After just scraping through under budget in August, I was optimistic that we’d do even better in September. That’s because most of the month was going to be spent in hotels booked using points, so our accommodation spending would be lower than normal.

Not only did we stay under budget, but we did far better than I was expecting. Well, that depends on how we account for things in our budget, but even if we didn’t account for things generously, we still stayed well under budget.

Here’s more about how our road trip budget and other stats ended up at the end of September 2020.

Miles Driven

We started September with our car’s mileage at 145,032. By the end of the month it was 146,160 which means we drove 1,128 miles last month. I predicted in last month’s stats that we’d drive fewer than 1,000 miles, so it turns out I was a little overoptimistic with how little we’d need to drive.

We’re not going to be traveling too far afield in October. We’re currently in Hampton, VA and are heading to Roanoke, VA next for a couple of weeks. After that we’re on to Frederick, MD, so it’s only a few hours drive between each of those places. As a result, I’ll predict we’ll drive 1,350 miles in October, although it may well be less than that.

Money Spent

If you’re not familiar with our monthly stats, we’re doing our 50 state road trip on a budget of $100 per day. That has to cover accommodation, food, gas, cell phone bills, hotel pet fees, activities, etc.

With 30 days in September, our budget for last month was $3,000. By the end of the month we’d spent $2,117.48 or $2,706.89 depending on how we account for our budget. That means we were either $882.53 or $293.12 under budget – a win either way!

The reason why there are two completely different figures listed above is because I wasn’t sure whether or not we should account for a credit card signup bonus in our spending tally. In a later section we account for all our hotel points, many of which were earned from credit card signup bonuses (e.g. earn 100,000 points when spending $3,000 in 3 months). In September, we received a $500 signup bonus from a credit card, with the spending on that card earning us an additional $89.41 cashback.

We include credit card annual fees in our budget each month and account for points earned from our credit cards in the section below. It therefore seemed appropriate to also account for the $589.41 earned from this new credit card, but it didn’t make sense to include that in the hotel points section seeing as it’s cash rather than points. As a result, we added it as a negative cost on our budget which in turn reduced our spend.

In theory it’s income which isn’t something we actually list in our stats, so that seemed the best way of accounting for it. If you think that’s cheating though, we still ended up $293.12 under budget.

The main reason we did so well with our September budget is because our net accommodation cost was $403.52 which is much lower than normal. We spent the first 3.5 weeks of September in hotels using points, so it was only the last week where we had to actually pay anything for our stays. Even that line item was reduced though because we finally received more than $100 cashback from the TopCashback shopping portal from our Candlewood Suites Albuquerque stay from back in March/April.

The rest of our spending was fairly average for the most part. We spent more on activities in September than we have all year, although previous months our spending had been so low in that category due to COVID. In September we visited the International Spy Museum and Mount Vernon, so tickets for those two places accounted for much of that spend.

Truffles was one of our higher spending categories as she cost us $500+. She had both a vet appointment and grooming session in September which came to ~$350, with hotel pet fees costing us ~$150.

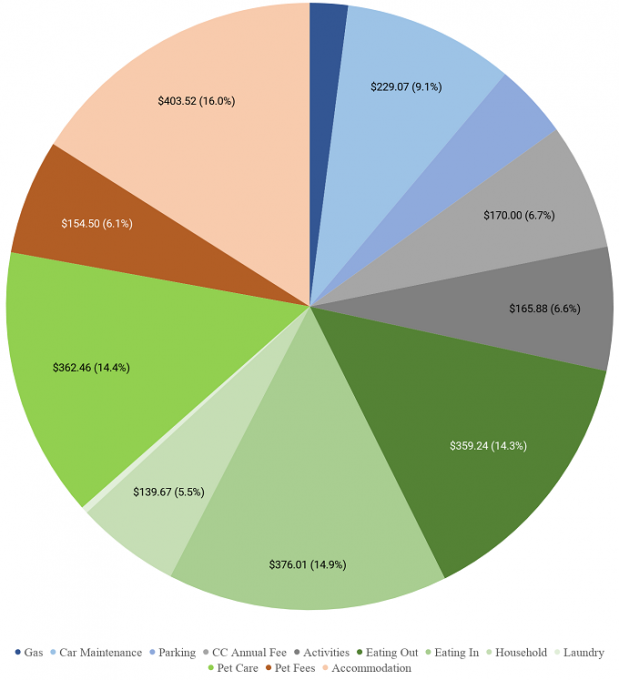

Here’s a breakdown of all the different spending categories last month…

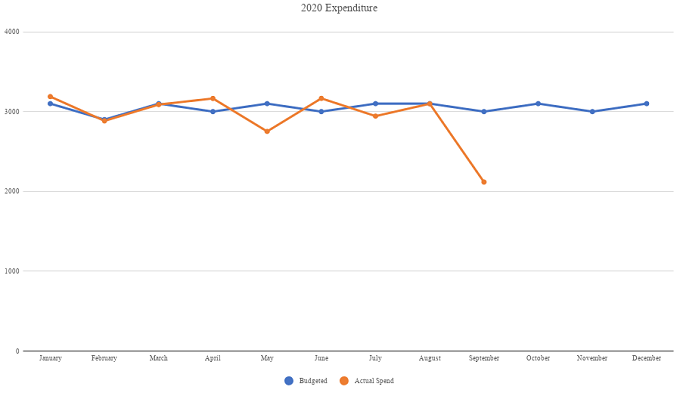

…as well as a chart tracking our spending for 2020 so far. This chart includes the $589.41 cashback from the credit card, so that’s why it looks so good this month.

Looking ahead to our budget for October, I’m not as optimistic about our prospects for staying under budget. That’s because our accommodation spending with hotel pet fees added in comes to ~$1,750, so more than half our budget. That’s more than our average accommodation spending, so it won’t surprise me if we end up spending more than $3,100 this month.

Having said that, I applied for the same credit card which we earned almost $600 cashback on (Shae applied for that one), so if that ~$600 cashback is credited during October, that should help us stay much closer to our budget.

Accommodation Cost

As mentioned earlier, we spent the first 3.5 weeks of September in hotels paid for using points, while the final week was spent at a hotel we actually paid for. In all three cases though, we were able to reduce the cost of our stays.

September 1-4: Candlewood Suites Virginia Beach Town Center, VA (you can read my review here). It was due to cost 15,000 points per night, but we got the 4th night free as that’s a benefit on one of our IHG credit cards, while we also got a 10% rebate of the points we redeemed which is a benefit on my other IHG credit card. That meant our net cost was 10,125 points per night which is great value for IHG Rewards Club points.

September 4-25: Hyatt House Sterling/Dulles Airport-North, VA (we’ll have a review in the next couple of weeks). This hotel is a category 1 property in the World of Hyatt program which means it costs 5,000 points per night. We therefore had to redeem 105,000 points for our three weeks there.

Our net cost was actually lower than that though. World of Hyatt is currently running a promotion offering a 25% points rebate on award nights, so that got us 26,250 points back which reduced the cost to only 3,750 points per night which is a fantastic deal.

September 25-30: Embassy Suites Hampton Convention Center, VA. We booked the room for $120.95 per night including tax which is more than we’d normally pay for our accommodation. It didn’t end up costing us that much though because we took advantage of Hilton’s Price Match Guarantee. Their Price Match Guarantee is a guarantee that you’ll find the lowest price on their website; if you find a cheaper price elsewhere within 24 hours, they’ll match that price and discount it by a further 25%.

I’d found a cheaper price on Hotels.com, so I submitted a claim and that dropped our nightly cost to $86.10 per night with tax.

Hotel Points Earned

Despite only spending the last week of September on a paid hotel stay, we still managed to earn a bunch of hotel points last month. The ~25,000 Hilton Honors points were from buying gift cards at grocery stores and gas stations with my Hilton Surpass credit card as that earns 6 points per dollar in both those categories.

My Marriott balance increased a decent amount which was also thanks to buying gift cards at gas stations because our Chase Marriott cards were temporarily earning 10x points per dollar in that category.

My Hyatt account balance increased, although that was largely due to the 25% points rebate I mentioned earlier. We also earned some other points here and there, mostly from credit card spending, although the Wyndham points were from a two night stay we had at the end of August which didn’t hit our account until the beginning of September, hence it appearing on this month’s stats.

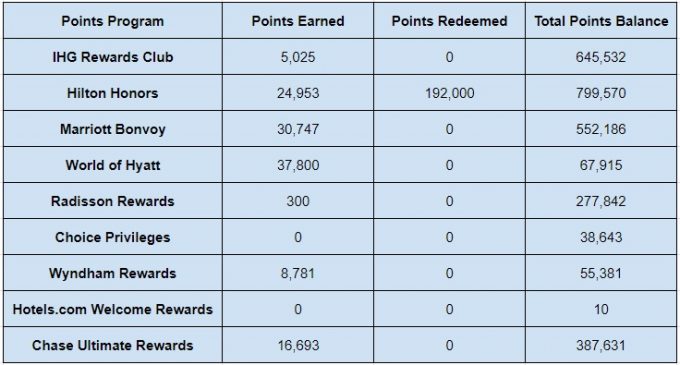

Here’s a breakdown of all the points we earned in September:

- IHG Rewards Club – 5,025

- Hilton Honors – 24,953

- Marriott Bonvoy – 30,747

- World of Hyatt – 37,800

- Radisson Rewards – 300

- Choice Privileges – 0

- Wyndham Rewards – 8,781

- Hotels.com Rewards Credits – 0

- Chase Ultimate Rewards – 16,693

Hotel Points Redeemed

We only made one points redemption last month, although it took a fairly large chunk out of our Hilton points balance. We booked an upcoming two week stay in Frederick, MD at one of Hilton’s properties using points, so that cost us almost 200,000 points.

- IHG Rewards Club – 0

- Hilton Honors – 192,000

- Marriott Bonvoy – 0

- World of Hyatt – 0

- Radisson Rewards – 0

- Choice Privileges – 0

- Wyndham Rewards – 0

- Hotels.com Rewards Credits – 0

- Chase Ultimate Rewards – 0

Total Hotel Points Balances

Taking into account all those changes, here are where our hotel points balances were at by the end of last month:

- IHG Rewards Club – 645,532

- Hilton Honors – 799,570

- Marriott Bonvoy – 552,186

- World of Hyatt – 67,915

- Radisson Rewards – 277,842

- Choice Privileges – 38,643

- Wyndham Rewards – 55,381

- Hotels.com Rewards Credits – 10

- Chase Ultimate Rewards – 387,631

Here’s that data in table format:

Jogging

After a couple of months of not jogging at all, I finally put my running shoes back on last month. I didn’t go out as frequently as I should, but I did go jogging five times for a total of 8.02 miles. That’s poor, but better than I had done, so hopefully I have the motivation to keep increasing that in October.

Blog Stats

We had a problem with our website hosting for several days in September which took down ~20 of my websites including this one. That means we took a traffic hit and also weren’t able to publish as many posts as we could have.

- Number of blog posts published – 6

- Page views – 20,823

Final Thoughts

Even if you ignore the ~$600 cashback we received from a new credit card last month, we stayed almost $300 under budget in September which is one of our best results since we set off on the road trip. Hopefully that’ll stand us in good stead to stay under budget for 2020 as a whole, provided we don’t drastically overspend in the last few months of this year.

[…] managed to stay well under budget in September, but heading into October I wasn’t overly optimistic that we’d managed to stay under […]