In last month’s road trip stat’s post I mentioned that I was mildly confident that we’d stay within budget. I’d said:

Our accommodation spending won’t be crazy high, but unfortunately pet fees are set to be a total of $500 which is far higher than normal. If we get lucky, we won’t get charged for a couple of pet fees, but I’m not counting on that.

It turns out that we did get lucky with not getting charged one of the pet fees, but despite that we still struggled to rein in our spending. Did we manage to stay under budget or did we overspend yet again this year? Read on to find out.

Miles Driven

September began with our car having 204,337 miles as its odometer reading. By the end of the month it was at 206,288 which means we drove 1,951 miles in September. I’d predicted we’d drive 1.850 miles, so that’s two months in a row where I came up with a fairly accurate guess as to our mileage.

Looking ahead to our mileage for October, it’s hard to know where it’ll end up. We’ll be bouncing around from Maine to Vermont to Massachusetts, but the distance between them all isn’t very far. However, we will be making a number of day trips during that time to places a little further afield from where we’ll be staying, so I’ll estimate our October mileage at 1,675 miles.

Money Spent

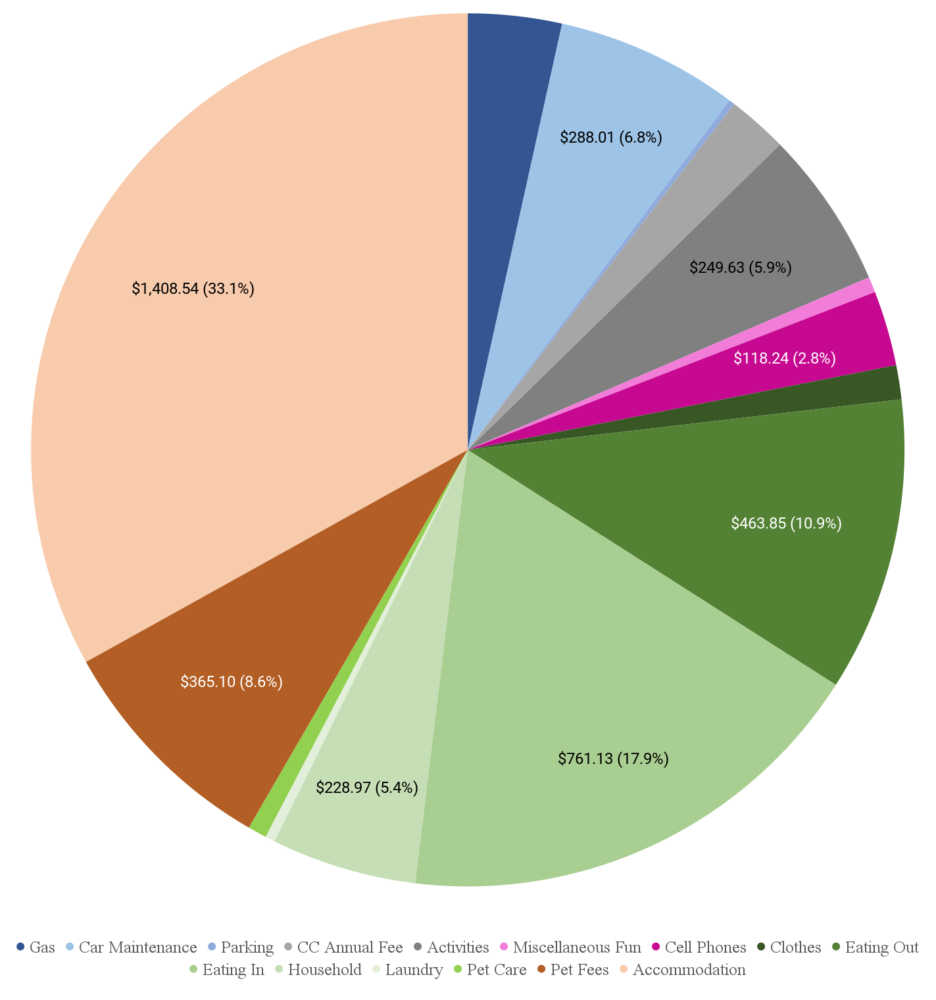

We have a budget of $125 per day on our road trip which, if you’re not familiar with our trip, has to include accommodation, food, gas, activities, etc. September has 30 days in it which means over the course of the month we had $3,750 to play with. By the end of the month we’d spent $4,258.56 which means we went $508.56 over budget – ouch!

Part of the reason for that overspend is because hotel pet fees came to just over $350. Our spending on activities was $250 which was higher than average, while our grocery spend was inexplicably high at just over $750.

Here’s a breakdown of what we spent our money on…

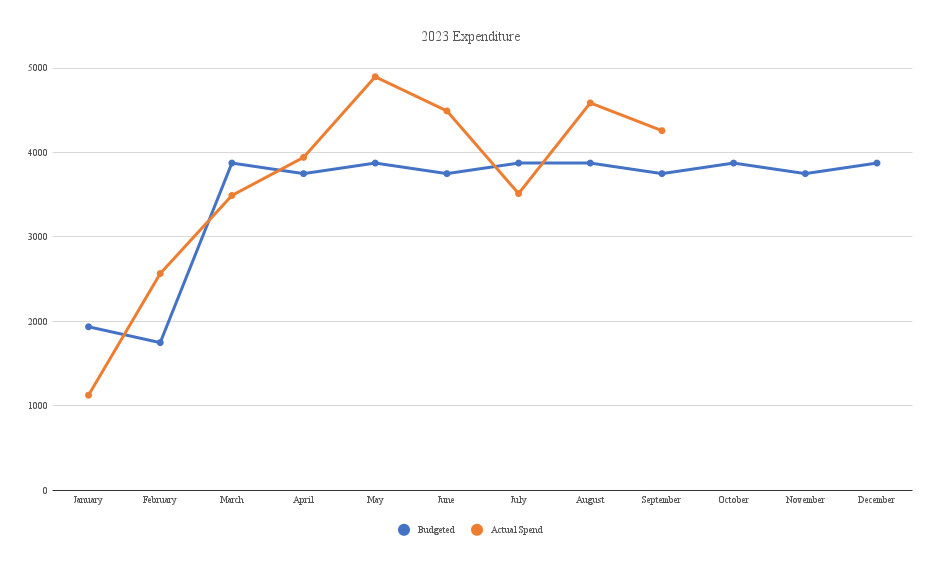

…and here’s a chart tracking our spending so far this year.

As for how I think our spending will go in October, I’m not overly optimistic. I don’t think we’ll be wildly overspending, but I wouldn’t be surprised if we end up a couple of hundred bucks over budget based on anticipated spending (particularly on accommodation costs).

Accommodation Cost

Speaking of accommodation costs, here’s a breakdown of how we paid for our stays in September.

September 1-4: Airbnb in Troy, NY (this one). This two bedroom Airbnb cost $115.91 per night, but we reduced our cost to $98.52 per night by paying with discounted Airbnb gift cards.

September 4-11: Airbnb in Conway, MA (this one). We’d wanted to spend a little time in western Massachusetts, but everything seemed kinda expensive. We did manage to find a fairly reasonably priced Airbnb for $102.66 per night, although paying with discounted Airbnb gift cards reduced that cost to $92.39 per night.

September 11-16: Vacasa property in Wareham, MA (this one). Vacasa is a home rental company a little like Airbnb, Vrbo, etc. They have a partnership with Wyndham which allows you to book these properties with points. It costs 15,000 points for every bedroom, so with this being a one bedroom property it cost 15,000 points per night. However, it gets better than that; because I have a Wyndham Rewards Earner Business credit card, I get a 10% discount when redeeming points for accommodation, so the actual cost was 13,500 Wyndham Rewards points per night.

September 16-21: Hyatt Regency Boston (read my review here). We booked this stay using points, with the number of points needed differing by night as some nights were at standard pricing, while others were at peak pricing. At the time of our stay it was a category 5 property, so the first two nights cost 20,000 points per night, while the last three nights cost 23,000 points per night.

September 21-28: Vacasa property in Kokadjo, ME (this one). This was officially a one bedroom cabin, but it had a second bedroom area in the loft. Seeing as it was only one official bedroom though, we only had to redeem 13,500 Wyndham Rewards points per night.

September 28-October 1: Vacasa property in Eddington, ME (this one). Similar to the property in Kokadjo, this cabin had one official bedroom but with a bonus bedroom area in the loft which meant it cost us 13,500 Wyndham Rewards points per night.

Hotel Points Earned

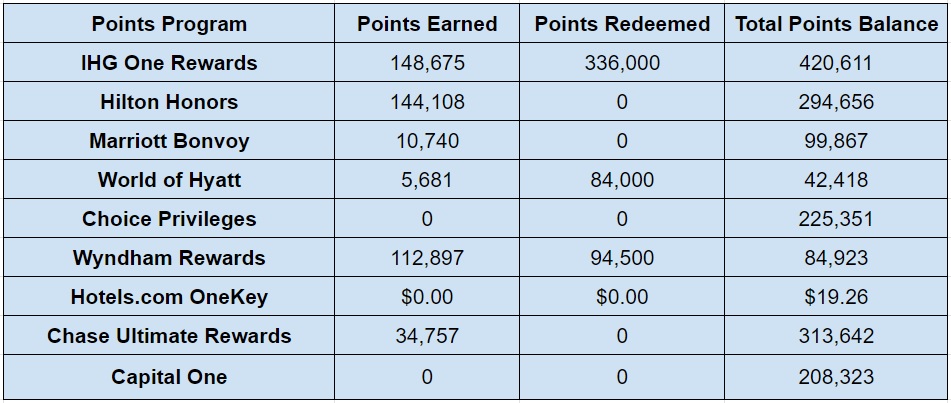

Our hotel points balances have been dropping in recent months as I’ve done quite a few award bookings for future stays. Things were fairly even in September because we replenished our supplies a little but also redeemed quite a few points.

The bulk of our points increases were with IHG, Hilton and Wyndham. The IHG increase was mostly from a cancelled award stay rather than newly earned points, the Hilton increase was largely the result of earning a signup bonus on a new Hilton card along with some spend on our Hilton cards in some of their bonus categories, while a large portion of the Wyndham increase was the bonus earned from a credit card signup after meeting the minimum spend requirement.

- IHG One Rewards – 148,675

- Hilton Honors – 144,108

- Marriott Bonvoy – 10,740

- World of Hyatt – 5,681

- Choice Privileges – 0

- Wyndham Rewards – 112,897

- Hotels.com OneKey – $0

- Chase Ultimate Rewards – 34,757

- Capital One – 0

Hotel Points Redeemed

We redeemed quite a few points across three programs last month. The IHG redemptions were for upcoming stays in Massachusetts and Florida, Hyatt for Massachusetts and Wyndham points (via Vacasa) for a week-long stay in Florida next January.

- IHG One Rewards – 336,000

- Hilton Honors – 0

- Marriott Bonvoy – 0

- World of Hyatt – 84,000

- Choice Privileges – 0

- Wyndham Rewards – 94,500

- Hotels.com OneKey – $0

- Chase Ultimate Rewards – 0

- Capital One – 0

Total Hotel Points Balances

Based on those changes above, here’s how our points balances finished up at the end of September;

- IHG One Rewards – 420,611

- Hilton Honors – 294,656

- Marriott Bonvoy – 99,867

- World of Hyatt – 42,418

- Choice Privileges – 225,351

- Wyndham Rewards – 84,923

- Hotels.com OneKey – $19.26

- Chase Ultimate Rewards – 313,642

- Capital One – 208,323

Here’s all the info in table format:

Hotel Free Night Certificates

There hasn’t been much of a change to our supply of hotel free night certificates since the previous month other than the fact that we earned a new Hilton certificate as part of the welcome offer on a new Hilton credit card.

- IHG (up to 40,000 points per night) – 2

- Hilton (any property worldwide) – 2

- Marriott (up to 35,000 points per night) – 3

- Marriott (up to 40,000 points per night) – 0

- Hyatt (category 1-4) – 3

- Hyatt (category 1-7) – 0

Blog Stats

After getting caught up on some of our backlog of blog posts in August, we managed to stay somewhat up-to-date with posts in September by publishing a new post almost every other day.

- Number of blog posts published – 13

- Page views – 26,397

Final Thoughts

September was another disappointing month when it comes to our road trip budget. We went about $500 over budget which means we’re now at about $2,500 over budget for the year as a whole. Hopefully it doesn’t end up that bad again in October!

[…] October I wasn’t overly optimistic about our ability to stay under budget. I mentioned in last month’s stats post […]