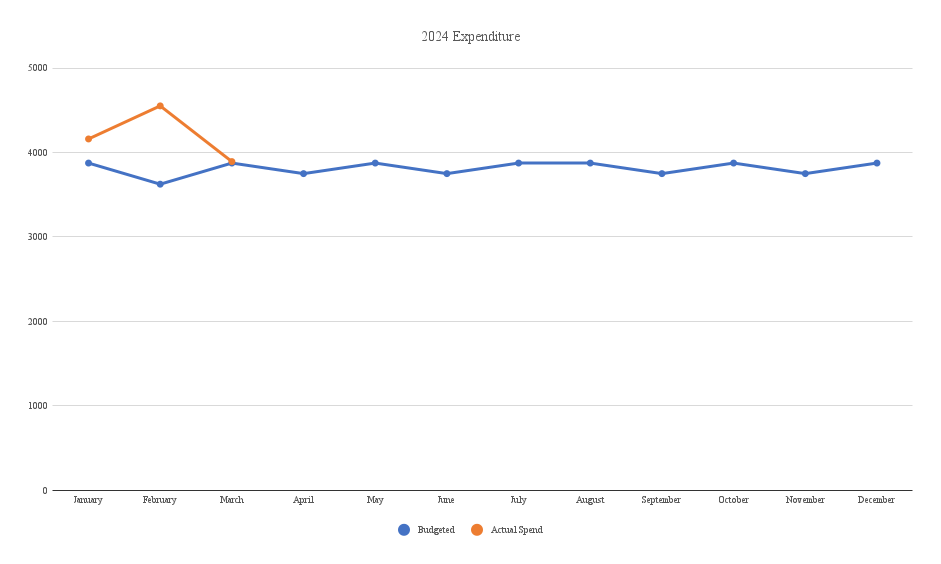

After an abysmal month for going over budget in February, I’d been somewhat hopeful heading into March that we’d manage to stay under budget in the third month of this year.

Everything was looking good until the last few days of the month when we had some sudden unexpected expenses. Had we managed to underspend enough in the first few weeks of the month to still stay under budget, or would this be the third month in a row where we’d go over budget? Read on to find out.

Miles Driven

The month began with 217,238 on our car’s odometer. By the end of the month its reading was 219,618 which means we drove 2,380 miles in March. I’d predicted in last month’s stats post that we’d drive 2,650 miles, I was almost 300 miles off.

We started April in Boise and will end the month in Seattle, staying in Coeur d’Alene, Spokane and Leavenworth in between. I don’t think we’ll be doing many particularly long drives outside of those places, so our mileage should be much lower this month. I’m going to guesstimate it at 1,350 miles.

Money Spent

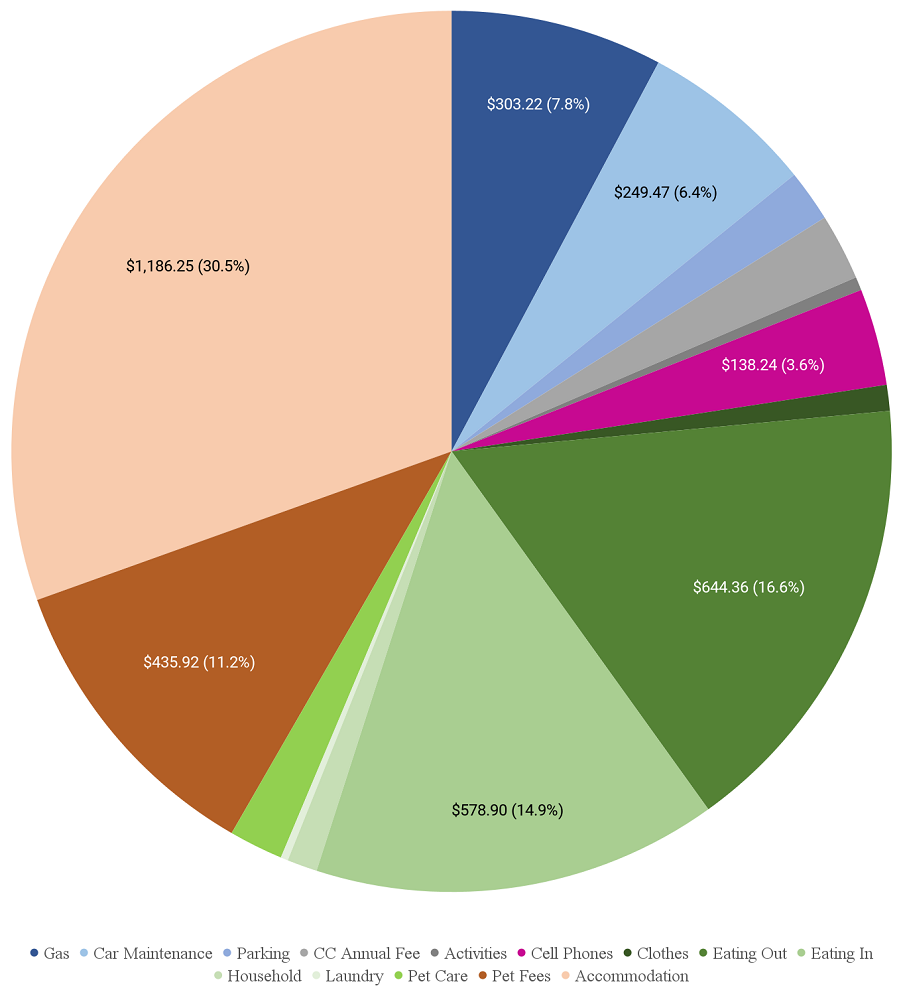

Since 2022 we’ve been doing our road trip on a budget of $125 per day. That has to include all of our road trip expenses – accommodation, food, gas, hotel pet fees, activities, parking, etc. March’s 31 days meant our total budget for the month was $3,875 and we ended the month having spent $3,892.47 which means we went $17.47 over budget. So close!

As I mentioned earlier, we’d been doing OK until the last few days of the month. While in Idaho Falls we’d had some car trouble which continued into our time in Boise. It wasn’t anything major, but it ended up being what pushed us over budget by March 31. Boise also didn’t help because it had some breweries, a winery and a cidery we wanted to check out, so that added $300 to our eating/drinking out expenditure in the last week of the month too. We’ll still blame our car for us going over budget though 😉

Here’s a breakdown of our spending in March…

…along with a chart tracking our spending so far this year.

I hate to tempt fate, but I’m feeling pretty confident about us staying under budget in April. Our accommodation expenditure will be lower than normal which will greatly help, although hotel pet fees are once again set to be high – $450 as things stand unless we get lucky with one or more of the hotels not charging us for having Truffles with us.

There is the potential for us to still go over budget though, with a couple of categories putting us most at risk. One is parking; we’re staying in downtown Spokane for 10 days and the hotel charges $25 per night for parking, so $250 for our stay. I need to look into whether there are any other parking options nearby that have in/out privileges as there might be places we want to drive to nearby to explore.

Our other potential overspend risk is eating/drinking out. We’ll be staying downtown in both Spokane and Seattle. When that happens, we often find breweries and restaurants we want to visit, so hopefully we don’t end up consuming so much that we also spend too much as well!

Accommodation Cost

It didn’t feel like we moved around a ton in March, but the long drive from Indiana to Idaho meant we made a few stops along the way for a total of seven different places we stayed last month.

March 1-11: Airbnb in Indianapolis, IN (this one). This Airbnb was fantastic value considering it’s a 3 bedroom apartment. It cost $96.67 per night, but paying with discounted Airbnb gift cards reduced the cost to $87 per night.

March 11-15: Hyatt Regency St Louis At The Arch, MO (see our review from last year). We loved St Louis when visiting there last year, so we had no hesitation booking another few nights at the Hyatt Regency which is right next to the Gateway Arch. Having Globalist status meant we were upgraded to an Executive Suite again, although this one was even better than our previous stay as it had a view of the Arch from our room. This cost us 8,000 World of Hyatt points for two of the nights and we redeemed two category 1-4 free night certificates for the other two nights.

Using those free night certificates wasn’t a great redemption and so it’s not normally something I’d recommend doing at this hotel. However, the certificates were about to expire and Hyatt wouldn’t extend them or give us points in exchange like they will for some types of certificates, so using them here was better than letting them go to waste and saved us 16,000 points we’d have had to redeem for those two nights otherwise.

March 15-16: MainStay Suites Lincoln University Area, NE. This was a quick stopover on our way through to Idaho and cost us 12,000 Choice Privileges points for the night.

March 16-17: Super 8 Cheyenne, WY. This was another quick stopover on our way to Idaho and cost us only $57.61 including tax.

March 17-25: Candlewood Suites Idaho Falls, ID (review coming next week). We booked this stay with IHG points and they use dynamic pricing for award nights which means the number of points you have to redeem can change from night to night. For our dates it ranged from 15,000-19,000 points per night. I have the IHG Premier credit card which gives every 4th night free on award stays, so we got both the 4th and 8th nights free. I also get a 10% points rebate from also having the old IHG Select credit card, so our net cost was 11,363 IHG One Rewards points per night. We bought those points when they were on sale for 0.5cpp (cents per point), so the stay effectively cost us $56.82 per night which was great value.

March 25-29: Holiday Inn Boise Airport, ID. For our first four nights in Boise we decided to stay out by the airport seeing as we were going to be having to spend much of that time working and thus didn’t really care where we were located in the city. Holiday Inn is another of IHG’s brands, so once again we got the 4th night free and a 10% points rebate. That meant we redeemed an average of 15,750 IHG One Rewards points per night; once again, those were points we’d bought on sale so it effectively cost us $78.75 per night.

March 29-April 1: Residence Inn Boise Downtown, ID. For our non-work days we wanted to be downtown so that everything would be walkable. We booked a five night stay at the Residence Inn, with our stay spanning the end of March through the beginning of April. For the first two nights we redeemed two hotel free night certificates, while the third night was booked using 32,000 Marriott Bonvoy points. Those free night certificates came from us renewing a couple of our Marriott credit cards. I can’t remember which of our Marriott cards those came from, but the certificates effectively cost us two ~$100 annual fees which was good value seeing as the hotel would’ve cost $250 per night.

Hotel Points Earned

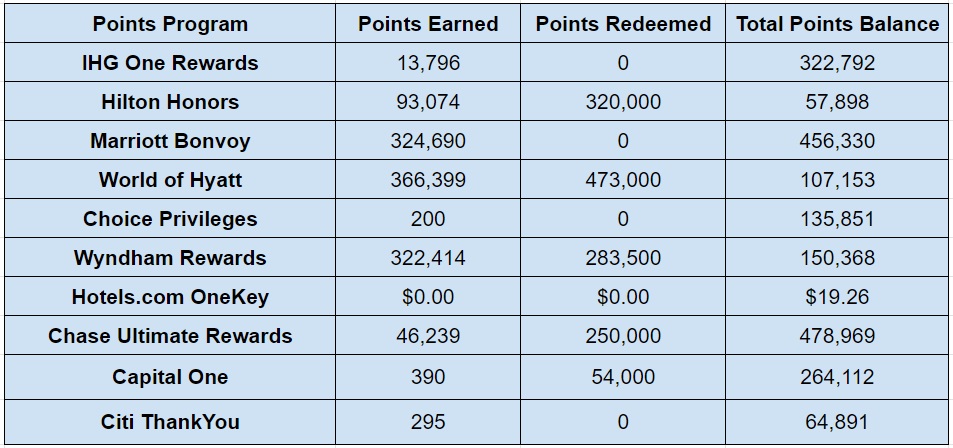

March was a good month for us earning Marriott points, as well as Chase Ultimate Rewards which we usually transfer to Hyatt. That’s because we were fortunate enough to be able to have some of our credit card referral links on Frequent Miler (a site I write for) which meant we picked up quite a lot of bonus points via those referrals; most of the increase in Marriott and Chase points came about that way.

We had a big influx of Hyatt points too, with most of those being transferred in from Chase in order to book award stays later this year. The increase in Wyndham points was a mix of cancelled award stays, purchased points and transferred points.

Here’s a breakdown of the increases by program:

- IHG One Rewards – 13,796

- Hilton Honors – 93,074

- Marriott Bonvoy – 324,690

- World of Hyatt – 366,399

- Choice Privileges – 200

- Wyndham Rewards – 322,414

- Hotels.com OneKey – $0

- Chase Ultimate Rewards – 46,239

- Capital One – 390

- Citi ThankYou – 295

Hotel Points Redeemed

I ended up booking quite a few award stays in March for later this year, so that’s why there was also a large number of Hilton, Hyatt and Wyndham points redeemed, with the Chase outflow going to Hyatt.

- IHG One Rewards – 0

- Hilton Honors – 320,000

- Marriott Bonvoy – 0

- World of Hyatt – 473,000

- Choice Privileges – 0

- Wyndham Rewards – 283,500

- Hotels.com OneKey – $0

- Chase Ultimate Rewards – 250,000

- Capital One – 54,000

- Citi ThankYou – 0

Total Hotel Points Balances

Based on all those changes, here’s how our points balances ended up at the end of March.

- IHG One Rewards – 322,792

- Hilton Honors – 57,898

- Marriott Bonvoy – 456,330

- World of Hyatt – 107,153

- Choice Privileges – 135,851

- Wyndham Rewards – 150,368

- Hotels.com OneKey – $19.26

- Chase Ultimate Rewards – 478,969

- Capital One – 264,112

- Citi ThankYou – 64,891

Here’s all that information in table format:

Hotel Free Night Certificates

We had quite a few changes to our lineup of hotel free night certificates last month. Shae and I got a couple more IHG certs from two of our IHG credit cards renewing, while we also earned two more Hilton certificates by putting $15,000 spend on each of our Hilton Surpass Amex credit cards. We had three Hyatt certificates about to expire, so we redeemed two for the St Louis stay and one for part of a stay in May.

- IHG (up to 40,000 points per night) – 3

- Hilton (any property worldwide) – 4

- Marriott (up to 35,000 points per night) – 1

- Marriott (up to 40,000 points per night) – 0

- Hyatt (category 1-4) – 0

- Hyatt (category 1-7) – 0

Blog Stats

A fair bit of March was spent driving, so we only got 10 new posts published last month.

- Number of blog posts published – 10

- Page views – 10,832

Final Thoughts

While it was a little disappointing to go over budget again, the fact that it was only by $17.47 meant it wasn’t a big deal. It was more than made up for by the fact that we earned a ton of Marriott points last month.

Leave a Reply