Having stayed more than $100 under budget in September, I wasn’t too optimistic about how our budget would look at the end of October.

Our accommodation spending wasn’t due to be too high, but we had an expected expense that would likely push us far over budget – a hot air balloon flight costing more than $500 for the two of us. That’s more than 1/6 of our entire monthly budget, so I figured we’d end up several hundred bucks over budget by the end of October.

How did we end up doing? Read on to find out.

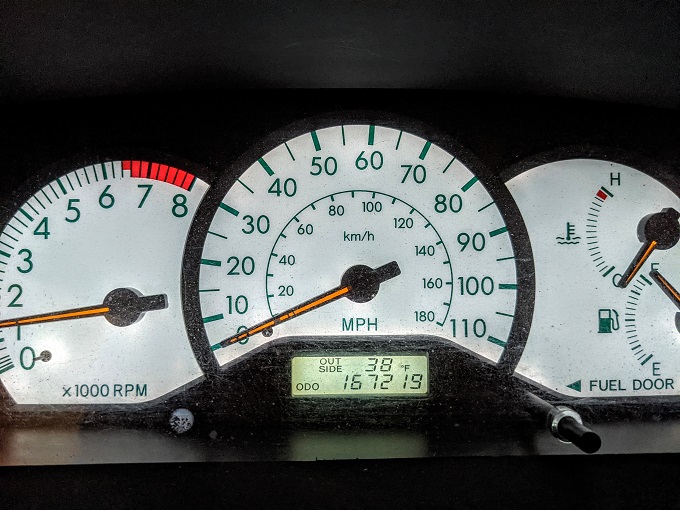

Miles Driven

October started with 164,235 miles on our car’s odometer, while by the end of the month its reading was 167,219. That means that we drove 2,984 miles in October. I predicted last month that we’d drive 2,700 miles, so I wasn’t too far off seeing as we ended up having to do a lot of unexpected driving towards the end of the month.

I don’t think we’ll be doing a ton of driving during November. We’re in Bend, OR until next week, then we’re heading to Portland, OR for a month. Although we’ll be doing some driving in both those places to visit attractions and go hiking, I can’t see us driving much more than 1,000 miles. It’s more likely that we’ll be closer to 750 miles for the month.

Money Spent

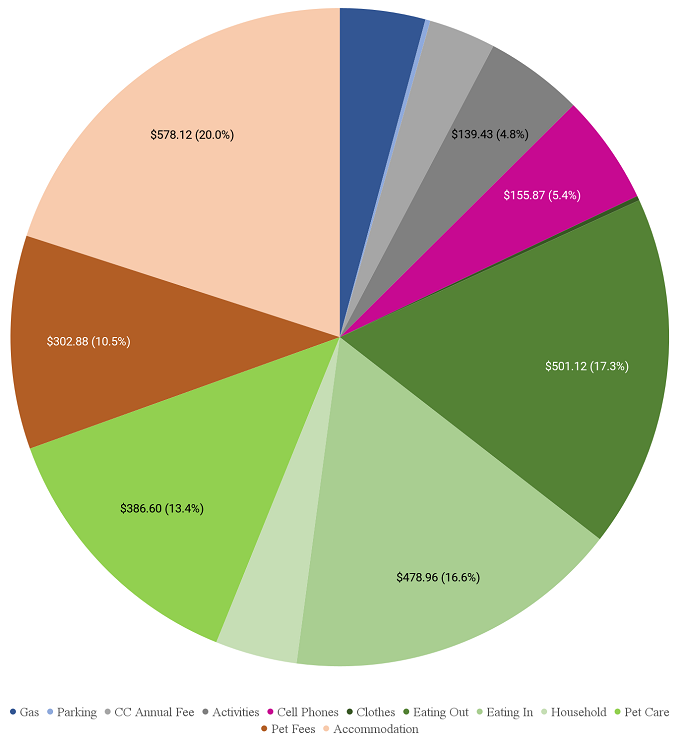

With 31 days in October, our $100 daily budget meant our budget for the month was $3,100. As mentioned earlier, I was expecting us to be at least several hundred dollars over budget due to the $500+ hot air balloon expense at the Albuquerque International Balloon Fiesta.

I was therefore very pleasantly surprised when we ended the month having spent $3,074.72 which means we stayed $25.28 under budget!

That means for what we overspent on activities, we underspent in other categories. We didn’t eat out much last month which helped, while our grocery expenditure was also down compared to normal. We didn’t have to spend as much on care for Truffles as normal and our general household spending was down too.

Here’s a breakdown of our spending for October…

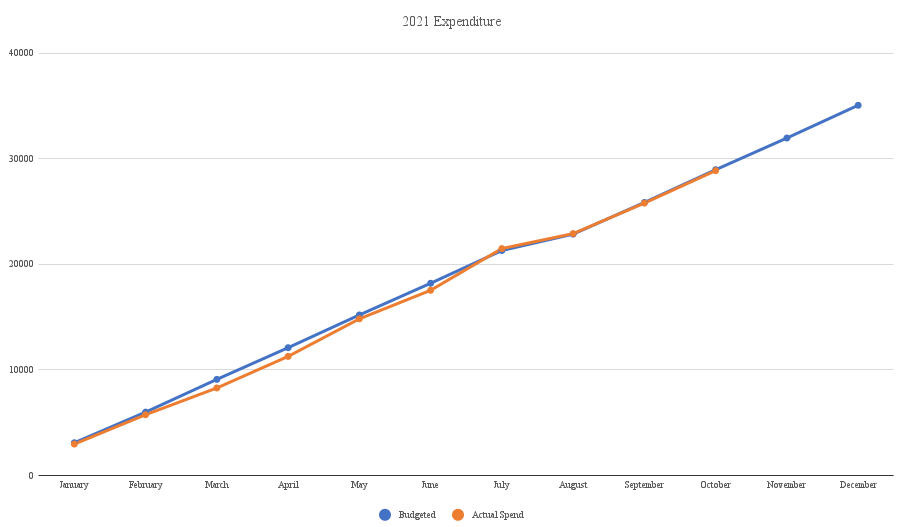

…along with our spending for the year so far. We’ve changed how this year-to-date chart is displayed to make it easier to see our progress over the course of the year, rather than it just showing whether we were over or under budget for each month.

Looking ahead to our budget for November, I think it’ll be a close run thing. Our accommodation spending isn’t due to be too high seeing as almost half the month will be spent in hotels using points, but I imagine the general cost of living in Portland will be a bit higher, so if we do any activities or visit breweries, wineries, etc., we’ll end up spending more.

~

Side note: If you’ve been following us on social media, you’ll likely have seen that Shae ended up having to have emergency surgery to remove her gall bladder. I’ll be writing about that whole situation in the next couple of weeks, but I wanted to explain why it’s not included on our budget for October seeing as that’s when it happened.

For starters, I’ve no idea how much it cost as we’re waiting for the bill! It’s also a tricky situation knowing whether to include it on the budget as the purpose of our Road Trip Stats series is to show how much (or how little) it can cost to travel full-time. Ultimately, Shae would’ve had to have that surgery regardless of whether we were traveling full-time, so we’ve decided not to include it in our road trip budget.

Accommodation Cost

We ended up staying in six different hotels and Airbnbs during October – here’s a breakdown of how much they cost.

October 1-14: Hyatt Place Albuquerque/Uptown, NM (here’s my review). We paid for this stay using points as it was only 5,000 World of Hyatt points per night – much better than the $200+ it would’ve cost us due to it being during the International Balloon Fiesta.

October 14-15: Super 8 Green River, UT (I won’t be writing a review for this stay as it was only one night). After leaving Albuquerque, we headed northwest to spend a couple of months in Oregon. That’s a long drive, so we stopped at a couple of places along the way. The first was at a Super 8 in Green River, UT. This only cost $81.95 including tax.

October 15-16: SureStay by Best Western Twin Falls, ID (I won’t be reviewing this hotel either). This was another quick overnight stop on our way to Oregon. I booked this one because it only cost $74.96 including tax. In reality, it cost us less than that because I booked it via Hotels.com using one of our free Rewards nights. Our Rewards night was worth $64.60, so that dropped our out-of-pocket cost to $10.36.

October 16-23: Airbnb in Halfway, OR. This was an RV we booked on Airbnb but which had plenty of space for us. This only cost $366.94 for the week, so $52.42 per night. We paid for it with discounted Airbnb gift cards, so our net cost was $47.18 per night.

October 22-25: Clarion Inn Ontario, OR (I won’t be writing a review of this stay). We ended up checking out of the Airbnb a day early because Shae’s surgery was in Ontario – a two hour drive away. Rather than driving two hours back just after she’d gotten out of hospital only to have to move the following day, I booked us a few nights at the Clarion Inn in Ontario which was only five minutes from the hospital.

Room rates in Ontario weren’t particularly cheap, but thankfully the Clarion Inn could be booked for only 10,000 Choice Privileges points per night which was very good value.

October 25-31: Holiday Inn Express Bend, OR (review to come in a couple of weeks). Oregon hotels all seem to be quite expensive, so it was awesome being able to book this hotel for only 20,000 points per night. Even better is the fact that we get every 4th night free on award stays thanks to the IHG Premier credit card and a 10% points rebate from the IHG Select card. That means our net cost was only 13,500 IHG Rewards points per night.

I wanted to book this stay on Shae’s account so that she’d end up with enough nights to earn Spire Elite status, so we bought IHG points by booking a Points + Cash stay elsewhere and cancelling that – doing that means you keep the points you purchase on the ‘+ Cash’ part. That meant we bought those points at 0.6 cents per point, so those 13,500 points per night effectively cost us $81 per night which is about half the cost of the stay if we’d paid cash.

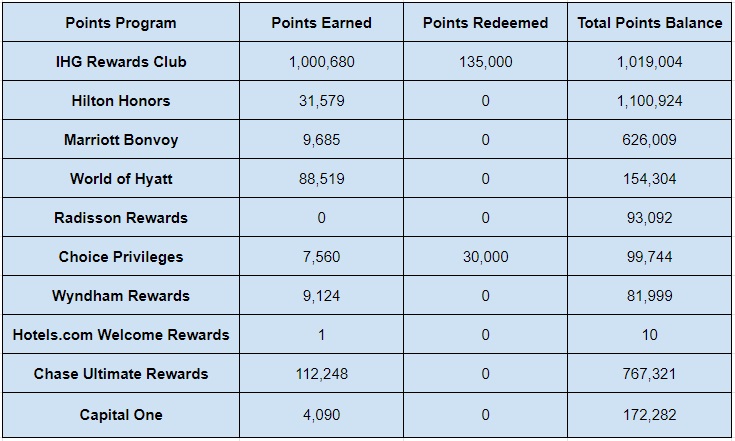

Hotel Points Earned

October 2021 was a good month when it came to boosting our hotel points balances, although there were various reasons behind the increases. We added just over 30,000 Hilton Honors points which came from credit card spend (manufactured spend at grocery stores earns 6 points per dollar on the Hilton Surpass cards). Our Hyatt balances went up, but that was mainly because we cancelled an upcoming stay at the Hyatt Place in Eugene, OR to stay longer in Bend.

Our IHG Rewards balances had a ridiculously large increase of 1 million points, but that’s not as exciting as it sounds. They went on sale for 0.5 cents per point via Daily Getaways. IHG often sells points at that rate, but that’s via Points.com and for whatever reason we can never get an order submitted – it always glitches out. We therefore bought $5,000 worth of points from the Daily Getaways deal as we often get excellent value from IHG points. Seeing as those points should last us for quite some time, we’re spreading out their cost on our budget over the course of 24 months.

Our Chase Ultimate Rewards balances also had a great boost thanks to getting some referral bonuses on Shae’s Sapphire Preferred card, along with some spending at office supply stores on a card that earns 5 points per dollar.

Here’s a breakdown of all the hotel points we earned in October:

- IHG Rewards – 1,000,680

- Hilton Honors – 31,579

- Marriott Bonvoy – 9,685

- World of Hyatt – 88,519

- Radisson Rewards – 0

- Choice Privileges – 7,560

- Wyndham Rewards – 9,124

- Hotels.com Rewards Credits – 1

- Chase Ultimate Rewards – 112,248

- Capital One – 4,090

Hotel Points Redeemed

Compared to how many points we earned and bought last month, we didn’t redeem many. There were 135,000 IHG Rewards points we redeemed for our stays in Bend and elsewhere next month. The only other redemption was the 30,000 Choice Privileges points for our stay in Ontario, OR after Shae’s surgery.

- IHG Rewards – 135,000

- Hilton Honors – 0

- Marriott Bonvoy – 0

- World of Hyatt – 0

- Radisson Rewards – 0

- Choice Privileges – 30,000

- Wyndham Rewards – 0

- Hotels.com Rewards Credits – 0

- Chase Ultimate Rewards – 0

- Capital One – 0

Total Hotel Points Balances

Based on all those changes, here’s how our points balances ended up by the end of October 2021:

- IHG Rewards – 1,019,004

- Hilton Honors – 1,100,924

- Marriott Bonvoy – 626,009

- World of Hyatt – 154,304

- Radisson Rewards – 93,092

- Choice Privileges – 99,744

- Wyndham Rewards – 81,999

- Hotels.com Rewards Credits – 10

- Chase Ultimate Rewards – 767,321

- Capital One – 172,282

Here’s all that info in table format.

Hotel Free Night Certificates

We had a few changes to the number of hotel free night certificates we have last month. We earned an additional Hilton free night certificate from spending $15,000 over the course of the year on one of our Hilton Surpass cards and redeemed three of our Marriott certificates for a stay in San Diego over the New Year.

There’s also now an extra category 1-4 certificate for Hyatt on our accounts – that was from Shae reaching 30 nights with Hyatt for the year, as that certificate is one of the Milestone Rewards for staying that many nights.

- IHG (up to 40,000 points per night) – 4

- Hilton (any property worldwide) – 5

- Marriott (up to 35,000 points per night) – 2

- Marriott (up to 40,000 points per night) – 0

- Hyatt (category 1-4) – 3

- Hyatt (category 1-7) – 1

Jogging

My general exercise regimen has been non-existent, so there was no jogging in October and not much hiking either.

Blog Stats

I managed to write a blog post just over every other day last month which wasn’t bad going for me, especially seeing as I didn’t have much time to write them early in the month due to us being busy with Balloon Fiesta fun.

- Number of blog posts published – 17

- Page views – 22,617

Final Thoughts

The fact that we managed to stay just under budget in October despite spending over $500 on a hot air balloon flight was awesome and totally unexpected. We’re still slightly under budget for the year, so it’s going to be a close-run thing as to whether we manage to stay under budget through December 31.

This is impressive! How the heck did you earn so many IHG points in 1 month!?

We bought them rather than earning them unfortunately. Daily Getaways was selling 500,000 point packages for $2,500, so we bought two of them – one for my account and one for Shae’s.

That’s a lot of money to drop on points, but with us living in hotels and having IHG cards for the 4th night free benefit and 10% points rebate, we can get a lot of value from the points – far more than we actually paid for them.

How do you account for that $5,000 then? Normally you don’t count your “points stays” in your budget

We’ve added $208.33 to our budget each month for the next 24 months. I’m hoping that’s how long the points will last us, so we’ve spread out the cost for them rather than taking a giant hit to the budget for October.