Having celebrated New Year’s Eve in style in New York City (more on that in a future post), 2023 has come to an end. That means it’s time to share our stats for the last month of the year.

As the month went on, it seemed like we were doing really well with our budget and so I became progressively more hopeful that we’d stay several hundred bucks under budget. At the end of the month though, I checked our EZ-Pass account to see how much we’d spent on tolls and the result wasn’t pretty.

Would taking all those toll roads push us over budget for the month, or were we lucky enough to have still stayed under budget? Read on to find out.

Miles Driven

December began with our car’s odometer reading at 209,845. It ended with it at 211,751 which means we drove 1,906 miles. I’d predicted we’d drive 1,750 miles and so I was fairly close with that guesstimate.

You might notice that the odometer reading in the photo below is different from 211,751 though. That’s because I forgot to take a photo of the mileage before we left New York City on New Year’s Day to head back to New Jersey (that’s a lot of New things!). That journey was 87 miles according to Google Maps, so I deducted that from the mileage reading.

Our mileage in January will likely be higher. We drove down from New Jersey to Virginia where we’re staying for a few days right now. We head to Florida tomorrow and based on our moving around there in January, we’ll already be at 1,450 miles. Adding in additional trips to activities, grocery stores, etc., I’m predicting that we’ll be at 2,200 miles by the end of the month.

Money Spent

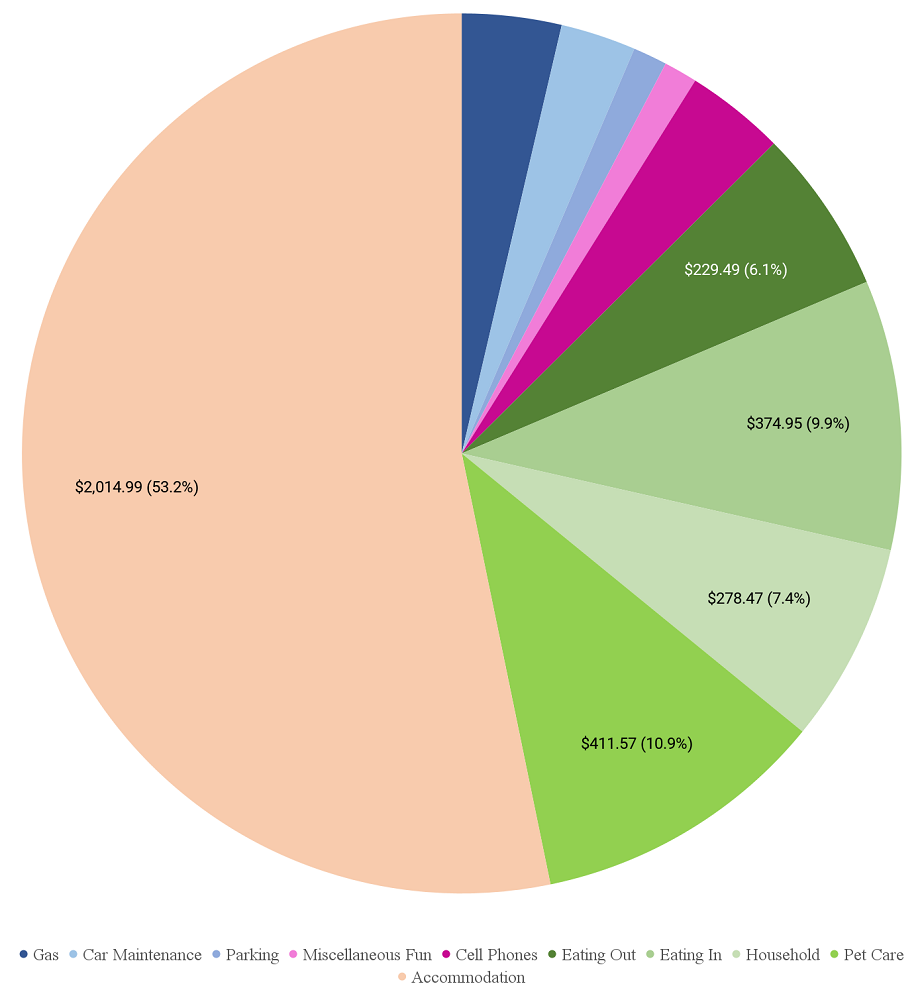

Shae and I have a budget of $125 per day for our road trip. December’s 31 days meant our total budget for the month was $3,875. By the end of December we’d spent $3,784.19 which means we stayed $90.81 under budget last month.

As I mentioned earlier, that was no thanks to toll roads. Shae took a couple of trips up to New York for Hamilton-related attractions there for the classes she teaches, plus we returned for New Year’s Eve. Those tolls and other tolls driving around New Jersey as well as to and from Baltimore for a show there came to $216.47 – ouch!

Other than that, our budget was fairly healthy. Our gas expenditure was slightly lower than average, while our spending on activities was non-existent as we were so busy working and anything we did do was free. Even our eating out and grocery spending was subdued compared to normal.

The only categories that were noticeably higher than normal were pet care (thanks to a ridiculously expensive vet visit for Truffles where they charged far more than was justified) and accommodation seeing as most of the month was spent in Airbnbs rather than stays in hotels booked with points.

Here’s a breakdown of our spending by category…

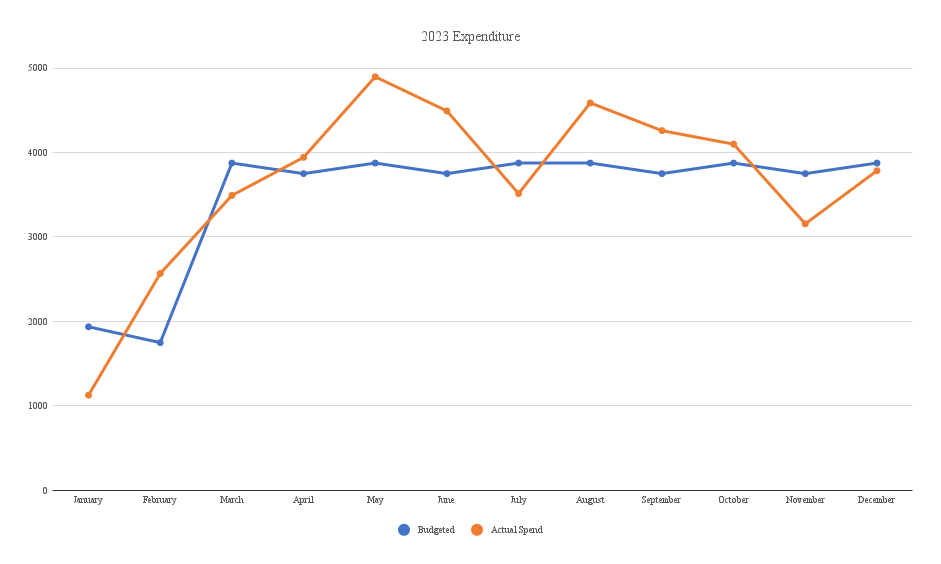

…and a chart tracking our spending across last year as a whole.

Looking ahead to our spending for January, I think it’ll be a close-run thing as to whether or not we stay under budget. Our accommodation expenditure shouldn’t be too high, but pet fees are – as things stand – due to come to ~$600 which is much more than normal. Hopefully at least one or two of those hotels neglect to charge us the pet fee which would go a long way to helping us stay under budget for the month.

Accommodation Cost

It didn’t feel like we moved all that much in December, but a couple of quick overnight stays meant we ended up staying in five different places. Here’s how we paid for all those stays, whether with cash or with points.

December 1-21: Airbnb in Seaside Heights, NJ (this one). We booked a month-long stay which meant we got a discount for staying that long. The total cost was $2,093.56 and we paid with Airbnb gift cards we bought at a discount, so our net cost was $57.40 per night.

December 8-9: Kimpton Hotel Monaco Baltimore Inner Harbor, MD. Shae and I got tickets to see the touring theater production of Moulin Rouge (we’d highly recommend it as it’s a lot of fun), so we needed to stay in Baltimore overnight. We had an IHG free night certificate that was due to expire, so we used that to book an one night stay at the Kimpton Hotel Monaco Baltimore Inner Harbor.

It was a great stay and was enhanced thanks to Kimpton’s secret password. Every few months Kimpton announces a phrase on social media that you should say when checking in; if you do, you get some kind of free gift which varies from property to property. We were given the choice of picking something at the front desk, or having a surprise sent to our room. We went with the surprise that was sent to our room and it was excellent. There was a bottle of sparkling rosé which was very good, a couple of Kimpton-branded stainless steel to-go cups, bath bombs, Old Bay seasoning (Maryland is home to Old Bay) and some chocolate-covered almonds. This was such an awesome welcome gift, especially seeing as we were only staying one night using a free night certificate.

December 21-28: Airbnb in Cape May, NJ (this one). Shae’s mom and stepdad joined us for Christmas in Cape May. Cape May does Christmas really well, with many of its Victorian mansions lit up beautifully at that time of year.

Seeing as there’d be four of us, we booked a two bedroom Airbnb. We had a fantastic stay; it was a great amount of space, it was beautifully decorated and was only a few minutes from downtown Cape May.

The best part though was the backyard. There’s an acre of open space which is fully fenced, so Truffles absolutely adored getting to run around chasing after her toys back there.

We paid for the stay with discounted Airbnb gift cards and split the cost 50-50 with Shae’s parents, so our portion came to $92.05 per night.

December 28-January 1: Hyatt House Mt Laurel, NJ. This is a category 1 property in the World of Hyatt program which means it costs 3,500, 5,000 or 6,500 points per night depending on if it’s at off-peak, standard or peak pricing. Our first night was off-peak, while the next three nights were at standard pricing and so were at 3,500 and 5,000 World of Hyatt points per night respectively.

That was for a one bedroom suite with a kitchen which was already good value. We were able to use a suite upgrade award to get a two bedroom suite (each with its own bathroom), as well as a living room and kitchen. We did this because my in-laws were still with us and meant we didn’t have to redeem points for a separate one bedroom unit.

December 31-January 1: Thompson Gild Hall, NY. Shae’s parents were originally only due to be joining us at the Airbnb in Cape May over Christmas. However, we managed to get four tickets for a New Year’s Eve event in New York City, so it made sense for them to stay with us in New Jersey in the meantime rather than driving back to Virginia only to have to head back up to NYC.

For New Year’s Eve we booked a one night stay at the Thompson Gild Hall in New York City for 23,000 World of Hyatt points. I had a suite upgrade award that was due to expire a couple of months later, so we used that to get a one bedroom suite. Shae’s mom and stepdad stayed in the bedroom, while Shae and I slept in the living room on the sofa bed. It might’ve just been all the booze we had at the New Year’s Eve party, but I swear that this was the most comfortable sofa bed we’ve ever slept on! It was much more spacious than most sofa beds, didn’t dig into our backs and didn’t creak every time we made any kind of slight movement either.

Hotel Points Earned

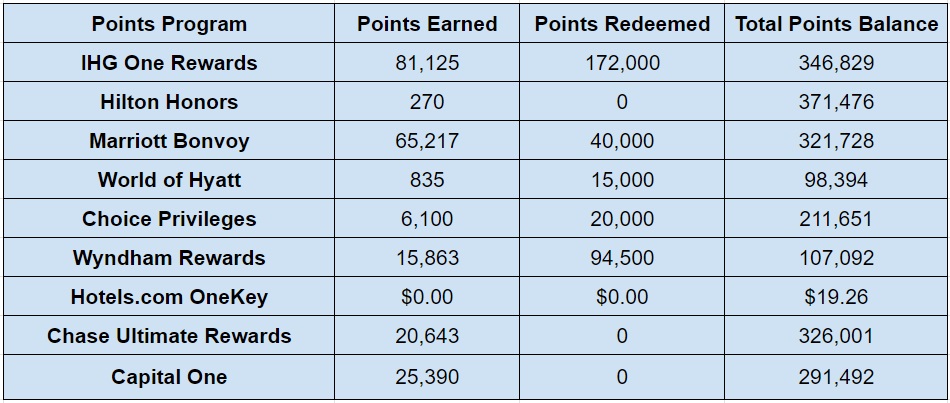

December was a fairly good month for adding hotel points. Most of the increase in IHG points was due to a cancelled stay, 40,000 of the Marriott points were from a credit card referral, while most of the rest of the points were earned from credit card spend.

- IHG One Rewards – 81,125

- Hilton Honors – 270

- Marriott Bonvoy – 65,217

- World of Hyatt – 835

- Choice Privileges – 6,100

- Wyndham Rewards – 15,863

- Hotels.com OneKey – $0

- Chase Ultimate Rewards – 20,643

- Capital One – 25,390

Hotel Points Redeemed

Although it was a fairly good month for earning hotel points, we ended up redeeming more points than we earned as I booked quite a few stays for the coming months. Here’s what we spent:

- IHG One Rewards – 172,000

- Hilton Honors – 0

- Marriott Bonvoy – 40,000

- World of Hyatt – 15,000

- Choice Privileges – 20,000

- Wyndham Rewards – 94,500

- Hotels.com OneKey – $0

- Chase Ultimate Rewards – 0

- Capital One – 0

Total Hotel Points Balances

Based on all those changes, here’s how our balances ended on December 31:

- IHG One Rewards – 346,829

- Hilton Honors – 371,476

- Marriott Bonvoy – 321,728

- World of Hyatt – 98,394

- Choice Privileges – 211,651

- Wyndham Rewards – 107,092

- Hotels.com OneKey – $19.26

- Chase Ultimate Rewards – 326,001

- Capital One – 291,942

Here’s that information in table format:

Hotel Free Night Certificates

We redeemed a few free night certificates last month. An IHG one was used for a quick overnight stay in North Carolina on our way from Florida to West Virginia, while the three Hyatt certificates we had at the end of November were used for a stay in the Miami area in February.

- IHG (up to 40,000 points per night) – 1

- Hilton (any property worldwide) – 1

- Marriott (up to 35,000 points per night) – 0

- Marriott (up to 40,000 points per night) – 0

- Hyatt (category 1-4) – 0

- Hyatt (category 1-7) – 0

Blog Stats

December was another busy month for me work-wise and so I didn’t have much time to publish new posts here on No Home Just Roam. Having said that, it was a little more productive than it was in November.

- Number of blog posts published – 8

- Page views – 9,776

Final Thoughts

While we didn’t stay as far under budget as I’d initially hoped, we did stay under budget which was a mean feat considering how much of 2023 went with respect to our spending! Hopefully we manage to continue that into the new year.

Leave a Reply