Our spending in the first month of our 5 year, 50 state road trip wasn’t great – we went $637.99 over budget.

There were some mitigating factors, but it was still disappointing that we spent far more than anticipated. We therefore made a much more concerted effort with staying on budget in our second month.

Did that effort work?

Yes.

And no.

Our day-to-day spending was on point, but we still ended up overspending due to a couple of one-off expenses. Here’s a complete breakdown of our expenditure, miles driven, points earned, points redeemed and more.

Miles Driven

We ended January 2018 with 81,350 miles on our Toyota Corolla. At the end of February, there were 83,585 miles on the clock, so we drove 2,235 miles in February. That’s 263 miles more than we drove in January, even though there were fewer days in the month.

The reason we traveled so many miles was because we headed back to Virginia for a few days so that Shae could go to Mom Prom in Norfolk. That added about 800 miles that we wouldn’t have driven if we’d remained in Georgia that weekend.

I don’t think those extra miles added to our budget though. Although we spent more in gas, we had free accommodation that weekend as we stayed at her dad’s.

Money Spent

Just as a quick recap, we’re doing our 50 state road trip on a budget of $100 a day. That has to cover accommodation, gas, food, activities – everything!

As there were 28 days in February, that meant our budget was $2,800. The amount we actually spent came to $3,064.13, so we were $264.13 over budget.

That’s a little disappointing as we really wanted to remain on budget, or – ideally – under budget. As I mentioned earlier, one positive aspect was that our day-to-day spending was on point.

That $264.13 overspend came from two one-off expenses. The first was a $198.16 charge for two tickets to Harry Potter & The Cursed Child – the Broadway production opening in New York this year. We’d registered for special pre-sale access with Ticketmaster and were lucky enough to get tickets for the show in March 2019.

In theory we could’ve allocated this spending in 2019 when we’re actually seeing the show, but we wanted to include it now so that we don’t forget to enter it on the budget next year.

The other (hopefully) one-off expense was a $95.85 vet bill. Truffles was sick for almost a week while we were in Atlanta, so we took her to the vet to get her checked out and she was prescribed some medicine. The vet bill was less than we were expecting though, so that was a pleasant surprise.

Although the vet bill was unexpected, in hindsight it might’ve saved us money. Due to Truffles’s sickness, we couldn’t leave her alone in the hotel room. That meant we didn’t do as many activities as we’d planned, some of which would’ve cost money. The cause of that vet bill might therefore have actually saved us money!

So that’s why we went over budget. I guess we need to rein in our day-to-day spending even more so that these one-off expenses don’t keep pushing us over each month.

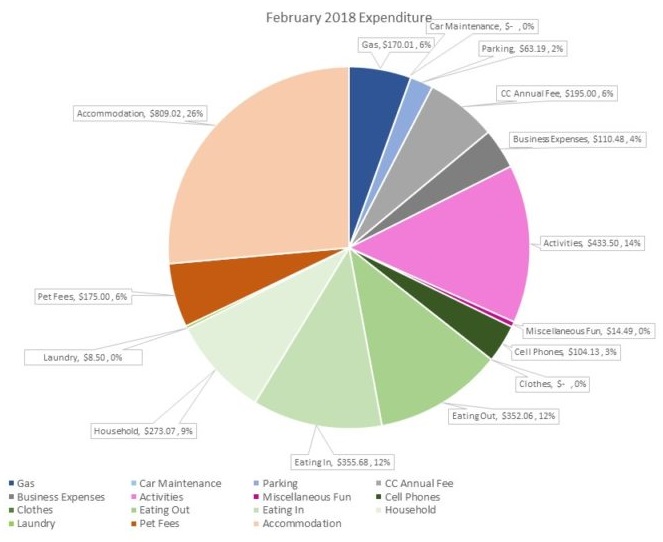

Here’s a breakdown of our expenditure from February:

And here are line and bar graphs showing our planned budget and our actual spending so far. These two graphs show the same data, just using different types of graphs – do you have a preference as to which type we use in the future? Let us know in the comments below if you do have a preference.

Points Earned

We didn’t have many paid-for hotel stays during February, so our point earnings were somewhat minimal. Here’s a list of all the points we earned:

- IHG Rewards Club – 0

- Hilton Honors – 858

- SPG – 1,496

- Marriott Rewards – 95,050 (90,000 transferred on a 3:1 ratio from SPG account)

- World of Hyatt – 20,000 (transferred from Chase Ultimate Rewards)

- Club Carlson – 0

- Choice Hotels – 4,061

- Wyndham Rewards – 0

- Hotels.com Welcome Rewards Credits – 0

- Chase Ultimate Rewards – 13,048

Points Redeemed

We didn’t use many points for hotel stays this past month. The points that we did use went towards stays not only in February, but also some of our pre-booked accommodation in Alabama during March and April.

- IHG Rewards Club – 0

- Hilton Honors – 40,000

- SPG – 30,000 (transferred to Marriott at a 1:3 ratio)

- Marriott Rewards – 0

- World of Hyatt – 25,000

- Club Carlson – 18,000

- Choice Hotels – 0

- Wyndham Rewards – 0

- Hotels.com Welcome Rewards Credits – 0

- Chase Ultimate Rewards – 20,000 (transferred to World of Hyatt)

Total Points Balances

Taking into account all the points earned and redeemed, here are our point balances going into March 2018.

- IHG Rewards Club – 539,307

- Hilton Honors – 646,591

- SPG – 104,275

- Marriott Rewards – 322,280

- World of Hyatt – 12,623

- Club Carlson – 341,238

- Choice Hotels – 40,414

- Wyndham Rewards – 45,000

- Hotels.com Welcome Rewards Credits – 9

- Chase Ultimate Rewards – 349,432

Blog Stats

We received a request last month to include some of our blog stats – happy to oblige! Here are our stats for February 2018:

- Number of blog posts published – 25

- Page views – 8,512

Final Thoughts

Overall, we’re pretty happy with how February went, although there’s obviously still work to be done with our spending.

We’re hoping we’ll be able to get back on track the next couple of months though while we’re in Alabama and Ohio. A lot of our accommodation in those states is either being paid for with points or we’ll be staying with friends. We just need to make sure we’re not then tempted to spend more day-to-day given that we’ll be spending less on accommodation!

Question

Are there any other stats or details you’d like us to include in this monthly series? If so, let us know what you’d be interested to know about in the comments below.

I like the graph colors (very Ravenclaw!) and I like the line graph one best–bar graphs are fine but the line graph seems to show life with it’s fluctuation if that makes any sense at all … maybe it reminds me of a heartbeat scan… ha! You may have mentioned this before and I missed it or forgotten, but how did you come to decide on $100/day?

Thanks for the input – line graphs it is 🙂

There are a few reasons for the $100 a day budget. The main one is that it was our expected income on average. It also seemed like a nice round number and seemed like a somewhat realistic amount to spend. We try to limit accommodation costs to no more than $85 per night which only leaves $15 for everything else. That’s not much, but we’re often able to keep accommodation under $85 per night, especially with all the hotel points we’ve saved up.

I like the line graph better, too! You guys are such an inspiration to live life to the fullest!!!

Thanks! We appreciate the kind words Becky 🙂 And thanks for the vote for line graphs – we’ll be using that in the future 🙂

With your eating in and eating out expenses being so similar in dollars, approximately how many times do you eat out during the month? I know eating in is less expensive. Jodi and I use it as a strategy to reduce traveling costs (eat out for lunch, eat in for dinner and most breakfasts). I am curious about how it works in your experience.

I think we’re eating out two, maybe three, times a week on average. We’re trying to avoid fast food places as much as possible so that we can afford to eat at places that offer more of an ‘experience’, like bison burgers and alcoholic thin mint milkshakes at Big Billy’s Burger Joint in Charleston.

We’re usually taking packed lunches when we’ll be out during the day to cut down on costs.

I have a second question. What activities built up your Hilton Honors balance? I am guessing it is not just stays at Hilton properties. Jodi and I use Hilton as our go to hotel properties, which builds up a few points. We concentrate our normal spending, however, on one particular credit card to use our points there. Perhaps you have already answered this elsewhere. If so, could you direct me to the relevant post?

A lot of them came from credit card signups, with both Shae and I getting the bonuses. With some of their cards you get Gold status which boosts the number of points you earn on stays.

I also tend to use the Hilton Ascend credit card (it used to be called Hilton Surpass) for grocery store shopping as it earns 6x points there.

I wrote more about how you earn as many points as possible in this post – hope it helps 🙂 https://nohomejustroam.com/how-to-earn-the-most-free-hotel-nights-with-hilton/