Having gone slightly over budget in January, we’d normally try to do better the next month. Heading into February, I was mildly optimistic that we’d be able to do that.

When putting together last month’s stats, our budget for February was looking OK. However, we’d not finished booking all our stays for the month and so there was an unknown factor. Also, even though we increased our daily budget at the start of the year, I knew it’d be hard keeping within the budget because we’d be in California. As much as I love the state, there’s a very high cost of living. Hotels are expensive, gas is expensive, groceries are expensive, etc.

Was my mild optimism well-founded, or did we end up going over budget? Read on to find out.

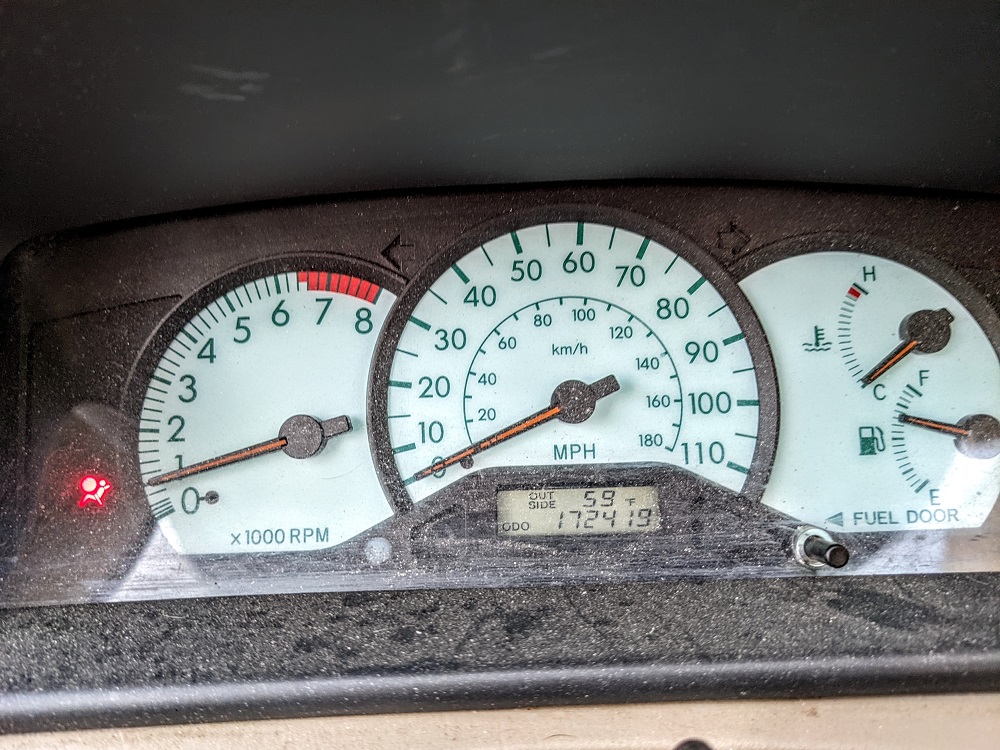

Miles Driven

January 2022 ended with us having 171,110 miles on our odometer. By the end of February its reading was 172,419 which means that we drove 1,309 miles in February.

I’d predicted at the start of last month that we’d drive 1,500 miles in February, so it was nice that our mileage came in less than that as it meant our gas expenditure wasn’t as high as it could’ve been.

Looking ahead to our mileage for March, I’m going to predict that we’ll drive 1,400 miles. We started the month in San Francisco and have been making our way down the coast, arriving in Irvine (just outside of Los Angeles) a couple of nights ago. We’re in the LA area for another week, then we head eastwards and will be ending the month in Phoenix, AZ. We’re not doing much driving day-to-day beyond our journeys between the places we’re staying, which is why I don’t think we’ll be driving much more than we did in February.

Money Spent

2022 wasn’t a leap year, so with February having 28 days in it our budget for the month was $3,500 seeing as our daily budget is $125. By the end of the month we’d spent $3,798.37 which means that we were $298.37 over budget. So much for my optimism that we’d stay under budget!

There were a couple of reasons why we ended up going over budget by a few hundred bucks. The first factor was our accommodation costs. As mentioned earlier, we hadn’t finished booking our February stays when putting together last month’s stats. In the end, we stayed at a fairly expensive hotel in San Francisco. Although we used free night certificates for a few of those nights, we paid for a couple of nights plus they charged for parking.

The other factor was Temecula. We had a fantastic time there and loved all their pet-friendly wineries and other breweries and restaurants there. That fun wasn’t cheap though, especially because we’d not actually planned on staying in Temecula (we booked there literally at the last minute due to an issue with an Airbnb an hour away).

Still, going about $300 over budget isn’t terrible given the high cost of visiting California. We’ll be spending a month in Nebraska and a month in Iowa this summer, so hopefully we’ll be able to make up for this overspend in those lower cost of living states.

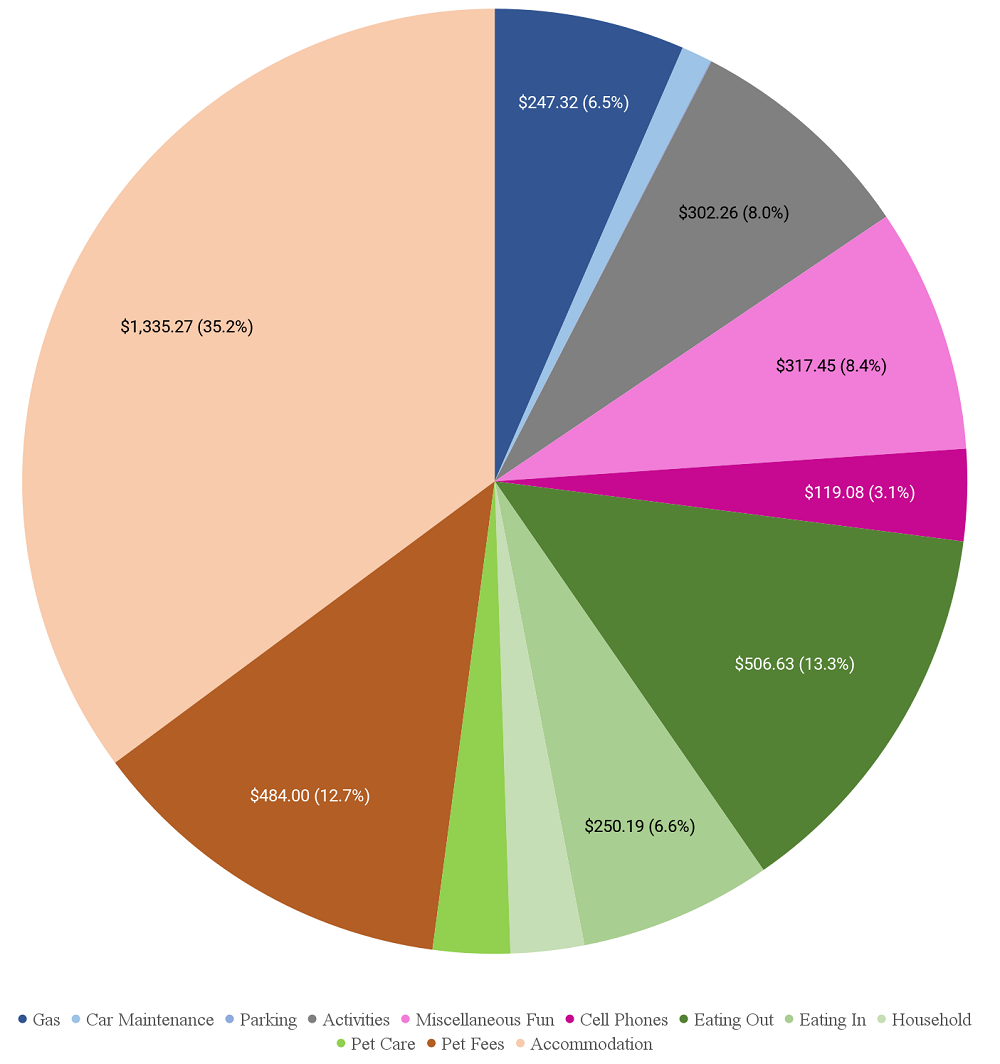

Here’s a breakdown of our spending in February…

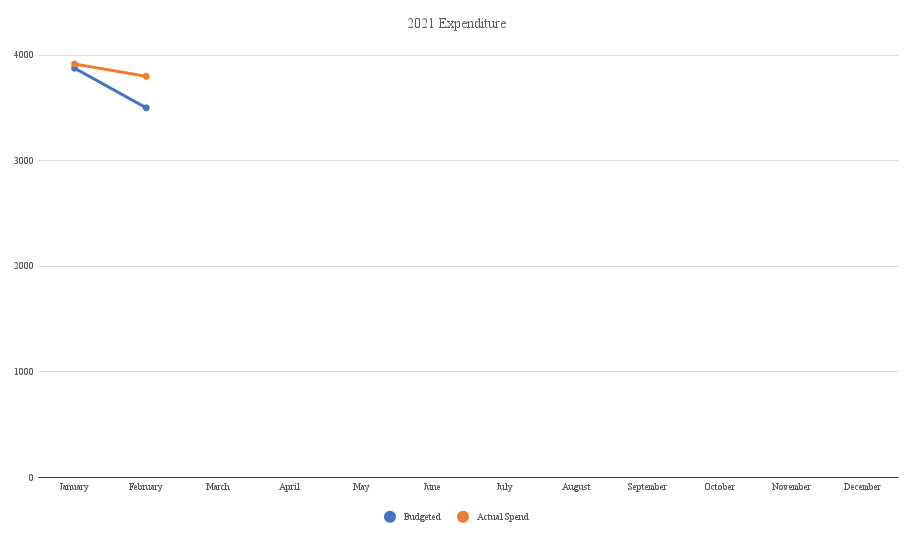

…along with a chart tracking our overall spending for 2022 so far.

Accommodation Cost

Shae and I did a bit of moving around in February, staying in six different places. Here’s a breakdown of how much all those stays cost us:

February 1-4: Hyatt House Irvine/John Wayne Airport, CA. This was a continuation of our stay which had started a couple of weeks earlier in January. This hotel has a standard award cost of 8,000 points per night which would ordinarily be good value for the area.

However, I found a low paid rate which got lowered even further by submitting a Best Rate Guarantee (BRG) claim. You can read more about how Hyatt’s BRG policy works here, but as a quick summary – if you find a lower rate within 24 hours of your booking, Hyatt will match it and you can then choose an additional 20% discount or 5,000 bonus points. With us staying for so long, I chose the additional 20% discount.

That BRG claim therefore reduced our cost to $86.34 per night. We then reduced that cost even further to $75.63 per night by paying with Hyatt gift cards we’d bought at a discount. Unfortunately the hotel also charged $20 per night for parking.

February 4-13: Staybridge Suites Temecula, CA (here’s my review). We booked this using IHG Rewards points and managed to reduce that cost in a couple of ways. I have both the IHG Premier and IHG Select credit cards. The former gives every 4th night free on award stays, while the latter gives a 10% points rebate on award stays.

On the dates we stayed, the hotel was charging 19,000-23,000 points per night. Our net cost by taking advantage of those two credit card benefits was a 9 night stay costing a total of 130,500 points or 14,500 IHG Rewards points per night.

February 13-19: Hyatt Palm Springs, CA (here’s my review). We booked this stay using points and, with it being a category 3 property that we booked before Hyatt introduced peak and off-peak pricing, it cost us 12,000 World of Hyatt points per night.

February 19-20: Bristlecone Motel, Big Pine, CA. After Palm Springs, we’d booked a stay up in Roseville (near Sacramento). We wanted to visit Manzanar National Historic Site along the way which meant we’d have a long drive as it wasn’t the most direct route.

As a result, we booked a one night stay at a random motel along the way. It had pretty good reviews online and didn’t charge a pet fee, so the $124.19 cost for one night seemed reasonable enough as there were few accommodation options in that area.

February 20-25: Residence Inn Rocklin/Roseville, CA. This was another stay we booked using points. Residence Inn is one of Marriott’s brands and they offer every 5th night free on award stays. With them charging 17,500 points per night as standard, our net cost per night with the 5th night free was 14,000 Marriott Bonvoy points per night.

February 25-28: InterContinental Mark Hopkins San Francisco (here’s my review). We stayed at this hotel for a total of six nights from the end of February to the beginning of March.

Before our stay, I bought an Ambassador membership which costs $200 (Ambassador is a paid-for status that gets you benefits at InterContinental and a couple of other IHG brands). I did this not just for the standard benefits but because they had a promotion offering 20,000 points for signing up and staying two paid nights. I value those points at $100, so that effectively made the membership $100.

One of the benefits of Ambassador membership is a free weekend night when paying for another weekend night. That means for our first three nights, we effectively only paid for two nights as that third night was free from that Ambassador certificate. The first night cost $272.49 and the second night cost $243.38, with that third night being free from the Ambassador certificate. That’s far more than we’ve ever paid for hotels before, but we wanted to stay in a great location for San Francisco rather than out by the airport and having to commute in to visit the city. Staying at the InterContinental meant everything we wanted to see was within walking distance.

The final three nights (two of which were in March) we used free night certificates. That means the night of February 28 was paid for with a free night certificate we got from an IHG Select credit card. That card comes with a $49 annual fee, although that fee has been accounted for separately on a past month whenever we were charged for it.

Hotel Points Earned

The number of hotel points we earned in February 2022 looks exciting on the surface, but doesn’t tell the whole story. Our points balances in our World of Hyatt accounts had almost a quarter of a million points added to them, but the majority of those were points transferred from our Chase Ultimate Rewards accounts, so they weren’t “new” points; instead, those are also accounted for in the Hotel Points Redeemed section next.

The majority of the IHG points we earned came in the form of a points rebate for past award stays where my IHG Select credit card gets us 10% of those points back. Most of the Wyndham points came from a cancelled stay, while the nice boost to our Hilton points came from some spending on our Hilton credit cards.

- IHG Rewards – 20,380

- Hilton Honors – 53,193

- Marriott Bonvoy – 1,094

- World of Hyatt – 233,164

- Radisson Rewards – 0

- Choice Privileges – 0

- Wyndham Rewards – 17,578

- Hotels.com Rewards Credits – 0

- Chase Ultimate Rewards – 30,948

- Capital One – 0

Hotel Points Redeemed

February 2022 was a busy month for me booking future hotel stays using points. We booked several stays with IHG, Hilton and Hyatt which is why we redeemed almost 650,000 of those points last month. The 200,000 Ultimate Rewards points that we redeemed were the ones we transferred to our Hyatt accounts.

- IHG Rewards – 208,000

- Hilton Honors – 195,000

- Marriott Bonvoy – 0

- World of Hyatt – 241,500

- Radisson Rewards – 0

- Choice Privileges – 0

- Wyndham Rewards – 0

- Hotels.com Rewards Credits – 0

- Chase Ultimate Rewards – 200,000

- Capital One – 0

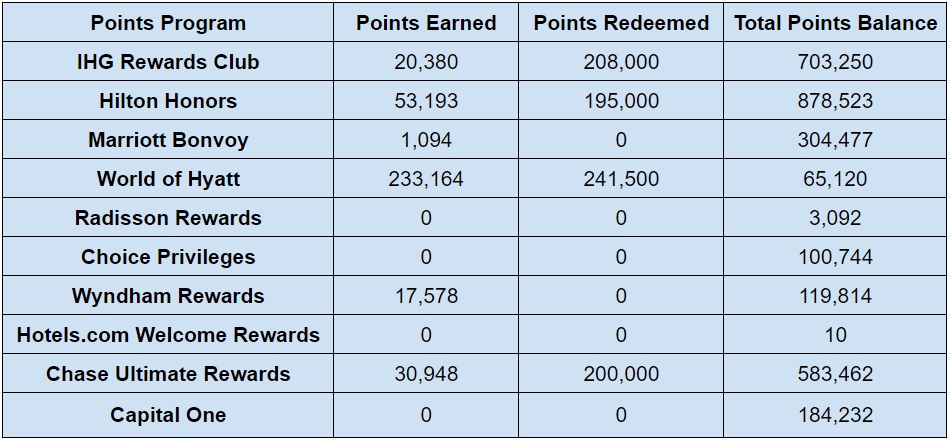

Total Hotel Points Balances

Based on all the points we earned and redeemed last month, here’s how our points balances ended up by the end of the month:

- IHG Rewards – 703,250

- Hilton Honors – 878,523

- Marriott Bonvoy – 304,477

- World of Hyatt – 65,120

- Radisson Rewards – 3,092

- Choice Privileges – 100,744

- Wyndham Rewards – 119,814

- Hotels.com Rewards Credits – 10

- Chase Ultimate Rewards – 583,462

- Capital One – 184,232

Hotel Free Night Certificates

We’ve had a lot of change in the number of hotel certificates Shae and I have between us over the course of the past month. We redeemed three IHG certificates for our stay in San Francisco and three Hyatt category 1-4 certificates for a stay at the Hyatt Regency Monterey immediately after that.

We earned several certificates in that time too though. Two new Hilton certificates were added to our accounts thanks to this promotion that we were both targeted for. We had both a Marriott and Hyatt credit card renew which meant we received another free night certificate for each of those. Here’s how many we now have:

- IHG (up to 40,000 points per night) – 1

- Hilton (any property worldwide) – 6

- Marriott (up to 35,000 points per night) – 1

- Marriott (up to 40,000 points per night) – 1

- Hyatt (category 1-4) – 2

- Hyatt (category 1-7) – 0

Blog Stats

Despite February having three fewer days than January, we had more page views last month than the month before.

- Number of blog posts published – 8

- Page views – 16,692

RAGBRAI Update

Throughout the entire month I rode 127.92 miles – but the big news was completing part 1 of my training plan with a 30 mile ride in Palm Springs.

I also got a new bike at the beginning of February – her name is Calliope. My first bike, Matilda, was great for getting started but for the kind of mileage I’m putting on it I needed a better bike. Matilda’s name meant “mighty in battle” and she was as we started our journey together. Calliope’s name came to me on our first practice ride. When I looked it up she was the muse in Ancient Greece for “epic storytelling.”

We’ve had some great rides this month around Southern California and some epic stories – some good, some less good. I had beautiful rides in Temecula, Palm Springs and Folsom. I also got stung on the leg during a ride and I’m still experiencing post-inflammatory hyperpigmentation.

I can’t wait to share more rides with you next month!

Final Thoughts

It’s a shame that we went a few hundred bucks over budget in February, but I guess I shouldn’t be too surprised considering how expensive California is overall. Most of March is being spent in California too, with more than half those nights being paid for with cash rather than points. I’m therefore not too optimistic about our budget for March either – hopefully we can make up for overspend in the first few months of this year later on in 2022.

[…] pessimistic about our budget for the month. We’d already gone over budget in January and February due to us being in California and its high cost of […]