The second half of November is always incredibly busy for me as one of my sites covers gift card deals and there are always a ton of them leading up to Black Friday and Cyber Monday.

Finding all the deals and writing about each one essentially becomes a full-time job in November and so there’s not much time to do anything else. After discovering that last year, we decided to stay in the same place for much of the month of November so that a) we wouldn’t have to spend time packing, unpacking and moving and b) we wouldn’t feel the pressure to get out and about to see things when I’d be so busy.

As a result, we booked a month-long stay in Ocean City, MD as we found a great paid rate at an oceanfront hotel. That was awesome, but paying cash for that stay rather than using points meant we spent a little more on accommodation than we normally would.

Did that mean we went over budget in November or did being busy working mean we spent less on other things than normal? Read on to find out the answer and details about all our other stats for last month.

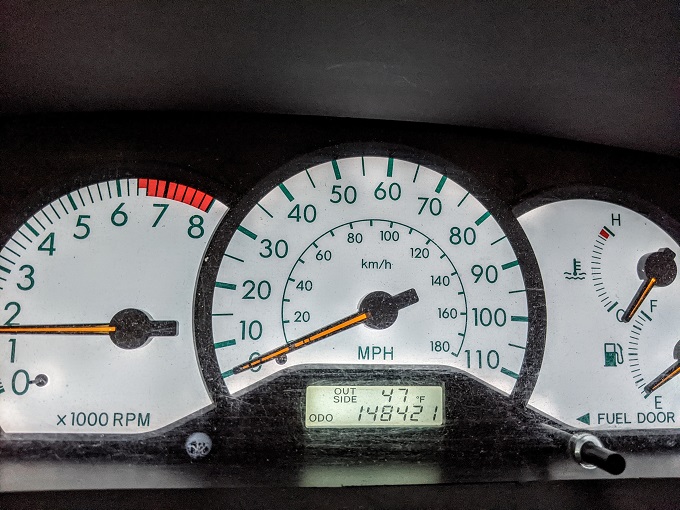

Miles Driven

November started with our car’s odometer reading at 147,738 miles. By the end of the month it was 148,421 which means we drove 683 miles.

I predicted in last month’s stats that we’d drive 825 miles but that I wouldn’t be surprised if we ended up driving fewer miles and so that came true.

We’ll be driving far more in December than that. We moved on from Ocean City to Baltimore a few days ago, then we’ll be spending two weeks in Virginia Beach over Christmas. After that we’re heading down to New Orleans, so we’ll be racking up more miles. I’ll therefore predict that we’ll drive 2,200 miles in December, but I’m not sure quite how accurate that’ll turn out to be.

Money Spent

The budget for our road trip is $100 per day, so with 30 days in November our budget for the month was $3,000. By the end of the month we’d spent $3,374.32 which means we overspent by $374.32.

We actually got lucky with our budget. I was expecting our accommodation expense to be higher than it was, but we managed to reduce its cost in a couple of different ways.

One way was by keeping an eye on hotel prices. We’d booked our Ocean City stay in four night increments as the hotel was offering a ‘Buy three nights, get the fourth night free’ promotion. The exception was November 26-29 as the hotel wasn’t offering that promotion during that time, presumably due to it being Thanksgiving. (n.b. I know that’s three nights, but any combination of four nights which included any of those specific days didn’t work). As a result we’d booked a AAA rate, but just over 24 hours before that stay I noticed we could rebook at a rate about $35 per night less, so that saved us ~$100.

Another way we got lucky is that we were staying at a Hyatt Place. After booking that stay there were a couple of card-based offers which saved us money. There was an Amex Offer giving $75 back when spending $250 at Hyatt brands and we had that on two cards, so that saved us $150. Our Hyatt credit cards had a similar offer giving us $25 back when spending $250 at Hyatt brands, so that was another $50 back.

In case you’re wondering how that worked, we were able to split the cost of our hotel stay across all those different cards. We put $250 on each of the two Amex cards and $250 on Shae’s Hyatt card. The rest was put on my Hyatt card to get both the $25 credit and to earn four points per dollar on the rest of the spend.

Rebooking that three night period and having those offers on our cards therefore saved us about $300.

I’m not entirely sure how this happened, but we spent more than $700 on groceries. That’s much higher than we expected, but I think there might have been a couple of reasons for that. We’d stocked up on alcohol which got allocated to groceries; we still have quite a bit of that left, but it means it went on November’s budget even though it’ll last through December. The other reason is that there was likely some non-grocery spend in there which was household-related items, but which didn’t get separated out.

Our car door broke while we were in Ocean City – it simply didn’t close or lock properly, so getting that fixed added about $100 to our budget – another reason we overspent.

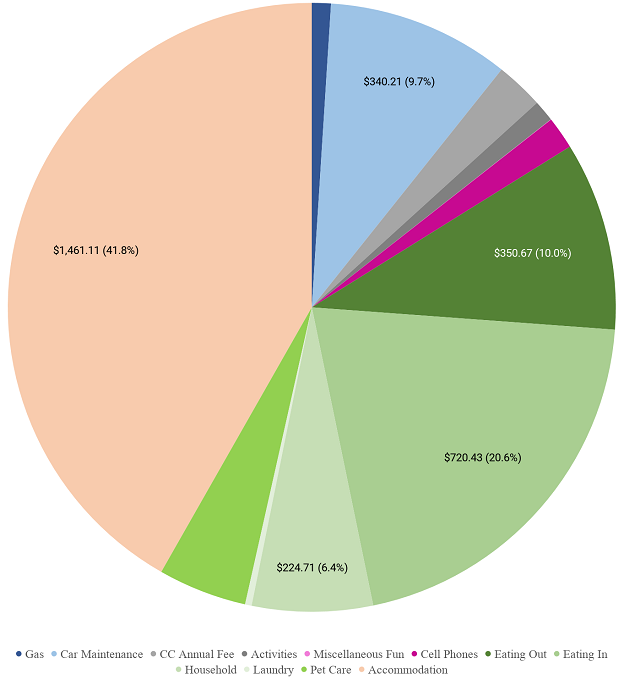

Here’s a breakdown of our spending for last month…

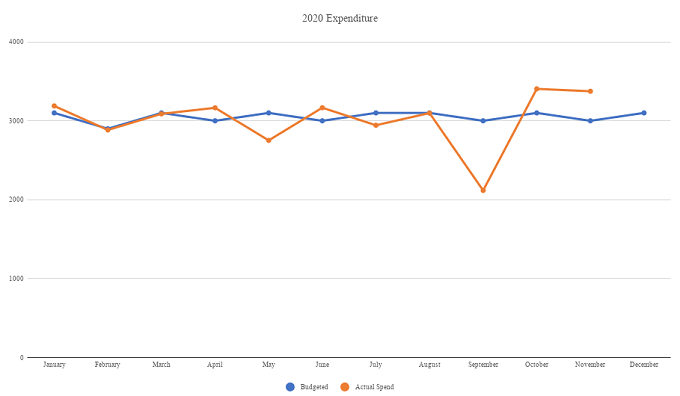

…and a chart tracking our spending over the course of 2020 so far.

That means we’ve been over budget for the last two months, but the three months before that were under budget and we’re still under budget for the year. I’m not sure if we’ll stay under budget in December, but even if we don’t I think we should still be able to contain our spending enough to ensure we’re under budget for the year.

Accommodation Cost

Most of November was spent at the Hyatt Place Ocean City, but the first few days of the month were spent as the Home2 Suites Frederick. Here’s a breakdown of how much they cost:

November 1-6: Home2 Suites Frederick, MD (I’ll be publishing our review this week). We booked this using points and it cost 16,000 points per night. Hilton offers every 5th night free to anyone who has status with them; you can get status with any of their credit cards – even those which don’t have an annual fee. Our total cost for those five nights was therefore 64,000 points, or 12,800 points per night.

November 7-30: Hyatt Place Ocean City, MD (I’ll be reviewing this hotel in the next 2-3 weeks). As mentioned earlier, we booked this stay in four night increments. The total cost for that time period was $1,691.11; most nights worked out to be $65.77 per night including tax, although November 26-29 was $81.39 per night including tax. That was a fantastic price for an oceanfront hotel, especially because we were upgraded to an ocean view room.

Hotel Points Earned

We earned a nice chunk of hotel points in November. Quite a few came from our paid stay at the Hyatt Place, while another chunk came from Hilton. Shae’s dad came to visit for a few days and they stayed at one of Hilton’s brands. We booked that stay under my account as I have Diamond status and so figured that would help them get a room upgrade (it did). That happened to push my number of elite nights over a certain threshold which awarded a bunch more points – even more than I’d been expecting which was a nice surprise.

Our Chase Ultimate Rewards balance also got a nice boost from some gift card spending we put on our cards which earned 3x and 5x points per dollar.

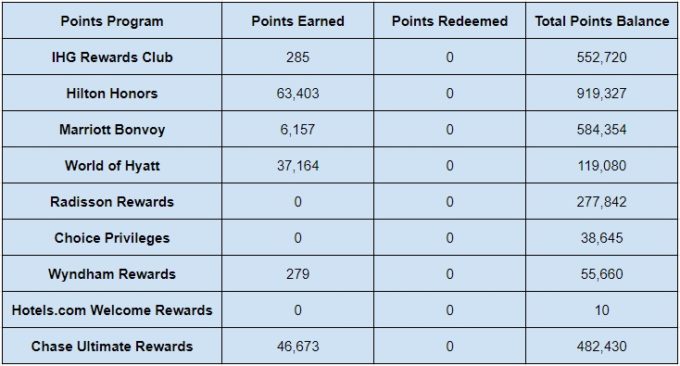

Here’s a list of all the different hotel points we earned in November:

- IHG Rewards Club – 285

- Hilton Honors – 63,403

- Marriott Bonvoy – 6,157

- World of Hyatt – 37,164

- Radisson Rewards – 0

- Choice Privileges – 0

- Wyndham Rewards – 279

- Hotels.com Rewards Credits – 0

- Chase Ultimate Rewards – 46,673

Hotel Points Redeemed

Last week I shared about our tentative plans for 2021. We’re planning on heading out west next year, but are holding off on booking anything just yet. As a result, we didn’t redeem any points last month.

- IHG Rewards Club – 0

- Hilton Honors – 0

- Marriott Bonvoy – 0

- World of Hyatt – 0

- Radisson Rewards – 0

- Choice Privileges – 0

- Wyndham Rewards – 0

- Hotels.com Rewards Credits – 0

- Chase Ultimate Rewards – 0

Total Hotel Points Balances

The fact that we earned a bunch of points in November but didn’t redeem any means our total points balances received a nice boost.

- IHG Rewards Club – 552,720

- Hilton Honors – 919,327

- Marriott Bonvoy – 584,354

- World of Hyatt – 119,080

- Radisson Rewards – 277,842

- Choice Privileges – 38,645

- Wyndham Rewards – 55,660

- Hotels.com Rewards Credits – 10

- Chase Ultimate Rewards – 482,430

Here’s all that information in table format:

Hotel Free Night Certificates

On last month’s stats, Craig asked if we assigned a points value to the free night certificates we have with various hotel chains. Most of these are received from renewing some of our credit cards each year, but others are earned through spending enough on those credit cards or by staying a certain number of nights.

We’re nearly into the fourth year of our road trip and I can’t believe it had never occurred to me to include those free night certificates in our monthly stats, so thanks to Craig for that idea. We’d included the credit card annual fees in our budget seeing as those were usually incurred due to us wanting the free night certificates; we’d just never included the certificates themselves in our stats.

As a result, here’s a list of all the different free night certificates we currently have across various hotel chains. In case you’re not familiar with hotel categories, most hotel chains place their different hotels at different category levels. Category 1 hotels require the lowest number of points, with higher categories requiring an increasing number of points.

Some of the certificates are valid for certain categories, while others are valid up to a certain number of points. Marriott and IHG certificates fall under that latter approach as they have dynamic pricing for award pricing (i.e. the number of points required can go up or down depending on demand).

- IHG (up to 40,000 points per night) – 3

- Hilton (any property worldwide) – 3

- Marriott (up to 35,000 points per night) – 10

- Marriott (up to 40,000 points per night) – 1

- Hyatt (category 1-4) – 2

- Hyatt (category 1-7) – 1

Jogging

Er….the less said about this the better. I’d been all kinds of optimistic about going jogging on the boardwalk in Ocean City, but I went a grand total of zero times. We did take Truffles on far more walks than normal though to enjoy our time by the ocean, so I got more exercise than I had been recently.

Blog Stats

Our page views dropped slightly in November compared to October, but that’s in part due to November having one less day.

I’d been wanting to increase the number of blog posts published, so even though I was busy working on GC Galore in November, we still managed to publish 11 new posts versus 9 the month before.

- Number of blog posts published – 11

- Page views – 16,891

Final Thoughts

We went over budget by several hundred dollars in November, but also earned a bunch of points which put our total points balances back above 3 million which is always fun to see.

I’m not sure how well we’ll do with our budget in December, but I’m somewhat optimistic that we’ll finish the year under budget overall – I hope I’m right!

I think you are just awesome to be able to keep all of those room stays straight! My goodness, I can’t even keep my days straight. I have enjoyed traveling with you two ,if on vicariously.

Thank you!

Curious how you passively earned 279 Wyndham Rewards?

Well done on “gardening” your future reservations. I do that as well and, especially in these low occupancy times, find lots of last minute rate drops.

The Wyndham Rewards points were from my new Wyndham Rewards Earner Business card – that was the start of meeting the minimum spend, so I should get the full signup bonus included when doing December’s stats next month.