One of the ways we’re able to afford living in hotels on our road trip is by earning as many hotel points as possible. We then maximize those points as best we can to get as many free nights as possible.

Trying to maximize our points when redeeming them means that there are many times when it’s not good value to book a stay using points. When that happens, we’ll pay for the hotel or Airbnb stay, but the credit card we use to do that varies depending on which hotel chain we’re staying with.

On this subject, we received the following question from Jeannine in our No Home Just Roam Inner Circle Facebook group recently:

Question for you – when you stay at hotel, how do you pay for your stay? With their co branded credit card, a Chase Sapphire card for ultimate rewards points, Amex with the ability to earn membership rewards or do you pay with points? How do you decide?

There are a couple of main questions here. One of them is how we decide whether to pay for our stay using points or cash. I’ll answer that in a future post (you can find that here) as that’s a whole different equation than deciding which credit card to actually pay with once we’ve decided to pay cash.

One thing to note before continuing is that even though we pay with a credit card, we always pay off the cards when each statement is received. That ensures we don’t pay any interest because the cost of the interest would far outweigh any value gained from earning points.

There are a number of factors which go into deciding which credit card to pay with. Which hotel chain we’ll be staying with, which credit cards we have of theirs, Amex Offers and Chase Offers currently available, gift card opportunities and more.

Here’s the reply I gave to Jeannine which I’ve expounded upon in even greater detail below. I’ve broken down each section by hotel chain; if you’re wondering which hotel brands are part of each chain, check out this post which lists them all.

Airbnb

OK, so Airbnb isn’t a hotel, but we stay at them pretty frequently, so it made sense to include them in this post to explain how we pay for those stays.

We usually pay for Airbnb stays with gift cards bought at a discount. The way we do that varies depending on the opportunities available at the time. For example, Amazon sometimes runs a promotion where you can save 20% on up to $250 of spend when paying with at least 1 American Express Membership Rewards point. When we’re targeted for that offer, I’ll buy a $250 Airbnb gift card which is discounted to $200 thanks to the 20% discount. I redeem 1 Membership Rewards point and pay for the rest of the gift card with a credit card. Shae and I both have Amazon accounts, so we’ll double up when possible by buying a $250 Airbnb gift card on each account.

Saving 20% on Airbnb gift cards isn’t an opportunity that comes around too often, but other savings are often possible. There was recently a SoFi Money deal which offered 10% back when spending up to $500 at Whole Foods, Trader Joe’s or Instacart. I went to Whole Foods and bought a $500 Airbnb gift card, with SoFi Money giving a $50 statement credit to reduce the net cost to $450.

IHG

For the past year we’ve paid for IHG stays with Shae’s IHG Premier card because in the first year it earned 25 points per dollar when paying for IHG stays. We’re coming to the end of that first year of card membership now, but we’ll usually still use an IHG Premier card to pay for stays seeing as the card still earns 10 points per dollar after the first year.

The exception will be if there’s an Amex Offer for whichever IHG brand we’ll be staying at. If you’re not familiar with Amex Offers, they’re offers which you can find on any American Express credit and charge cards you have. They come in a few different forms for different retailers, restaurants, hotels, etc.:

- Spend $x and get $y back as a statement credit

- Spend $x and get y number of Membership Rewards

- Get x% back on up to $y of spend

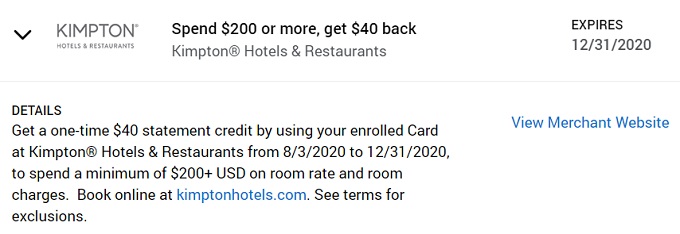

There are sometimes Amex Offers for hotel chains or hotel brands which we’re able to take advantage of when paying for stays. For example, there’s currently an Amex Offer for Kimpton which is one of IHG’s brands. This gives $40 back when spending $200 or more on room rate or room charges.

When there’s an Amex Offer like this, it generally makes sense to pay with an American Express card with that offer loaded as the statement credit you’ll receive ($40 in the above example) is usually going to be greater than the value of the points you’d earn by paying with an IHG Premier card which is issued by Chase rather than American Express.

Hilton

I have a Hilton Aspire card which earns 14 points per dollar when paying for Hilton stays, so we nearly always use that right now. It comes with a $450 annual fee, so I probably won’t keep it unless I get a good retention offer. The reason the annual fee is so high is because it offers a bunch of different benefits like a $200 airline fee credit, $250 resort credit, Diamond status and more. I don’t know if I care enough about all those benefits to pay the $450 annual fee which was waived the first year when I applied for it. If I do close it, we’ll use a Hilton Surpass credit card for future stays which earns 12 points per dollar, so not too much of a drop.

Similar to IHG though, that could be affected by Amex Offers. The nice thing about Hilton credit cards is that they’re issued by American Express, so you can sometimes find Hilton Amex Offers on Hilton credit cards which means you can stack the savings from the offer with the increased number of points per dollar by paying for the stay with that card.

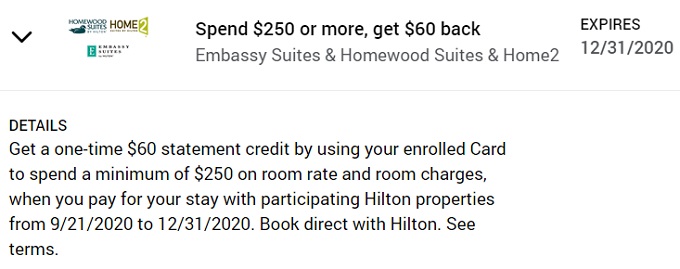

That doesn’t always work out though. For example, we’ll be staying at an Embassy Suites later this week which is one of Hilton’s brands. A brand new Amex Offer appeared yesterday for Embassy Suites and a couple of Hilton’s other brands (Home2 Suites and Homewood Suites).

Shae and I were both targeted for this offer, but sadly not on any of our Hilton cards. We’ll still use both our offers though because the savings are too good to pass up.

The good thing is that we can split the payment for our upcoming Embassy Suites stay to maximize these offers and my Hilton Aspire card. We can put $250 on my Amex card which has this offer, $250 on Shae’s card with this offer and the balance on my Hilton Aspire card to earn 14x on the rest. That’ll save us a total of $120 (2x $60 statement credits), while earning as many bonus Hilton points as possible.

Marriott

Marriott has a bunch of different credit cards, some of which are issued by Chase and some which are issued by American Express. We have four different types of Marriott cards – a personal and business card with Chase and a personal and business card with American Express.

Ordinarily there’s no difference as to which one we use because they all earn 6 points per dollar when paying for Marriott stays. That’s a little different right now because there are Amex Offers for Marriott hotel stays giving a total of 10 points per dollar, so we’ll be using one of our Amex cards to pay for a Marriott stay next month.

There are also semi-frequent Marriott Amex Offers which offer statement credits, so we try to take advantage of those when possible. One Marriott Amex Offer giving $50 back when spending $200 just ended, so I’m hoping another one takes its place before our next stay.

Marriott also sold gift cards for 20% off a few months ago, so we bought $3,000 of those, but used much of their value for our month-long stay in Cincinnati. I now wish I’d stocked up on even more of their gift cards, but I wasn’t sure at the time when our next paid Marriott stay would be and was wary about fronting that cost due to COVID-19 uncertainty. I didn’t want to spend another $3,000 on Marriott gift cards, only for them to go into liquidation before we had a chance to redeem the gift cards. While that scenario was (and is) unlikely, there was far more uncertainty back in May as to how things were going to turn out which is when that gift card offer happened.

Hyatt

We usually pay for Hyatt stays with my World of Hyatt credit card as that offers 4 points per dollar. However, they sold gift cards for 10% off a couple of times in the past year, so we stocked up on some of those and still need to redeem them. We have some paid Hyatt stays coming up later this year, so we’ll be able to spend down their balances then.

There are also Chase Offers and Amex Offers for 10-20% off Hyatt stays sometimes (n.b. Chase Offers are similar to Amex Offers, but are available on Chase cards), so when possible we pay with a card that has one of those offers loaded to it. That might therefore mean not using a gift card or Hyatt credit card.

The great thing is that many of Hyatt’s properties sell gift cards at the front desk. You can therefore buy gift cards to take advantage of Amex Offers and Chase Offers. For example, there have been Hyatt Place Amex Offers in the past giving $50 back when spending $250 or more. I therefore bought a $250 gift card from the front desk of a Hyatt Place we were staying at using points, so it had a net cost of $200.

Choice Hotels

Although we have a Choice credit card, we use Shae’s Chase Sapphire Reserve card to pay for our occasional stays at Choice Hotels properties. That’s because the Choice credit card earns 5 points per dollar, whereas the Chase Sapphire Reserve card earns 3 Ultimate Rewards points per dollar when paying for travel.

While a card offering 5x sounds like it would be a better option than a card offering 3x, that’s not actually the case in this scenario. I value Ultimate Rewards points at more than double the value of Choice Privileges points, so earning 3 Ultimate Rewards per dollar gets us greater value.

I’ll cover in a future post how different points are worth different amounts, but here’s a quick example. Let’s say for ease of calculation that we spent $1,667 for a stay at a Choice Hotels property. If we paid for the stay with the Choice credit card, we’d earn 8,335 Choice Privileges points. If we paid for that same stay with a Chase Sapphire Reserve, we’d earn 5,001 Ultimate Rewards points.

We could transfer 5,000 Ultimate Rewards points to Hyatt and get a free night at a category 1 property as those cost 5,000 points per night. Although 8,335 Choice points is in theory enough for a free night at one of their properties, the quality of the Choice property at the 8,000 point level generally isn’t going to be all that good, whereas many Hyatt properties costing 5,000 points per night are excellent value.

Wyndham

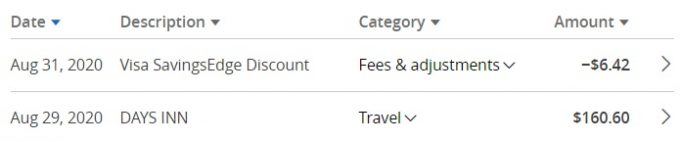

We don’t have a Wyndham credit card, but even if we did we’d pay for Wyndham stays with a Chase Ink Business Preferred card for a couple of reasons. First, it earns 3 Ultimate Rewards points per dollar, so the same as a Chase Sapphire Reserve. It’s better than a Sapphire Reserve card in this instance though because you can register it with a card-linked program called Visa Savings Edge which is for Visa business cards.

Visa Savings Edge offers a statement credit for purchases at certain retailers, services and hotels – a little bit like Amex and Chase Offers, but not quite the same. One of the partners is Wyndham, with most of their brands offering 4% back as a statement credit. We therefore paid for a recent Days Inn stay that way. The stay cost us $160.60, so Visa Savings Edge gave us a $6.42 statement credit.

Hotels.com

We occasionally book stays via Hotels.com, but the downside with that is that you don’t earn hotel points or get to take advantage of hotel status. Having said that, Hotels.com runs its own Rewards program but it doesn’t tend to be as good as earning points directly with hotel chains.

We’ve bought Hotels.com gift cards at a 20% discount in the past, so we pay for those occasional stays with gift cards.

Questions?

I hope I’ve explained things fairly clearly, but let me know in the comments below if you have any questions 🙂

It’s so complicated! how do you keep track??? I imagine a spreadsheet. I’ll have to start doing that soon.

I have it all in my head, but that’s because I spend far too much time thinking it! I also write about some of this stuff over on Frequent Miler, so that helps me keep up with everything. A spreadsheet is a good option too – it’s one of the few things I actually don’t have a spreadsheet for!

Some people use a label maker on their cards to remind them of what to use for other spending, like a certain card for groceries, a different one for gas, etc. to help maximize their spend.

I would think a Wyndham Business card would be preferable. 8x at hotels & gas. You are not giving up any extra discounts since you can link the Wyndham business card up Visa Savings Edge.

PS 90k signup bonus is not bad.

Yep, I have a Wyndham Business Earner card now – I must’ve written this post before their new lineup of cards came out. With the increased bonuses on those cards right now, we’ll probably get Shae one of those too.

I am working on a new CIC signup bonus. Do any hotels allow you to pay part of the bill with Visa gift cards? Hyatt?

I’ve never tried doing that, but I don’t see why you couldn’t. When checking out you can just ask them to split the payment on more than one card.

I imagine your biggest issue will be if you’re trying to do something like pay for a $2,000 stay with 10x $200 Visa gift cards. Although it might be possible to do that, they might be a little less keen splitting the payment on that many cards, either because it’d be a lot of hassle or because they’d think something shady might be going on even though what you’d be doing is legit. For a $600 stay though, splitting payment on three $200 cards would hopefully be fine.