When putting together our stats for June, I mentioned that I wasn’t feeling too optimistic about what our spending would look like in July.

A significant portion of our budget had already been allocated for hotel costs, so it wasn’t leaving us much leeway in our budget for anything else – food, gas, activities, etc.

It turns out I was right, although I guess I’d actually been somewhat overly optimistic before that as we overspent by even more at the end of the month than I’d anticipated. There were some mitigating factors though, so it’s not as bad as the headline numbers appear.

Anyway, here’s all our stats from July 2019.

Miles Driven

We started July 2019 with 118,827 miles showing on the odometer. By the end of the month it was displaying 121,708 which means we drove 2,881 miles.

I’d estimated last month that we’d drive 2,250 miles, so I was way off with that prediction. We ended up doing a lot more driving in Rhode Island and Vermont than expected, so that’s why we drove ~600 more miles than I thought we would.

August’s mileage will be significantly lower. We’re currently in Bali and get back on the 14th, so that’s two weeks of no driving. We’ll then be spending the rest of the month in Portsmouth and Richmond (both Virginia), so that won’t require much driving either. I’ll therefore predict that we’ll drive 850 miles in August, but it may well be even less than that.

Money Spent

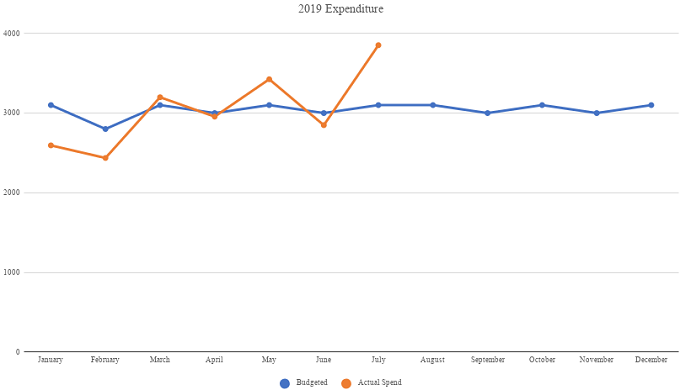

As I mentioned in the intro, we went significantly over budget last month. With 31 days in July and a daily budget of $100, we had $3,100 to play with. By the end of the month, we’d spent $3,851.77, so $751.77 over budget.

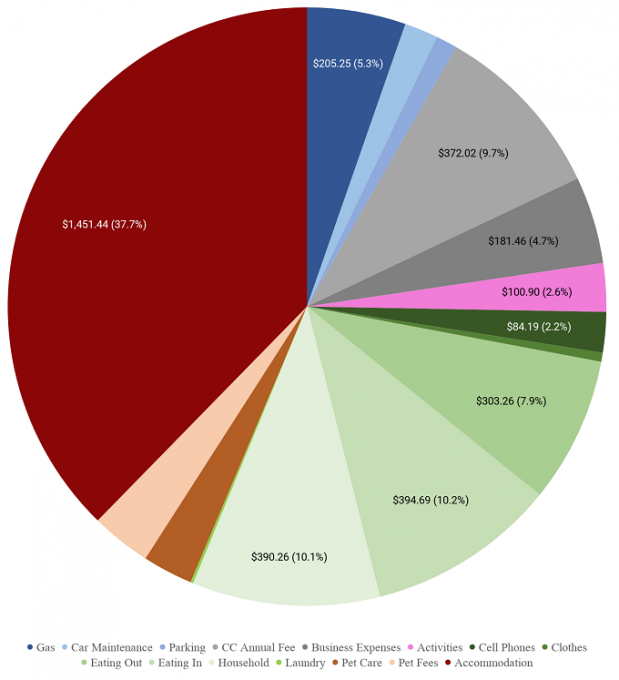

That’s our worst result in about a year, but not totally unexpected. Our accommodation costs and hotel pet fees came to more than $1,500 last month which is about twice as much as we usually spend. That accounts for pretty much all our overspend, so at least we kept much of our other spending reined in.

Credit card annual fees came in at almost $375. That’s a lot, but most of those are hotel cards that come with free night certificates, so those offset the fees. At only ~$300, our eating out bill was better than usual, although that was helped by Shae’s parents treating us when we met up with them in Vermont.

Here’s a pie chart breaking down all of last month’s spending…

…plus a chart tracking our spending in 2019 so far.

This sadly means we’re over budget for the year overall, but we’ll hopefully make up that difference in August. Similar to our trip to the UK and Amsterdam, we won’t be including spending from our Bali vacation in our budget as it’s not part of our road trip spending. We’re also due to be staying in hotels using points or with family for pretty much the rest of August, so that’ll reduce our spending too.

The downside is that we’re having work done on our car which is due to come to almost $1,000, so we won’t be anywhere near as under budget as we would’ve been. It’s all maintenance that’s needed though, so better to spend $1,000 now rather than $5,000 later!

Points Earned

One of the benefits of spending so much (for us) on hotels is that we earned quite a few points off the back of it. That stay was at the Hampton Inn Providence/Warwick Airport which is owned by Hilton, so that gave our Hilton Honors balance a boost.

I was also targeted for a 150,000 point bonus when upgrading my no annual fee Hilton Amex card to a Hilton Surpass card. That required spending $3,000 in 3 months, with that spending completed last month.

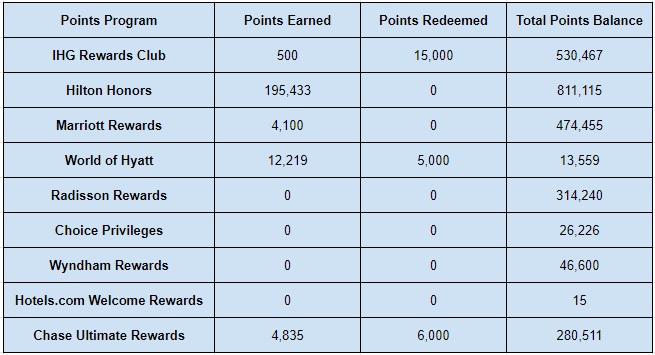

Other than that, there weren’t any significant additions to our points balances, but here’s a list of everything we earned last month:

- IHG Rewards Club – 500

- Hilton Honors – 195,433

- Marriott Bonvoy – 4,100

- World of Hyatt – 12,219

- Radisson Rewards – 0

- Choice Privileges – 0

- Wyndham Rewards – 0

- Hotels.com Welcome Rewards Credits – 0

- Chase Ultimate Rewards – 4,835

Points Redeemed

I’m a little behind in getting our future travel booked, so we didn’t redeem many points in July. I should be booking our August and September stays in the next couple of days, so our list of points redemptions will be higher when I put together next month’s stats.

- IHG Rewards Club – 15,000

- Hilton Honors – 0

- Marriott Bonvoy – 0

- World of Hyatt – 5,000

- Radisson Rewards – 0

- Choice Privileges – 0

- Wyndham Rewards – 0

- Hotels.com Welcome Rewards Credits – 0

- Chase Ultimate Rewards – 6,000

Total Points Balances

Based on all those changes, here are our total hotel points balances at the end of July:

- IHG Rewards Club – 530,467

- Hilton Honors – 811,115

- Marriott Bonvoy – 474,455

- World of Hyatt – 13,559

- Radisson Rewards – 314,240

- Choice Privileges – 26,226

- Wyndham Rewards – 46,600

- Hotels.com Welcome Rewards Credits – 15

- Chase Ultimate Rewards – 280,511

Here’s all that information in table form:

Blog Stats

Our blog traffic has been steadily increasing over the last few months, so here are a couple of figures regarding how that changed in July:

- Number of blog posts published – 15

- Page views – 36,614

Final Thoughts

It sucks that we went so far over budget last month, but that can be pretty much attributed to higher than normal hotel costs which in turn earned us a good number of points that’ll reduce the cost of future stays.

The rest of our spending in July was reasonable, so that’s positive. We should be under budget in August, but our car maintenance expenses mean our spending in August won’t be as low as it could be.

[…] I’ve already given away that we went over budget last month, but here’s more info about how it went. With 31 days in May, our budget for the month was $3,100 as we’ve set ourselves a $100 per day budget. By the end of the month we’d spent $3,556.72, so $456.72 over budget. That’s the most we’ve overspent since July 2019. […]