,000 Hilton Honors points.

Hotel Points Earned

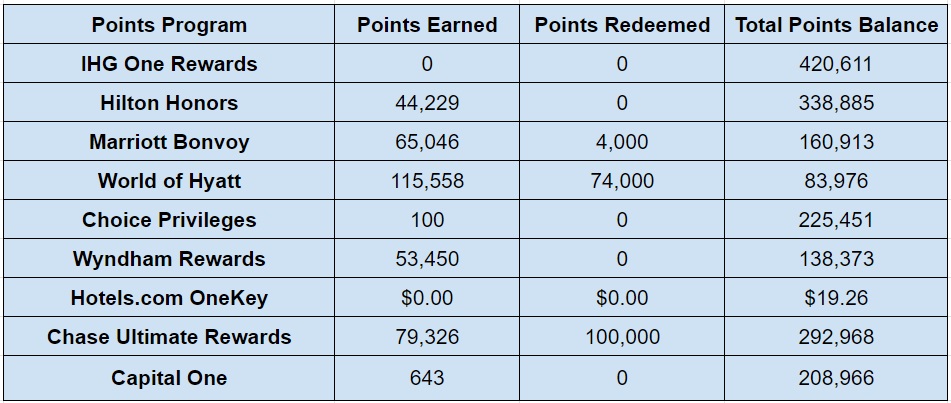

October was a pretty good month when it came to earning points. 40,000 of the points we earned for Marriott came from referring someone to a Marriott credit card, while much of the increase in our Hyatt points was the result of transferring in points from our Chase Ultimate Rewards balances. Most of the rest of our points earnings came about through credit card spend/manufactured spending.

Here’s a breakdown of what we earned:

- IHG One Rewards – 0

- Hilton Honors – 44,229

- Marriott Bonvoy – 65,046

- World of Hyatt – 115,558

- Choice Privileges – 100

- Wyndham Rewards – 53,450

- Hotels.com OneKey – $0

- Chase Ultimate Rewards – 79,326

- Capital One – 643

Hotel Points Redeemed

We didn’t end up having many redemptions in October. The 4,000 Marriott points were to top up one of our 35,000 point free night certificates mentioned in the ‘Accommodation Cost’ section above. The Ultimate Rewards were transferred to our Hyatt accounts as we had a couple of reservations to make for upcoming stays. Here’s a breakdown of what we spent points-wise:

- IHG One Rewards – 0

- Hilton Honors – 0

- Marriott Bonvoy – 4,000

- World of Hyatt – 74,000

- Choice Privileges – 0

- Wyndham Rewards – 0

- Hotels.com OneKey – $0

- Chase Ultimate Rewards – 100,000

- Capital One – 0

Total Hotel Points Balances

Based on those changes, here’s how our points balances looked by the end of October:

- IHG One Rewards – 420,611

- Hilton Honors – 338,885

- Marriott Bonvoy – 160,913

- World of Hyatt – 83,976

- Choice Privileges – 225,451

- Wyndham Rewards – 138,373

- Hotels.com OneKey – $19.26

- Chase Ultimate Rewards – 292,968

- Capital One – 208,966

Here’s all that information in table format:

Hotel Free Night Certificates

There were a few changes to our free night certificates last month. One of our IHG credit cards renewed which meant we got another free night certificate. We earned another Hilton certificate by spending $15,000 on a Hilton Surpass credit card this year, redeemed a 35k Marriott certificate and earned a 40k Marriott certificate as my Choice Benefit after earning Titanium status again this year (75 elite nights).

- IHG (up to 40,000 points per night) – 3

- Hilton (any property worldwide) – 3

- Marriott (up to 35,000 points per night) – 2

- Marriott (up to 40,000 points per night) – 1

- Hyatt (category 1-4) – 3

- Hyatt (category 1-7) – 0

Blog Stats

It was a busy month with my parents over here, so we published fewer posts than normal. There was a huge drop in the number of page views in October and I’m not sure why. Google Analytics made some changes a few months ago and trying to get any meaningful data with the new set up is impossible, so it’s hard to work out what happened – hopefully it rebounds this month.

- Number of blog posts published – 9

- Page views – 16,019

Final Thoughts

Yet another month where we went over budget by at least a couple of hundred bucks. Let’s hope that doesn’t continue in November!

[…] said in last month’s stats post that I was mildly optimistic about our ability to stay under budget in November. As it turns out, […]