Confession time: we cheated with our budget last month.

Well, sort of.

We spent almost two weeks at the end of the month in the UK and Amsterdam and our original plan had been to include all that spending in our budget.

As the month progressed, our budget wasn’t looking too healthy, mainly because we’d spent a week in New York at the start of the month which was pretty expensive.

In the end, we decided to exclude our UK/Amsterdam spending from our budget – and thus these stats. We still have some money in a bank account in the UK, so we used that to fund our activities.

Doing that had an unexpected consequence. In addition to not destroying our budget for last month, it was incredibly relieving. Taking my nephew and his girlfriend out for lunch was something we could do without having to worry about how it’d affect our budget. Having a drink in a bar we used to enjoy visiting could be done without any guilt. We could take a boat ride in Stratford-Upon-Avon without wondering if that would push us over budget for the day.

As a result, we’ve returned to the US feeling renewed and ready to be careful with our spending again. Our vacation overseas was therefore a holiday in more ways than one.

So given that we excluded more than 1/3 of the month from our budget, does that mean we managed to stay under budget? Keep reading to find out.

Miles Driven

We started March with 111,523 miles showing on our car’s odometer. By the end of the month, it had 112,133 miles on the clock, meaning we drove 610 miles in March.

That’s significantly less than normal and is because we didn’t drive to New York, plus the last couple of weeks in March were spent overseas.

Our road trip restarts tomorrow as we’ll be driving from Virginia to Kentucky. I’m therefore going to predict that we’ll drive 1,600 miles during April – we’ll see next month how accurate that is.

Money Spent

I mentioned at the start of the post how our budget wasn’t looking too healthy even before we flew to the UK. Our daily budget is $100, so we had, in theory, $3,100 to play with in March. Despite excluding all our UK and Amsterdam spending, we still managed to spend $3,198.87 which means we went $98.87 over budget.

Although money spent overseas wasn’t included in our budget, we did include US-incurred expenses relating to the trip. We spent $145.86 in taxes and fees for our flights, while it cost us $381 to leave Truffles with her dog boarder. It was tempting to leave these expenses off as it would’ve meant we’d have been under budget, but that felt like it’d be cheating far too much!

I’m feeling a little more optimistic for April though. Our accommodation costs will be lower than normal, mainly because most of our stays have been booked using points. Shae and I are both trying to eat more healthily, so that should reduce our eating out costs. The biggest issue will likely be activity costs as there seems to be quite a lot of fun stuff to do in Kentucky, so hopefully those don’t blow our budget out of the water.

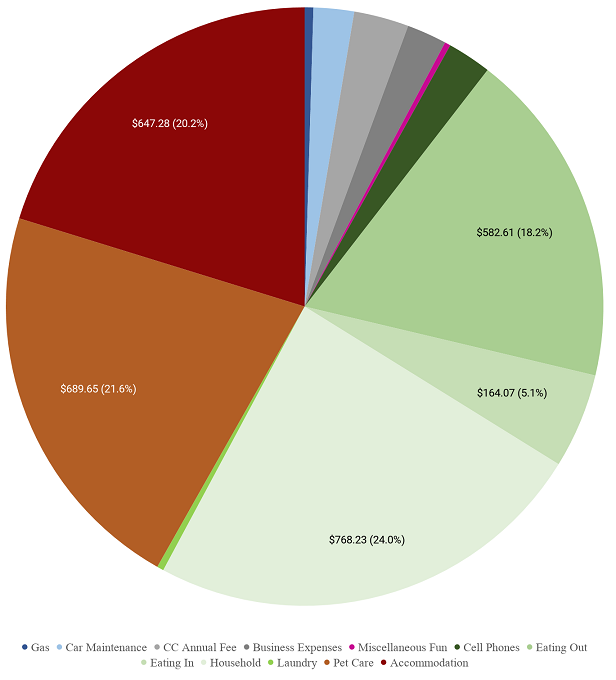

Here’s a breakdown of our spending from March 2019…

……and a chart showing our overall spending so far this year.

Points Earned

Although our stay at the Holiday Inn Manhattan 6th Ave-Chelsea in New York kinda sucked, it did help us earn a ton of points with IHG Rewards Club as it meant we completed several tasks from their latest promo.

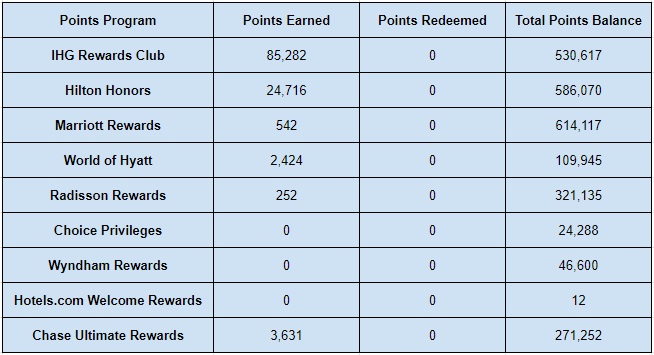

Here’s a list of the other points we earned last month:

- IHG Rewards Club – 85,282

- Hilton Honors – 24,716

- Marriott Rewards – 542

- World of Hyatt – 2,424

- Radisson Rewards – 252

- Choice Privileges – 0

- Wyndham Rewards – 0

- Hotels.com Welcome Rewards Credits – 0

- Chase Ultimate Rewards – 3,631

Points Redeemed

We didn’t redeem any of our points last month, so this next section was easy to fill out.

- IHG Rewards Club – 0

- Hilton Honors – 0

- Marriott Rewards – 0

- World of Hyatt – 0

- Radisson Rewards – 0

- Choice Privileges – 0

- Wyndham Rewards – 0

- Hotels.com Welcome Rewards Credits – 0

- Chase Ultimate Rewards – 0

Total Points Balances

Seeing as we earned more than 100,000 hotel points last month and didn’t redeem any, our total points balances looked a little healthier at the end of March.

That’s unlikely to be the case when we cover April’s stats as I’m in the process of booking several stays for April and May using points.

- IHG Rewards Club – 530,617

- Hilton Honors – 586,070

- Marriott Rewards – 614,117

- World of Hyatt – 109,945

- Radisson Rewards – 321,135

- Choice Privileges – 24,288

- Wyndham Rewards – 46,600

- Hotels.com Welcome Rewards Credits – 12

- Chase Ultimate Rewards – 271,252

Here’s all that points information listed in a table:

Blog Stats

In case you’re interested in how our readership is going, here are some stats for that:

- Number of blog posts published – 14

- Page views – 19,472

Final Thoughts

With a bit of cheating, our spending didn’t go as far over budget as it could have. We’re hopefully back on the wagon now though, so our stats post next week should be looking a little more healthy.

Your introduction to this post provides great insight into the difference between vacationing and long term travel. You vacationed in the UK and the Netherlands, so it makes sense that you separated that from your normal budget. I am very interested in reading about the psychological aspects of long term travel, so I enjoy reading your thought pieces and reflections. Your budget requires a lot of attention and discipline (psychological energy), and is hard to maintain.

Yep, not having to consider our budget 24/7 was definitely more relieving than I’d been expecting it to be. I’ll have to write a longer post sometime about why long-term travel isn’t as glamorous as it might seem!