Month 20 – how did that come around already?!

The first half of last month was spent in Bali, with the second half being spent in Virginia. Similar to when we went to the UK and Amsterdam earlier this year, we haven’t included our Bali spending in our budget for August as that wasn’t part of the road trip. We have included some vacation-related expenses though, such as Truffles’ pet boarding costs and the taxes and fees for our flights.

Needless to say, that made it easier – in theory – to stay under budget. However, we also had some large expenses that came up in August, including a nearly $1,000 car maintenance bill. So were we able to stay under budget or did we overspend for the third time in four months? Read on to find out.

Miles Driven

We ended July with 121,708 miles on the clock. Seeing as we were overseas for half of August, the odometer reading was only 122,594 miles at the end of the month meaning we drove 886 miles in August. I’d predicted last month that we’d drive 850 miles, so that was a pretty accurate guess.

We’re spending all of September in Virginia, so that’ll limit how many miles we drive. Having said that, we’ll be driving all around the state, so we’ll rack up more miles than we normally would when sticking to one state. As a result, I’ll guess that we’ll drive 1,900 miles in September.

The good thing is that our gas expenditure should be low during September as we have a ton of Kroger fuel points. It only cost $3 to fill up at a Kroger last week, so we can hopefully continue that run all month.

Money Spent

With 31 days in August and a budget of $100 per day, we had a monthly budget of $3,100. As I mentioned earlier, we didn’t include our spending in Bali in our budget, so our official expenditure was only $2,895.69. That means we were $204.31 under budget.

Being under budget is obviously great, but it’s not as far under as I was originally hoping for. We had some large expenses last month though which is why our spending was so high compared to what it could’ve been.

Our largest expense was a car repair bill which came in at $868.72. It sucks that we had to spend that much, but we needed new brakes, a couple of new tires, a new belt and more. I don’t think we’ve had any other maintenance costs so far on the road trip other than for things like oil changes, so this is just one of those things. Our 2004 Toyota Corolla is still in great shape, so spending less than $1,000 to keep it on the road rather than getting a new car is a much better investment.

Truffles was a big expense in August too. We had to pay $310 for her pet boarding while we were overseas, she had a $200 vet bill (nothing bad, just regular vaccinations, etc.) and grooming cost $81.50.

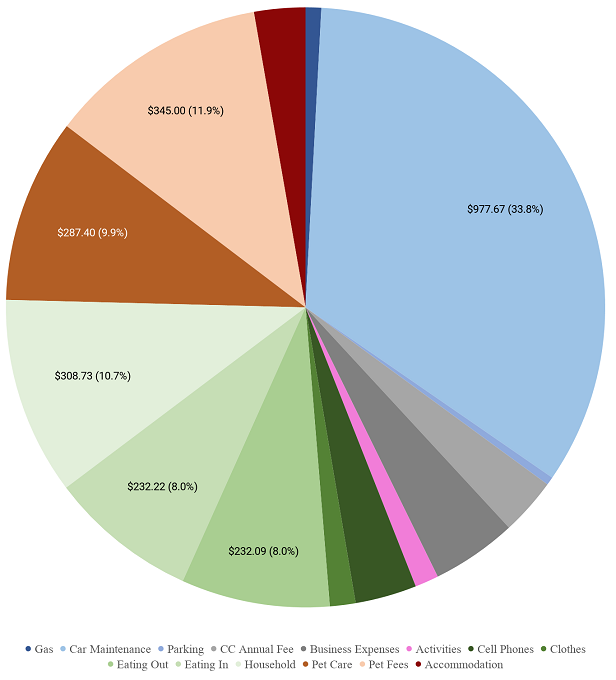

Here’s a pie chart of our spending from August…

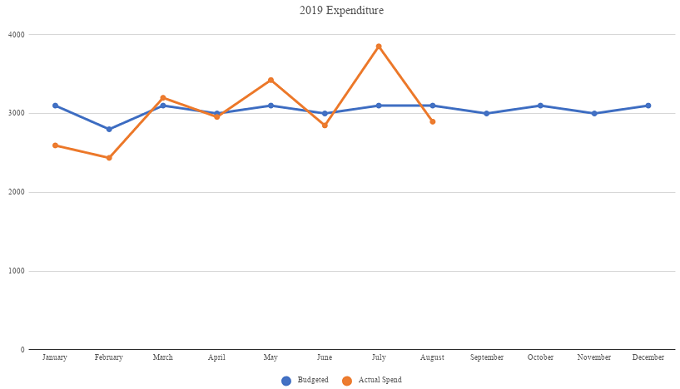

…and a chart showing our overall spending so far this year. The good thing about being under budget last month is that it means we’re back under budget for the year – a much better result than this time last year when we were $2,801.43 over budget!

Looking at our anticipated spending for September, things seem to be fairly healthy. Although we have a few paid stays, our overall accommodation costs aren’t too high thanks to some stays using hotel points and other times staying with family.

I’m therefore hopeful that we’ll be under budget again this month, but I’ve had my hopes dashed before, so we’ll see!

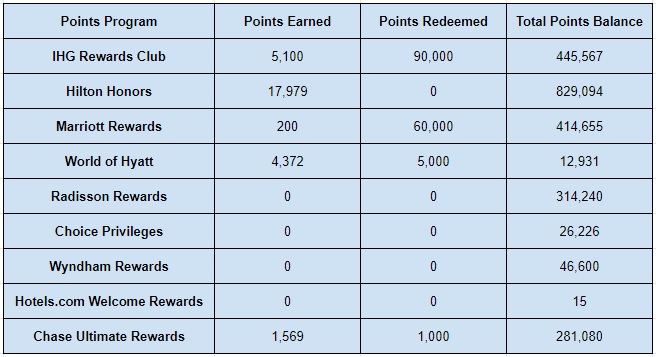

Points Earned

Pretty much all our stays last month were paid for using hotel points, so we didn’t earn that many points. Our biggest increase was for Hilton; that came about thanks to bonus points earned on our credit cards for past paid stays.

Here’s a list of everything we earned in August:

- IHG Rewards Club – 5,100

- Hilton Honors – 17,979

- Marriott Bonvoy – 200

- World of Hyatt – 4,372

- Radisson Rewards – 0

- Choice Privileges – 0

- Wyndham Rewards – 0

- Hotels.com Welcome Rewards Credits – 0

- Chase Ultimate Rewards – 1,569

Points Redeemed

Below is a list of all the points we redeemed in August. Most of those redeemed points were due to two different hotel reservations.

We stayed at a Candlewood Suites for almost two weeks at the end of August using points, so that’s where the IHG redemption came in. We’re due to stay in a category 1 Marriott property later this month for 10 days, so that’s why we redeemed 60,000 Marriott Bonvoy points.

- IHG Rewards Club – 90,000

- Hilton Honors – 0

- Marriott Bonvoy – 60,000

- World of Hyatt – 5,000

- Radisson Rewards – 0

- Choice Privileges – 0

- Wyndham Rewards – 0

- Hotels.com Welcome Rewards Credits – 0

- Chase Ultimate Rewards – 1,000

Total Points Balances

Based on all those changes, here are our total hotel points balances at the end of August:

- IHG Rewards Club – 445,567

- Hilton Honors – 829,094

- Marriott Bonvoy – 414,655

- World of Hyatt – 12,931

- Radisson Rewards – 314,240

- Choice Privileges – 26,226

- Wyndham Rewards – 46,600

- Hotels.com Welcome Rewards Credits – 15

- Chase Ultimate Rewards – 281,080

Here’s all that information in table format:

Blog Stats

Here’s a little information about how this blog did during August 2019:

- Number of blog posts published – 15

- Page views – 37,736

Final Thoughts

Any month we stay under budget is a good month. That said, it wasn’t as good as I was originally hoping for, but we can hopefully continue that throughout September – stay tuned to see if that’s the case.

Does your blog stats catch us RSS subscribers?

It doesn’t unfortunately – it’s just purely page views of the site that are tracked by Google Analytics.