When writing up our stats for October, I mentioned that I expected us to go over budget in November due to how high our accommodation costs were due to be.

That prediction came true, with us going pretty far over budget. Despite that, we did better than I’d been expecting and so I’m actually fairly pleased with how our budget ended up at the end of the month.

Here’s more about why that’s the case, along with all our other stats from November 2019.

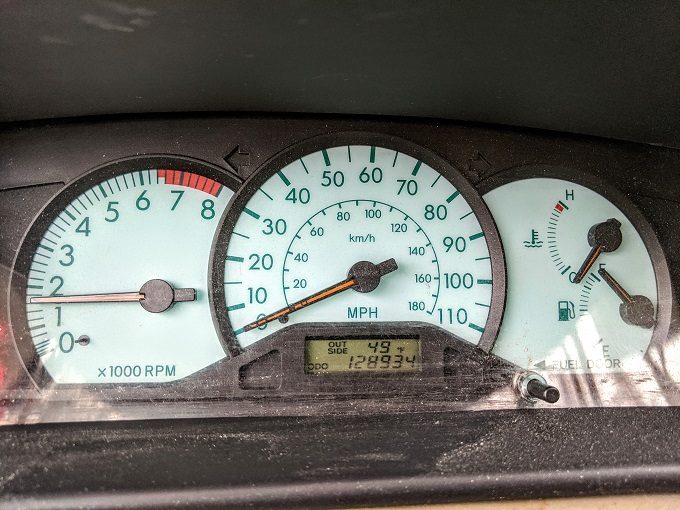

Miles Driven

We began November with exactly 127,000 miles on our car’s odometer. By the end of the month it had 128,934 miles on the clock, so we drove 1,934 miles last month.

I’d predicted that we’d drive 2.550 miles, so I was way off with that prediction. I think I was expecting us to drive more miles while in West Virginia, but driving fewer miles than expected helped reduce our gas costs.

Despite almost always getting my mileage predictions wrong, I’ll take another guess for how far we’ll drive during December. We’re in Tennessee all month, but this month’s mileage will also include the drive we made from Virginia to Tennessee the other day. My guess is that we’ll drive 1,850 miles in December, so we’ll see next month how accurate that is.

Money Spent

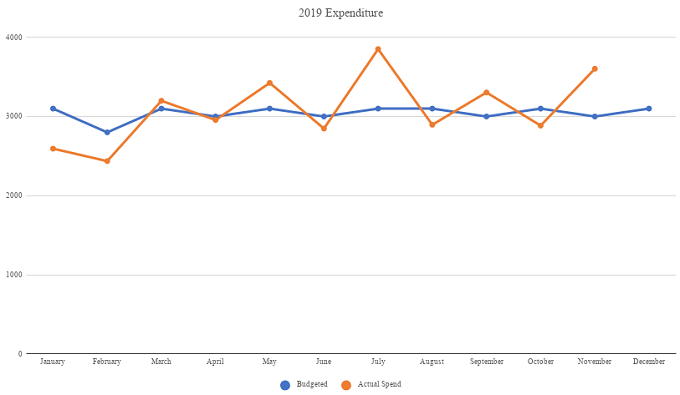

Our daily budget on the road trip is $100, so with 30 days in November we had $3,000 to spend. By the end of the month we’d spent $3,602.83, so we were $602.83 over budget.

Normally that’d be really painful, but as I mentioned earlier it was better than I’d expected. Since we set off on our 50 state road trip on January 1, 2018, our average expenditure on accommodation each month has been $855.50. That’s not as high as you might expect considering we live in hotels and Airbnbs, but we use hotel points when it provides good value which helps reduce our costs.

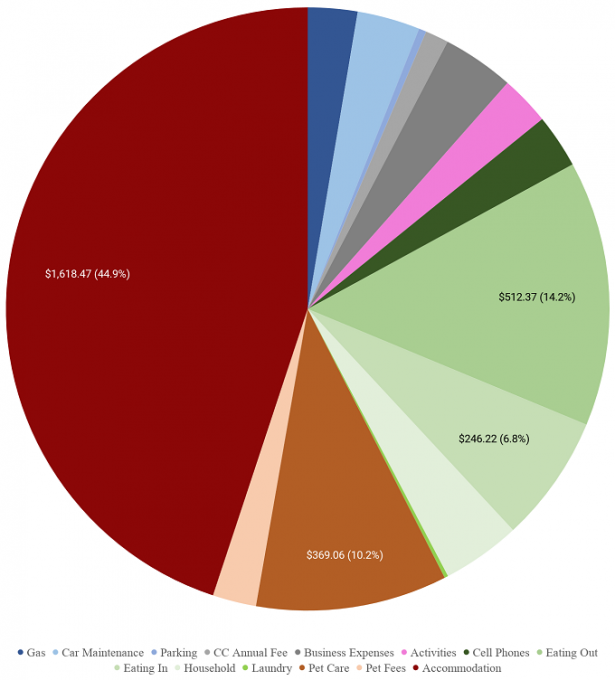

In November though, we spent $1,618.47 on accommodation, so $762.97 more than our average. That more than accounts for how much we went over budget, so that means we did well with our spending in other areas. The reason why we spent more on accommodation is because we were able to get some good rates on hotels, so it made sense financially to pay for those hotels rather than redeem points. The points we saved can be better used in other locations where hotels are more expensive.

For example, we recently stayed 12 nights at a Hyatt Place near Washington D.C. Four of those nights were paid for using points as those particular nights were more expensive. The other eight nights were cheaper though – they had a net cost of ~$66.39 per night. The 5,000 points per night we saved by paying cash can therefore be used somewhere like the Hyatt Place we’re staying at in Memphis next week. That hotel costs 5,000 points per night too, but would’ve cost us $132.84 if we’d been paying cash which is double how much we paid while staying near Washington D.C.

The additional benefit of paying for those recent stays is that we earned quite a few points along the way. Those will gain us extra free night stays in the future, helping reduce our budget in those months.

Our spending on pet care was also higher than normal. We took Truffles to get her teeth cleaned to help prevent more expensive dental procedures in the future. That cost something like $275 which, while somewhat expensive, is much less than many other places charge. For example, one place we heard about charges something like $2,000, so $275 is a bargain.

Here’s a breakdown of our spending in November…

…along with a chart showing our spending over the course of the year so far.

Due to how far we went over budget in November, we’re now $597 over budget for the year. I’m cautiously optimistic that we’ll finish the year marginally under budget though as our accommodation costs are lower this month. We’ll still have to be super careful with our spending in other areas, but I think it’s doable.

Points Earned

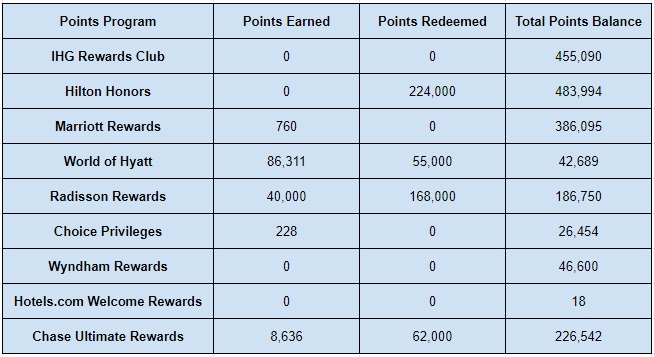

Paying for some hotel stays last month meant we earned more hotel points than normal. Having said that, some of those points don’t appear on this month’s list as we didn’t check out of one of our paid stays until December 1, so those points will appear in December’s stats that we’ll publish next month.

Here’s a breakdown of what we earned in November:

- IHG Rewards Club – 0

- Hilton Honors – 0

- Marriott Bonvoy – 760

- World of Hyatt – 86,311

- Radisson Rewards – 40,000

- Choice Privileges – 228

- Wyndham Rewards – 0

- Hotels.com Welcome Rewards Credits – 0

- Chase Ultimate Rewards – 8,636

Points Redeemed

Despite earning quite a few points, we also redeemed a ton of them for upcoming stays. That wasn’t just for stays in December but also January and February. For example, we’ve booked a New Orleans hotel in a great location for Mardi Gras in February 2020; a few of those nights were paid for using free night certificates, but we also redeemed quite a few points for them.

The largest chunk of redeemed points was with Hilton. We’ve booked a 10 night stay in Nashville this month which cost more points than we’d normally redeem, although 22,400 points per night is still great value for Hilton Honors points. Nashville hotels were expensive and this hotel is within a reasonable distance of downtown (I learned from my mistake!). The property also has an executive lounge which we’ll have access to, so that’ll provide free breakfast and dinner, thereby reducing our expenditure on meals.

We also redeemed quite a few Radisson Rewards points this month as they had a limited time promotion offering a 20% rebate on redeemed points. We’ll therefore get a good number of these points back in the next month or two.

Here’s a breakdown of what we redeemed in November:

- IHG Rewards Club – 0

- Hilton Honors – 224,000

- Marriott Bonvoy – 0

- World of Hyatt – 55,000

- Radisson Rewards – 168,000

- Choice Privileges – 0

- Wyndham Rewards – 0

- Hotels.com Welcome Rewards Credits – 0

- Chase Ultimate Rewards – 62,000

Total Points Balances

Based on all our earnings and redemptions, here’s a breakdown of our total points balances at the end of November:

- IHG Rewards Club – 455,090

- Hilton Honors – 483,994

- Marriott Bonvoy – 386,095

- World of Hyatt – 42,689

- Radisson Rewards – 186,750

- Choice Privileges – 26,454

- Wyndham Rewards – 46,600

- Hotels.com Welcome Rewards Credits – 18

- Chase Ultimate Rewards – 226,542

And here’s that information in a table for those that prefer it to be presented that way:

Blog Stats

Here are a couple of stats relating to the blog. I mentioned last month that we’d had a bit of a traffic drop due to an SSL change and unfortunately traffic sent from Google still hasn’t quite recovered from that.

- Number of blog posts published – 22

- Page views – 20,190

Final Thoughts

Higher than normal hotel and Airbnb costs ate into our budget last month which also pushed us over budget for the year. Can we make up that deficit to stay under budget for the year? You – and we! – will have to wait until next month to find out.

Leave a Reply