When I put together last month’s stats post, I had no idea how well we’d do with our budget in June.

We weren’t due to spend much on accommodation as we’d be staying in hotels using points for half the month and a couple of fairly inexpensive Airbnbs for the other half. However, we’d be visiting Vermont and Connecticut in June which are both fairly high cost-of-living states, so that would increase our other expenses.

So how did we do with our budget and everything else last month? Read on to find out.

Miles Driven

We began June with 117,458 miles on our car’s odometer. By the end of the month it had 118,827 miles on the clock, so we only drove 1,369 miles. That’s significantly less than the 2,050 miles I’d predicted we’d drive during June which is great as it meant less time in the car and lower gas costs.

Our mileage will definitely be higher during July. We’re currently in Connecticut, then we’re heading to Rhode Island for 10 days, then up to Vermont for a week with Shae’s mom and stepdad, then down to Virginia ready for our trip to Bali.

My prediction in that we’ll drive 2,250 miles this month, so we’ll see in a few weeks how accurate that guess is.

Money Spent

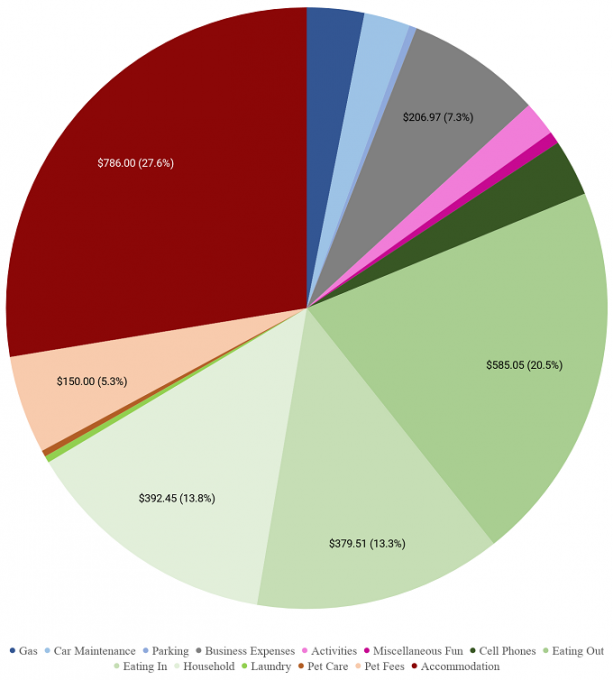

Despite the higher cost of living in Vermont and Connecticut, we did better with our budget than I’d expected.

With 30 days in June and a budget of $100 per day, that gave us a monthly budget of $3,000. By the end of the month we’d spent $2,847.91, so we managed to stay $152.09 under budget.

That was a little surprising as it felt like we spent far too much money on booze while exploring central Vermont and then checking out the Middlebury Tasting Trail. We only spent $786 on accommodation though which helped, as did our low cost in the ‘Activities’ category.

That latter point isn’t strictly true, although it depends on how you look at it. A lot of our ‘Activities’ included visiting wineries, breweries, distilleries, etc. Those expenses were allocated under ‘Eating Out’, but it’s nice that the fact that we like to go out to eat and drink dovetailed nicely as experiences too.

Here’s a pie chart that provides a breakdown of our June 2019 spending…

…and a chart tracking our overall spending in 2019 so far.

Looking ahead at our budget for July, I’m not feeling quite as confident. Our accommodation costs are due to be twice as much as last month, while our gas costs will be higher due to the additional mileage we’ll be putting on our car. We’ll hopefully be able to cut spending on our food and drink budget though, so hopefully we’ll be able to mitigate some of those extra expenses.

Points Earned

Even though we didn’t have any paid hotel stays last month, we still managed to earn a good number of points thanks to bonus points from a credit card renewal, other credit card spend, points from a hotel stay from the previous month being credited and a few other minor avenues (e.g. 250 IHG Rewards Club points from a Grubhub order).

Here’s what we earned last month:

- IHG Rewards Club – 250

- Hilton Honors – 33,207

- Marriott Bonvoy – 500

- World of Hyatt – 25,701 (21,000 of which were transferred in from my Chase Ultimate Rewards account)

- Radisson Rewards – 40,000

- Choice Privileges – 0

- Wyndham Rewards – 0

- Hotels.com Welcome Rewards Credits – 0

- Chase Ultimate Rewards – 12,533

Points Redeemed

We ended up redeeming more points than we earned last month as our entire 3.5 weeks in Connecticut is being spent in hotels using points – thanks Hyatt and Marriott for having a number of category 1 and 2 properties in CT!

Here’s a breakdown of what we spent:

- IHG Rewards Club – 0

- Hilton Honors – 0

- Marriott Bonvoy – 100,000

- World of Hyatt – 75,000

- Radisson Rewards – 0

- Choice Privileges – 0

- Wyndham Rewards – 0

- Hotels.com Welcome Rewards Credits – 0

- Chase Ultimate Rewards – 21,000 (transferred to my World of Hyatt account)

Total Points Balances

Despite redeeming more points than we earned last month, our total points balances are still looking pretty healthy:

- IHG Rewards Club – 544,967

- Hilton Honors – 615,682

- Marriott Bonvoy – 470,355

- World of Hyatt – 6,340

- Radisson Rewards – 314,240

- Choice Privileges – 26,226

- Wyndham Rewards – 46,600

- Hotels.com Welcome Rewards Credits – 15

- Chase Ultimate Rewards – 281,676

I’m not sure how our balances will look by the end of July. We have a paid stay at a Hampton Inn (one of Hilton’s brands) in Rhode Island later this month, so that should earn us a decent number of points as we’ll be earning double points from their latest promotion and paying for the stay with a Hilton credit card that earns 12x points per dollar.

I’ve no idea how many points we’ll be redeeming though. I need to start planning out where we’ll be staying in Virginia in the second half of August once we get back from Bali, so I’m not sure if those will be paid or award stays. I may end up procrastinating though and not book them until the beginning of August, so we’ll see.

Here’s all our points information in table format if you prefer to view it that way:

Blog Stats

Here’s how the blog did last month:

- Number of blog posts published – 22

- Page views – 30,458

Final Thoughts

I’m really pleased that we managed to stay more than $150 under budget last month, especially because that’s four months out of six we’ve stayed under budget this year. It’ll also hopefully help offset any overspending that happens during July.

Leave a Reply