We managed to stay well under budget in September, but heading into October I wasn’t overly optimistic that we’d managed to stay under budget.

That was mainly because our hotel stays were due to take up a larger proportion of our budget than normal, but we also had a couple of other one-off expenses coming up. Still, COVID has meant we’ve been spending less on activities and eating out for the most part, so that’s helped reduce some of our spending.

Did we go over budget nonetheless, or we did somehow manage to scrape in under budget? Read on to find out.

Miles Driven

We started October with 146,160 miles on our odometer. By the end of the month its reading was 147,738 which means we drove 1,578 miles last month.

I’d predicted that we’d drive 1,350 miles in October, so I was off by a couple of hundred miles.

We should be doing about half that amount of driving in November. We’re currently in Frederick, MD and will be heading to Ocean City, MD later this week and will be staying there until the beginning of December. That means we won’t be needing to drive too much, although we’ll likely end up driving a few places further afield for activities while in Ocean City.

I’ll therefore predict that we’ll drive 825 miles in November, but it wouldn’t surprise me if we end up driving fewer miles than that.

Money Spent

We’re doing our 50 state road trip on a budget of $100 per day. That has to cover our accommodation, food, gas, activities, cell phone bills, pet expenses (we travel with our dog Truffles), etc. October has 31 days in it, so our total budget for last month was $3,100. By the end of October we’d spent $3,404.77 which means we went $304.77 over budget.

While that’s not an ideal situation, we didn’t overspend on day-to-day items. Our accommodation plus hotel pet fees came to $1,639.42 which was more than half the budget and is a higher amount than we normally spend.

We also had a couple of larger one-off expenses. Shae had a doctor’s checkup which cost $254, so that alone accounts for nearly all the overspend. She also got more tattoos while we were in Roanoke which cost $142.50. Our eating out expenses were higher than I was expecting, but that was offset by our grocery spending being relatively low.

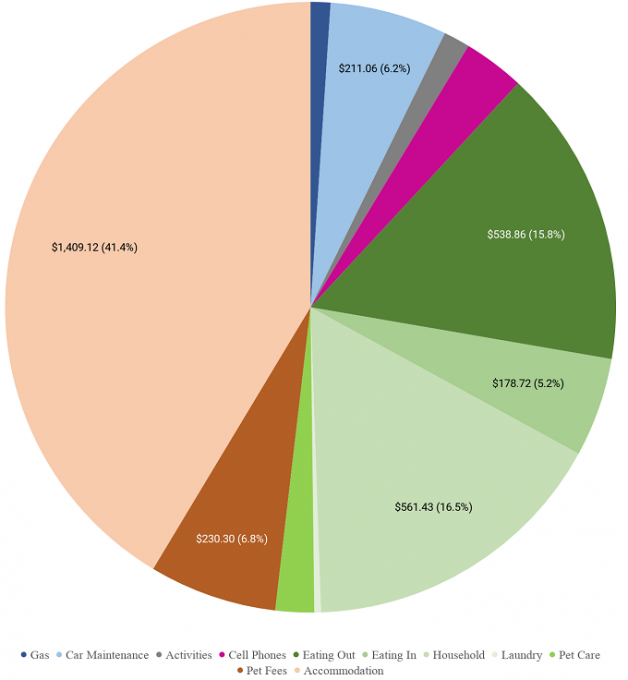

Here’s a breakdown of all our expenditure in October…

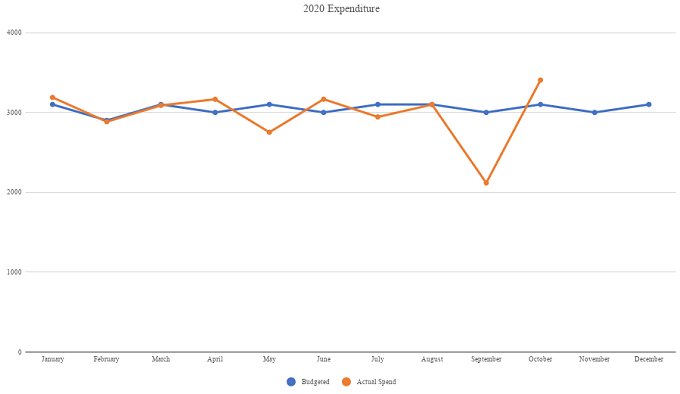

…along with a chart tracking our spending over the course of this year.

I’m not convinced our budget will be looking any more healthy at the end of November. Our Ocean City, MD stay is a hotel we’re paying for, so our accommodation spend is due to be about 2/3 of our budget. That therefore doesn’t leave much leeway for other spending, although we don’t have any one-off expenses coming up – or none that we’re aware of right now anyway!

Accommodation Cost

We stayed in three different places in October – two of them were hotels we paid for with cash, the other was paid for with points. Here’s a breakdown of what each of those cost.

October 1-9: Embassy Suites Hampton Convention Center, VA (here’s my review). We stayed there a total of two weeks, with our stay crossing from September into October. The night of October 1 cost us $86.10, while the next 7 nights cost $86.75 per night.

October 9-22: Residence Inn Roanoke Airport, VA (here’s my review). This was our other stay paid for with cash and it cost us $64.29 per night. I made a successful Best Rate Guarantee claim which is why that cost is so relatively low. It would’ve been $81.25 per night, but Hotels.com had a slightly cheaper rate, so Marriott matched that rate and gave a further discount.

October 22-31: Home2 Suites Frederick, MD (This review will come out in the future too). We paid for this stay using 16,000 Hilton Honors points per night. Hilton offers every 5th night free on award stays if you have any kind of status with them and we’re staying a total of 15 nights. That means our 5th, 10th and 15th night were all free, so our net cost was 12,600 points per night.

Hotel Points Earned

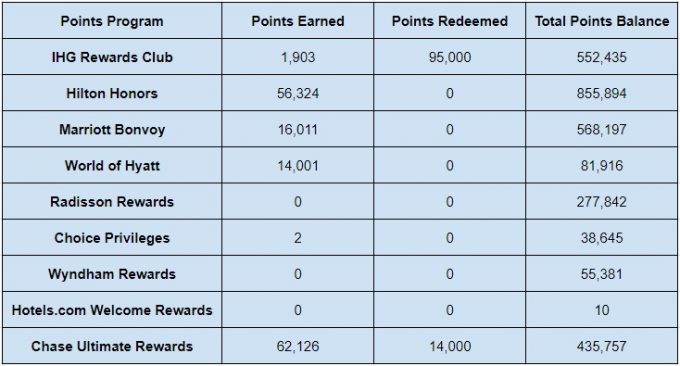

We earned a reasonable number of Hilton Honors and Marriott Bonvoy points in October thanks to our paid stays at the Embassy Suites and Residence Inn. We also earned a healthy number of Chase Ultimate Rewards points thanks to a new credit card signup bonus and putting a bunch of spend on one of our Chase cards which earns 5 points per dollar at office supply stores.

- IHG Rewards Club – 1,903

- Hilton Honors – 56,324

- Marriott Bonvoy – 16,011

- World of Hyatt – 14,001

- Radisson Rewards – 0

- Choice Privileges – 2

- Wyndham Rewards – 0

- Hotels.com Rewards Credits – 0

- Chase Ultimate Rewards – 62,126

Hotel Points Redeemed

We didn’t redeem many points last month. We transferred 14,000 Ultimate Rewards points to my Hyatt account as I thought we were going to need them to book a stay, but didn’t need them in the end. Our other redemption was for an upcoming stay at a Candlewood Suites hotel which is one of IHG’s brands.

Here’s a breakdown of those limited redemptions.

- IHG Rewards Club – 95,000

- Hilton Honors – 0

- Marriott Bonvoy – 0

- World of Hyatt – 0

- Radisson Rewards – 0

- Choice Privileges – 0

- Wyndham Rewards – 0

- Hotels.com Rewards Credits – 0

- Chase Ultimate Rewards – 14,000

Total Hotel Points Balances

Based on those earnings and redemptions, here’s how our total hotel points balances finished at the end of October.

- IHG Rewards Club – 552,435

- Hilton Honors – 855,894

- Marriott Bonvoy – 568,197

- World of Hyatt – 81,916

- Radisson Rewards – 277,842

- Choice Privileges – 38,645

- Wyndham Rewards – 55,381

- Hotels.com Rewards Credits – 10

- Chase Ultimate Rewards – 435,757

Here’s all that information in table format for those who prefer seeing it laid out in that way.

Jogging

My jogging regimen was non-existent last month. Part of it was laziness and part of it was that our hotel’s location in Roanoke wasn’t ideal for jogging which knocked out my momentum. Despite not getting any exercise from jogging, I went hiking quite a few times and so still got more exercise last month than I had been getting in recent months.

Seeing as we’re spending most of November in Ocean City, I’m hoping the flat terrain will encourage me to get my running shoes back on.

Blog Stats

We had a problem with our web hosting in September which took down this site for a few days and it sadly happened again in October. I’m hoping the issue has been resolved, so this hopefully won’t happen anymore.

The site being offline meant I didn’t get to publish as many posts as I’d hoped, plus it meant we lost some traffic for those few days.

- Number of blog posts published – 9

- Page views – 17,895

Final Thoughts

We might have ended up over budget by about $300 in October, but that result wasn’t terrible considering it was mostly due to one doctor’s appointment. November’s budget is likely going to be more of the same due to our accommodation costing ~$2,000, but being by the beach for most of the month should make it worth it!

Thanks I absolutely love your stats page as I have been living in hotel for 9 years full time and dec 1 starts my 10 th year ….I was wondering do you give your free night certs a point value and add into your totals as I don’t see your free night certs anywhere …just curious

Thanks! And congrats on almost getting to your 10th year in hotels – we still have some way to go to reach that.

That’s a great point about the free night certificates – it hadn’t really occurred to me to include the certificates in the stats. I’ve made a note to start including those from next month’s stats post – great suggestion!