December 2020 – the end of our third year on the road.

It’s hard to believe we’ve been road tripping it for three whole years now, although when looking back to when we set off on January 1, 2018, it feels like that was a lifetime ago.

2020 was, needless to say, a bit of a strange time to be traveling full time. When it came to our budget, I’d have thought that our spending would have decreased during the pandemic due to us doing much less stuff. However, we spent more on accommodation as we booked longer, paid stays which had an impact on that.

We were still on course to stay under budget for the year as we headed in to December 2020, but there have been times on the road trip where we’ve had unexpected expenses which pushed us over budget. Did that happen at the end of last year, or did we manage to round out the year under budget for both the month and the year? Read on to find out.

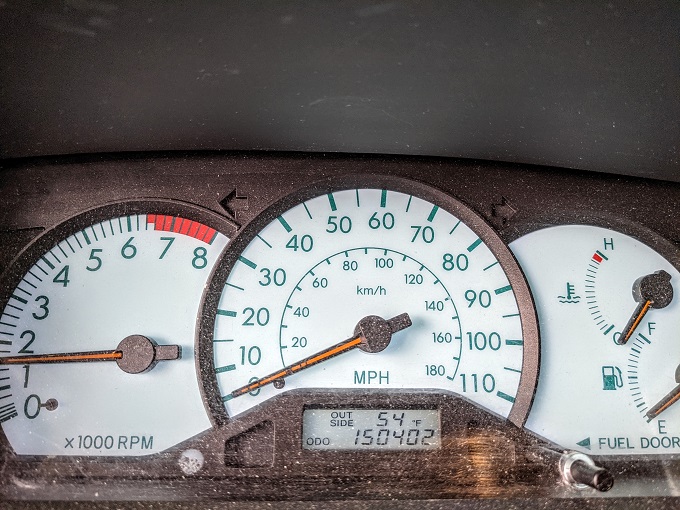

Miles Driven

December 2020 began with 148,421 miles on our odometer and ended with it at 150,402 which means we drove 1,981 miles in the final month of last year. I’d predicted in last month’s stats that we’d drive 2,200 miles, so I wasn’t too far off.

Looking ahead to the rest of January 2021, it’s hard to know how much we’ll be driving as we don’t have anything booked beyond mid-January. I’ll guess though that we’ll drive 1,650 miles this month.

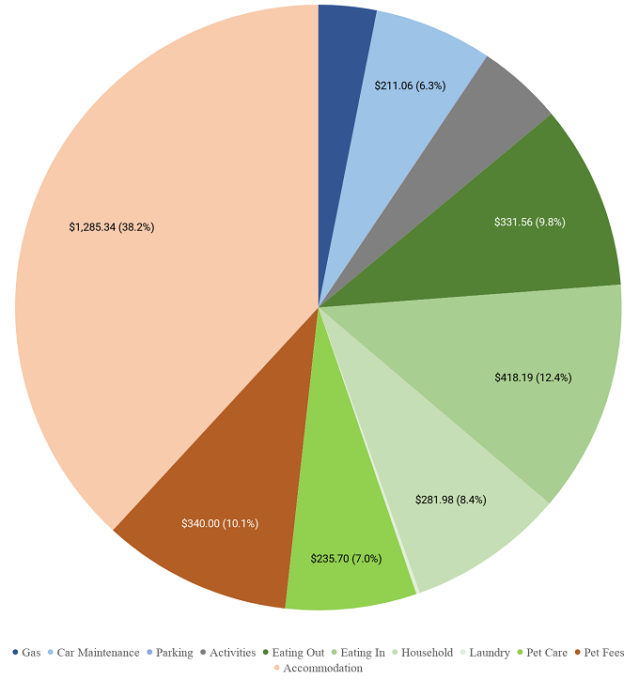

Money Spent

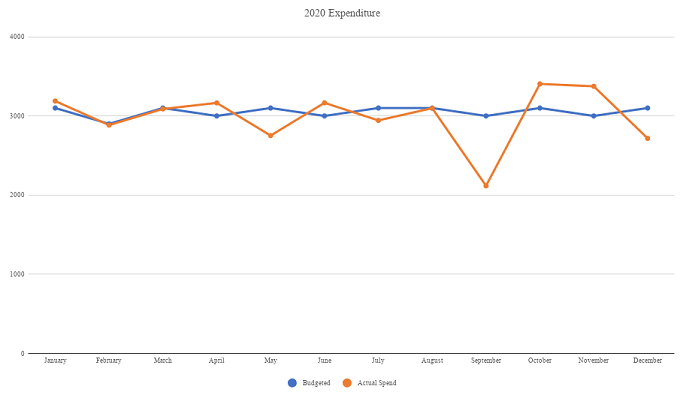

Shae and I are doing our road trip on a budget of $100 per day which has to cover accommodation, gas, activities, food, etc. With 31 days in December, our budget for last month was $3,100. By the end of the month our net spending total was $2,717.02 which means we were $382.98 under budget – woo-hoo!

That was in large part due to a large sum of credit card cashback we received in December from a credit card signup bonus – just over $600. We had a similar situation with September’s stats when Shae had gotten that same card, so we accommodated those amounts in our budget rather than in the hotel points section later on.

That means we managed to stay under budget for the year as a whole – another woo-hoo! 2020 was a leap year which meant our budget over the course of the year was $36,600. By the end of the year we’d spent $35,898.16 on the road trip, so $701.84 under budget for the year – not too shabby!

Here’s a breakdown of what we spent our money on last month…

…along with a chart showing our spend over the course of last year.

Accommodation Cost

We stayed at a bunch of different places in December – here’s a breakdown of how much all those stays cost.

December 1-3: Hyatt Place Ocean City Oceanfront, MD (here’s my review). This was the end of our month-long stay which we’d mostly booked in four night increments as they had a ‘Buy three nights, get fourth night free’ rate. That cost us $65.77 per night including tax.

December 3-12: Hyatt Regency Baltimore Inner Harbor, MD (here’s my review). This was due to cost us $96.06 per night, but I submitted a Best Rate Guarantee claim as there was a cheaper rate on another website. Hyatt matched that rate and then gave a further 20% discount which means the cost dropped to $67.01 per night.

It got even better though. They had to move us one night during our stay as the NFL booked the entire hotel. When taking a look at our bill after the stay, it seemed like they didn’t charge us for that night even though they covered the cost of our stay at another hotel which means our cost per night was really $59.56.

December 12-20: Candlewood Suites Virginia Beach Town Center, VA (we won’t be writing a review for this stay, but here’s a review from our stay earlier this year). We booked this stay with points as they let you book into a one bedroom suite with points even though their cash price for that room type is more than their standard studio suites.

We booked an eight night stay as IHG offers every fourth night free on award stays if you have the IHG Premier credit card, meaning we got two of the eight nights free. I also have the older IHG Select card which gives a 10% rebate when redeeming points.

The hotel charged 20,000 points for the first night and 15,000 points per night thereafter. When accounting for the two free nights, that came to a total of 95,000 points. The 10% points rebate means the net cost was 85,500 points or 10,688 points per night.

December 20-27: La Quinta Virginia Beach, VA. This cost $69.86 per night.

December 20-27: Candlewood Suites Virginia Beach Town Center, VA. This is where things get a little messy. We booked a week at the La Quinta Virginia Beach thinking it was on the beach, but it wasn’t on the oceanfront itself. After checking in, we realized it was a mistake moving there from the Candlewood Suites.

The hotel was the noisiest hotel we’d ever stayed in. It seemed like the walls were literally made of paper as we could hear people talking at a regular level in their room down the hall. There were dogs barking, people stomping around above us and the room felt really cramped compared to the one bedroom suite with a kitchen we’d had at the Candlewood Suites. Although she’s fine with fireworks, our dog Truffles doesn’t appreciate noise outside our room, so we were dreading a week of loudness.

After a couple of hours shaking our heads at our mistake, we decided to do something about it as the thought of spending Christmas there wasn’t at all appealing. It was too late to get a refund seeing as we’d already checked in, so the hotel stay was a sunk cost regardless of what we did. We decided to move back to the Candlewood Suites for the week, so booked that using points again.

Four of the seven nights cost 17,500 points each, two of the other nights cost 15,000 points each and one of the nights was free due to the fourth night free benefit. The 10% points rebate means our net cost was 90,000 points, or 12,857 points per night. It was painful redeeming those points seeing as we’d already paid for the other hotel, but it meant that week’s stay was far more pleasant than staying at the La Quinta.

December 27-28: Candlewood Suites Mooresville/Lake Norman, NC. I had an IHG free night certificate expiring at the end of the year and we needed to book a one night stay somewhere, so I redeemed it at this hotel. It wasn’t a great redemption seeing as we could’ve gotten better value elsewhere, although at least it means it didn’t go to waste.

That sort of means the stay was free, but the credit card annual fee the certificate came from was $49, so that’s what we’ll account for here.

December 28-30: Microtel Montgomery, AL. We needed somewhere to stay in Montgomery for a couple of nights, so we booked a relatively cheap stay at the Microtel seeing as it only cost $64.35 per night. This was our second paid Wyndham stay during their latest promotion period (the first was our aborted La Quinta stay), so it earned us 7,500 bonus points – another reason I chose that property.

December 30-January 1: Hyatt Centric French Quarter New Orleans, LA (we won’t be reviewing this stay, but here’s a review from our stay back in February for Mardi Gras). We booked this stay using free night certificates, so it didn’t really cost us anything. One of those certificates was from a credit card renewal which has a $95 annual fee, so that’s the true cost for one of those nights.

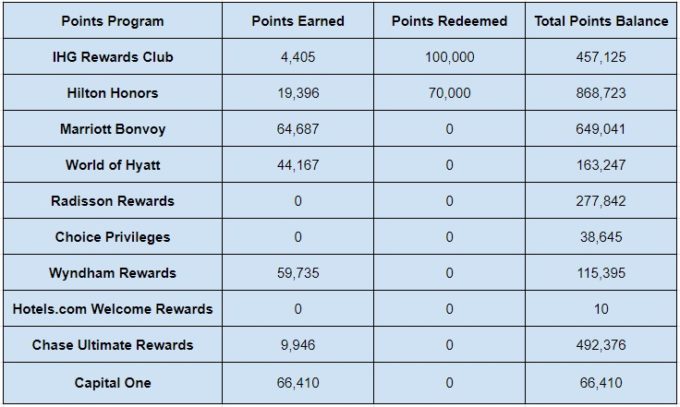

Hotel Points Earned

We earned quite a lot of points during December 2020. Most of these points were earned from credit card spend, although a fair chunk of our World of Hyatt points came about thanks to our paid stays in Ocean City and Baltimore.

I realized that we’ve been earning Capital One rewards for the last few months which can be redeemed for paid hotel stays, so I’ve added those to the list below for us to track each month going forward.

- IHG Rewards Club – 4,405

- Hilton Honors – 19,396

- Marriott Bonvoy – 64,687

- World of Hyatt – 44,167

- Radisson Rewards – 0

- Choice Privileges – 0

- Wyndham Rewards – 59,735

- Hotels.com Rewards Credits – 0

- Chase Ultimate Rewards – 9,946

- Capital One – 66,410

Hotel Points Redeemed

In addition to earning a bunch of points, we redeemed quite a few points in December. The IHG points were from the second stay replacing our La Quinta reservation, while the Hilton redemption was for our current stay in Houston.

- IHG Rewards Club – 100,000

- Hilton Honors – 70,000

- Marriott Bonvoy – 0

- World of Hyatt – 0

- Radisson Rewards – 0

- Choice Privileges – 0

- Wyndham Rewards – 0

- Hotels.com Rewards Credits – 0

- Chase Ultimate Rewards – 0

- Capital One – 0

Total Hotel Points Balances

Although we redeemed quite a lot of points last month, our balances increased overall thanks to all the points we earned. Here’s where our balances ended up at the end of the year:

- IHG Rewards Club – 457,125

- Hilton Honors – 868,723

- Marriott Bonvoy – 649,041

- World of Hyatt – 163,247

- Radisson Rewards – 277,842

- Choice Privileges – 38,645

- Wyndham Rewards – 115,395

- Hotels.com Rewards Credits – 10

- Chase Ultimate Rewards – 492,376

- Capital One – 66,410

Here’s all that information in table format:

Hotel Free Night Certificates

Last month we started tracking all the hotel free night certificates we have from credit card renewals, credit card spend, etc. in these stats posts.

There have been a few changes in the last month. For starters, we redeemed an IHG certificate but also got a replacement. I chose another 40k Marriott certificate as my reward for earning Titanium status with Marriott in 2020. Shae also earned another Hyatt category 1-4 night certificate for completing a spending offer at the end of last year.

Here’s a list of the free night certificates we’re now sitting on:

- IHG (up to 40,000 points per night) – 3

- Hilton (any property worldwide) – 3

- Marriott (up to 35,000 points per night) – 10

- Marriott (up to 40,000 points per night) – 2

- Hyatt (category 1-4) – 3

- Hyatt (category 1-7) – 1

Jogging

I didn’t go jogging at all in December, so I think this might be the last time I include this section in the stats for now!

Blog Stats

December was a fairly busy month, but we still managed to publish more posts than we had the previous month. Here’s our latest update:

- Number of blog posts published – 13

- Page views – 16,062

Final Thoughts

This was a great way to round out our stats for the year. We stayed under budget for both the month and the year and also increased our hotel points balances, so an overall great result. Hopefully we’ll have more of the same in 2021!

You continue to amaze me with your ability to juggle all the numbers and make decisions based on so many possibilities. Well done!

Thank you!

The La Quinta fiasco was sunk cost for one night, correct? You didn’t eat the whole 7 nights, right?

We did eat the entire week I’m afraid. It was our first time “canceling” like this, so I assumed that the fact that we’d already checked in meant we were liable for the entire stay, rather than being able to get away with them only charging us for the first night.

Have you had an alternative experience then?

I’m not familiar with La Quinta policies but I’ve done early check-outs from many many hotels. Most have a policy to cover this that may be chain-wide or property specific. In these COVID Times, I’d imagine properties are MUCH more flexible.

Not to rub it in but… I’ve never paid more than $100 early check-out fee. Most times the fee is waived due to status. Sorry!

That’s really good to know – thanks! I’ll definitely ask about that next time as it’d be nice not to be on the hook for several hundred bucks.

Impressive that you were under budget for December and the year. I enjoy following you along on your journey and how your coping through COVID-19, like the rest of us.

Thank you!