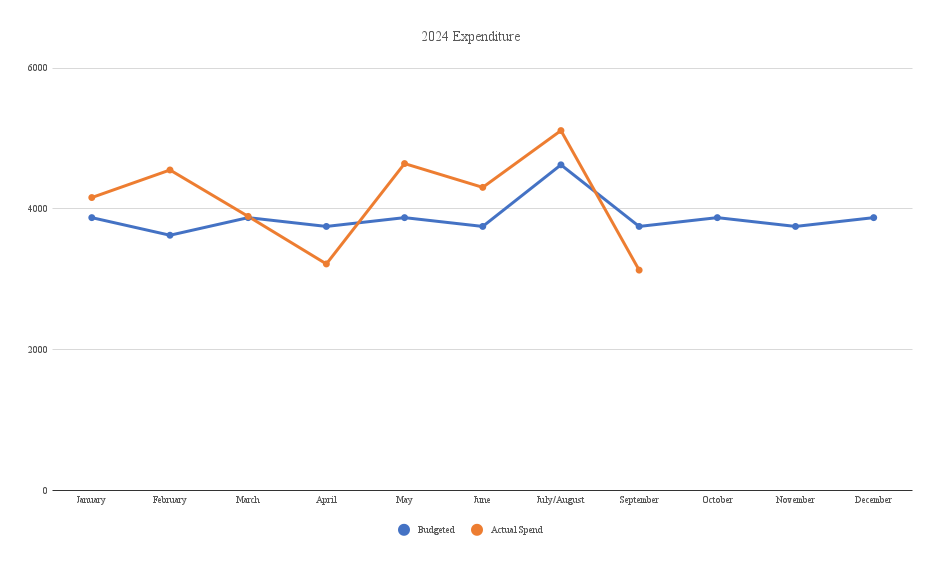

Despite going over budget in nearly every month so far this year, we went into September feeling fairly confident about our ability to stay under budget in September.

That’s because most of the month was going to be spent in hotels we’d paid for using points, so our accommodation spending was set to be much lower than usual. However, with there being lots of breweries, cideries, distilleries and wineries where we’d be visiting in Montana, North Dakota and Wyoming, there was a very real risk that we’d spend far too much money imbibing.

Did we manage to stay under budget? Here are all our road trip stats for September 2024 where we share about that and more.

Miles Driven

Last month started with our car having driven 230,593 miles over its lifetime. We ended the month at 233,673 which means we drove 3,080 miles in September. In last month’s stats post I’d predicted that we’d drive 2,350 miles, so I was a pretty long way off with that guesstimate.

Looking ahead to our mileage for October, it should be less than our mileage in September. We started the month in Jackson, WY and are currently in Cheyenne, WY. We’ll be moving on to Salt Lake City for a few days after that, then on to state 49 – Nevada. Based on that distance and the driving we’ll likely do in each location, I’m going to give the same prediction that I gave last month – that we’ll drive 2,350 miles. Hopefully I’m a little closer this time!

Money Spent

For the last few years we’ve been working on a budget of $125 per day for our road trip. That has to cover all our expenses – accommodation, food, activities, gas, etc. September has 30 days and so our budget for the entire month was $3,750. By the end of the month we’d spent $3,129.77 which means we stayed $620.23 under budget – an excellent result!

As I mentioned at the start of the post, a key reason we were able to stay under budget was because our accommodation expenditure was so low compared to normal. However, it could’ve been much better due to how much we spent on groceries and eating/drinking out. Our grocery spending was $625.80 which was a little higher than normal, but it was eating/drinking out which was excessive as we spent almost $900 in that category. There were lots of breweries, cideries, etc. that we visited in September, so that’s where much of that money went.

Here’s a breakdown of our spending for last month…

..along with a chart tracking our spending so far in 2024.

Looking ahead to our spending for October, I’m optimistic that we’ll stay under budget again. We’re due to be spending all month in hotels booked using points, so that’ll give us a fair bit of leeway. Shae will be overseas for a couple of weeks too, so I probably won’t be spending a bunch of money by myself eating and drinking out.

Accommodation Cost

We stayed in eight different hotels in September – here’s how we booked them:

September 1-4: Residence Inn in Helena, MT. Residence Inn is one of Marriott’s brands and they have a ‘Stay 5, Pay For 4’ benefit on award stays which deducts the cost of the cheapest night. Marriott also uses dynamic pricing which means points prices can vary night by night. We stayed a total of five nights (includes two nights in the previous month) and points pricing ranged from 23,500-26,500 points per night; with that cheapest night deducted, our net cost was 20,200 Marriott Bonvoy points per night.

September 4-9: Element Bozeman, MT (see my review here). Element is another of Marriott’s brands and we once again took advantage of the ‘Stay 5, Pay For 4’ benefit. The nightly cost ranged from 58,000-70,000 points per night, with it averaging out at 54,200 points per night – in theory. However, we ended up leaving a night early so that we’d have a chance to visit some places in Billings on our way through to North Dakota, so in reality it cost us 67,750 Marriott Bonvoy points per night.

September 8-9: Home2 Suites Billings, MT. Home2 Suites is one of Hilton’s brands and we redeemed 35,000 Hilton Honors points.

September 9-13: Candlewood Suites Dickinson, ND. This is one of IHG’s brands and they have a 4th night free benefit on award stays for those with certain IHG credit cards. The cost each night ranged from 19,000-22,000 points, with the total cost being 62,000 points. I also have an old IHG Select credit card which gives a 10% rebate on award stays, so our net cost was 55,800 points for the stay, or an average of 13,950 points per night. We’d bought those points for 0.5cpp (cents per point), so in reality our cost was $69.75 per night which was a great deal as the actual cash price was $131.32 per night.

September 13-20: MainStay Suites Fargo, ND (see my review here). We booked this stay using an average of 17,143 Choice Privileges points per night.

September 20-25: Residence Inn Bismarck North, ND. This was another stay booked with Marriott points where we used their ‘Stay 5, Pay For 4’ benefit. This stay cost us an average of 18,500 Marriott Bonvoy points per night.

September 25-30: Fairfield Inn Gillette, WY (review coming in the next month). Fairfield Inn is another of Marriott’s brands, but this time we paid for the stay using cash as it was only $99.68 per night including tax. We actually paid less than that though thanks to an Amex Offer. There was an Amex Offer last year giving $200 back when spending $500 at certain Marriott brands. With those offers you can buy a Marriott gift card from the front desk of an eligible property to lock in the savings. I did that and used that gift card to pay for this stay. That meant our net cost was, in theory, $59.68 per night.

However, we subsequently decided to leave a day early so that we could get to Jackson, WY a day earlier due to when Shae’s dad was going to be flying in to join us for a few days. That meant we only stayed four nights at the Fairfield Inn. We didn’t ask to shorten the stay though because staying five nights got us a significant enough discount that reducing it to four days would’ve cost us more. Our true net cost was therefore $74.60 per night.

September 29-October 1: Homewood Suites Jackson, WY (review coming next month). We stayed a total of six nights at this hotel, with it costing 80,000 points per night. Hilton has a 5th night free benefit on award stays for anyone with Silver status or higher, so our cost was reduced to 400,000 points. That means we only had to redeem an average of 66,667 Hilton Honors points per night.

Hotel Points Earned

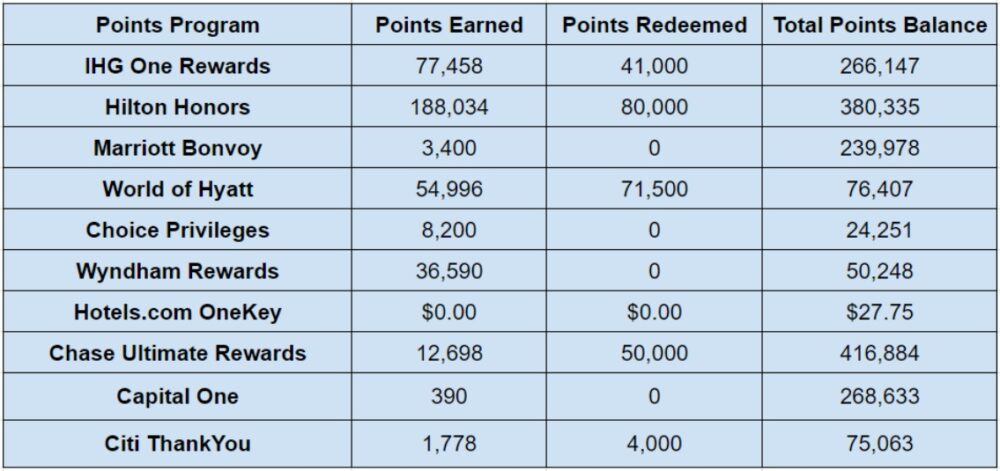

We had a decent influx of points in September, although for a variety of different reasons. The IHG increase was due to a cancelled award stay, while the Hyatt increase was mostly due to transferring in 50,000 Ultimate Rewards points. The Wyndham increase was from putting a decent amount of spend on a Wyndham credit card, while the bulk of the Hilton increase was by earning the bonus points from a new credit card signup.

Here’s a breakdown of everything we earned:

- IHG One Rewards – 77,458

- Hilton Honors – 188,034

- Marriott Bonvoy – 3,400

- World of Hyatt – 54,996

- Choice Privileges – 8,200

- Wyndham Rewards – 36,590

- Hotels.com OneKey – $0.00

- Chase Ultimate Rewards – 12,698

- Capital One – 390

- Citi ThankYou – 1,778

Hotel Points Redeemed

We didn’t make too many redemptions in September. The 80,000 Hilton points was for the extra night at the Homewood Suites in Jackson, WY, while the IHG redemption was for a hotel for Shae for a few nights when she heads overseas. We decided to add a few days in Lake Tahoe during our time in Nevada, so that’s where most of the Hyatt points were redeemed.

- IHG One Rewards – 41,000

- Hilton Honors – 80,000

- Marriott Bonvoy – 0

- World of Hyatt – 71,500

- Choice Privileges – 0

- Wyndham Rewards – 0

- Hotels.com OneKey – $0.00

- Chase Ultimate Rewards – 50,000

- Capital One – 0

- Citi ThankYou – 4,000

Total Hotel Points Balances

Based on all those changes, here’s how our hotel points balances ended up by September 30.

- IHG One Rewards – 266,147

- Hilton Honors – 380,335

- Marriott Bonvoy – 239,978

- World of Hyatt – 76,407

- Choice Privileges – 24,251

- Wyndham Rewards – 50,248

- Hotels.com OneKey – $27.75

- Chase Ultimate Rewards – 416,884

- Capital One – 268,633

- Citi ThankYou – 75,063

Here’s that information in table format:

Hotel Free Night Certificates

We earned an additional Hilton free night certificate in September to ad to the five we already had, then redeemed all six for a stay in Scotland next year. We got another Hyatt category 1-4 free night certificate from a credit card renewal and also redeemed one for a stay Shae has in a few weeks on her way back from South Africa. Here’s what we’re left with:

- IHG (up to 40,000 points per night) – 1

- Hilton (any property worldwide) – 0

- Marriott (up to 35,000 points per night) – 2

- Marriott (up to 40,000 points per night) – 0

- Hyatt (category 1-4) – 2

- Hyatt (category 1-7) – 0

Blog Stats

Shae and I were both sick for a week or two in September, so we weren’t quite as productive blog post-wise as we might’ve liked.

- Number of blog posts published – 8

- Page views – 12,615

Final Thoughts

It’s awesome that we managed to stay so far under budget last month, but truthfully we should’ve spent even less. Still, we had a lot of fun in September and our hotel points balances are still looking very healthy, especially considering nearly all of our accommodation for the rest of the year is already booked.

Leave a Reply