Wow!

Heading into October I was confident that we’d stay under budget as our accommodation expenditure was so low and I wasn’t anticipating us spending as much as normal as Shae was going to be overseas for a couple of weeks. Not because Shae’s the one spending all the money, but it meant I’d be less inclined to want to eat out, we’d be spending half the amount on food for those two weeks, etc.

Anyway, our spending was even lower than I’d hoped for, so that’s also helped our tally for overall 2024 spending too.

Here’s our full road trip stats for October 2024.

Miles Driven

We began the month with 233,673 miles on our car and ended it with the odometer reading at 236,457 miles. That means we drove 2,784 miles in October. I’d predicted last month that we’d drive 2,350 miles, so I was a little under with that guesstimate.

Looking ahead to our mileage for this month (November), it should be significantly less. We began the month in Lake Tahoe and are now in Las Vegas. We’ll be ending the month over in Green River, UT as we’re driving up to Denver. We probably won’t be driving too much while in Las Vegas, so I’ll predict we’ll drive a total of 1,300 miles.

Money Spent

With 31 days in October and a daily budget of $125, we had a total budget of $3,875 for October. By the end of the month we’d only spent $2,278.51 which means we stayed $1,596.49 under budget – woohoo!

The primary reason our accommodation spending was so low was because we spent the entire month in hotels booked with points (n.b. there’s a small amount of accommodation spending accounted for below from when we’d bought hotel points in the past). Our eating out and grocery spend was lower than average too as Shae was in South Africa for half the month.

A few categories had slightly higher spending than average – clothing, gas and pet fees – but that overspend was minimal compared to our savings in those aforementioned categories.

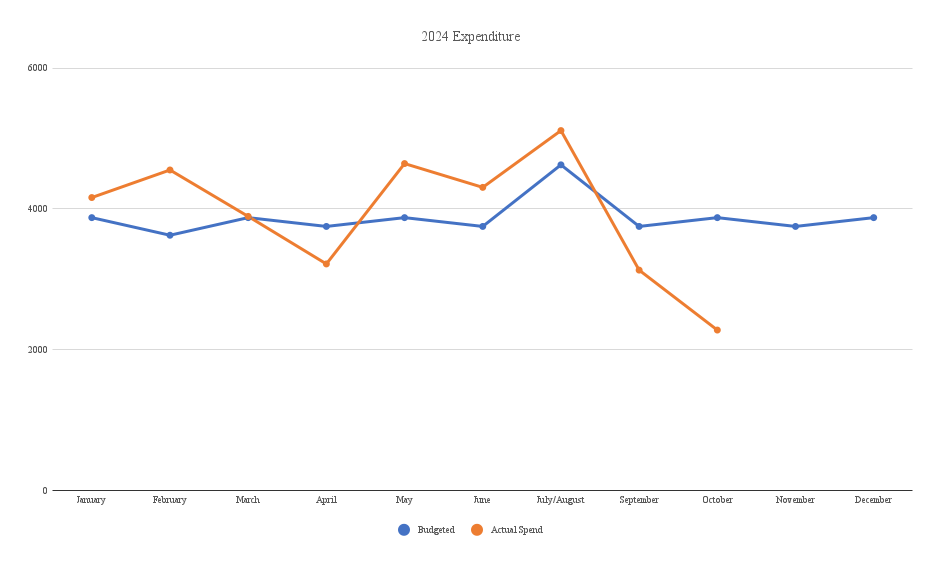

A great feature of those sizeable savings is that it’s put us back on track for our spending for 2024 as a whole. We’d been significantly overspending up until October, but by the end of October our actual spending versus our budget was only $289.17 higher.

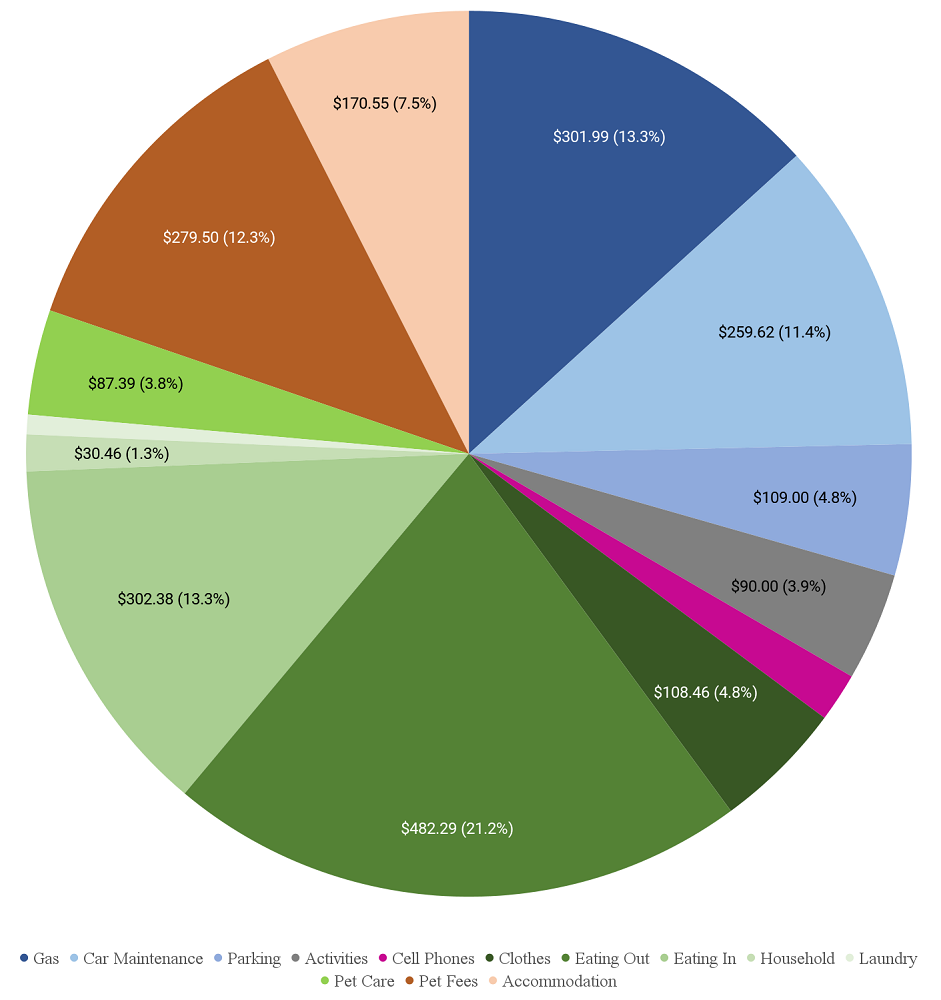

Here’s a breakdown of our spending for October…

…and a chart tracking our spending so far this year.

Looking ahead to our spending in November, I’m less confident that we’ll stay under budget. We’re in an Airbnb for most of the month which means we’re spending much more on accommodation this month than last month. We’re also in Las Vegas and so we’ll want to do some fun activities while we’re here.

That said, there’s still a chance that we’ll stay at or around our budget. I’m about to head off for a couple of weeks to fly around the world as part of the Frequent Miler Million Mile Madness challenge, so that’ll likely reduce our grocery and eating out expenditure.

Accommodation Cost

We stayed in seven different hotels in October – here’s how we paid for them.

October 1-5: Homewood Suites Jackson, WY (review coming in the next week or two). We stayed a total of six nights at this hotel, with it costing 80,000 points per night. Hilton has a 5th night free benefit on award stays for anyone with Silver status or higher, so our cost was reduced to 400,000 points. That means we only had to redeem an average of 66,667 Hilton Honors points per night.

October 5-10: Home2 Suites Cheyenne, WY. This was another hotel we booked using Hilton points and again is another time we managed to take advantage of Hilton’s 5th night free benefit on award stays. The first three nights cost 43,000 points per night and the fourth night cost 54,000 points, so our average across five nights was 36,600 Hilton Honors points per night.

October 10-13: Hyatt House Salt Lake City/Sandy, UT. We booked this using 8,000 Hyatt points for each of the first two nights and 6,500 points for the third night.

October 13-20: La Quinta Ely, NV. We booked this using Wyndham Rewards points. It normally costs 15,000 points per night, but I have a Wyndham Business credit card which gives a 10% discount on award bookings which reduced the cost to 13,500 Wyndham Rewards points per night.

October 20-26: Hyatt Place Reno-Tahoe Airport, NV. Five of the six nights cost 6,500 Hyatt points, with the sixth night costing 8,000 points.

October 26-31: Whitney Peak in Reno, NV (review coming in a few weeks). This cost 46,000 Hilton points per night, but the 5th night free benefit meant the net cost was reduced to 36,800 Hilton Honors points per night.

October 31-November 1: Hyatt Regency Lake Tahoe, NV (review coming in a few weeks). We redeemed 17,000 Hyatt points for this night.

Hotel Points Earned

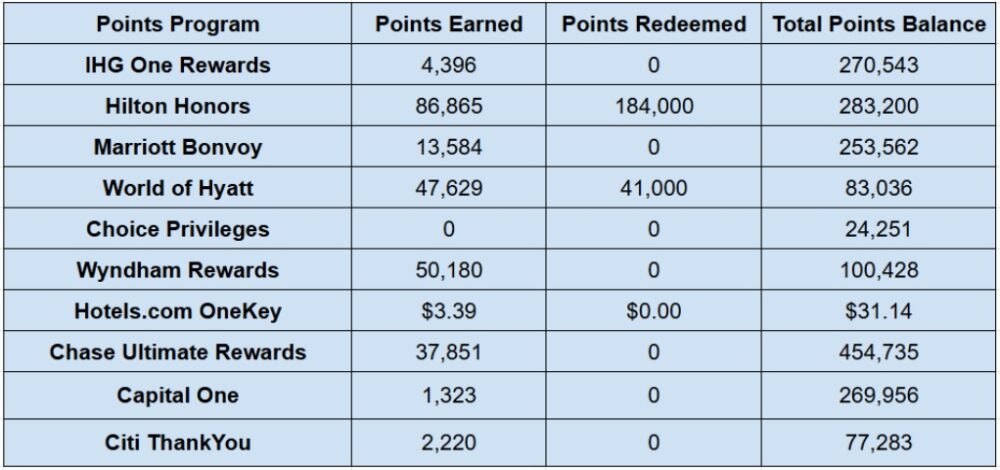

We earned a decent number of hotel points in October. The Hilton, Wyndham and Chase Ultimate Rewards increases were mostly due to credit card spending, while the bulk of the Hyatt increase was from a rebooked award stay.

- IHG One Rewards – 4,396

- Hilton Honors – 86,865

- Marriott Bonvoy – 13,584

- World of Hyatt – 47,629

- Choice Privileges – 0

- Wyndham Rewards – 50,180

- Hotels.com OneKey – $3.39

- Chase Ultimate Rewards – 37,851

- Capital One – 1,323

- Citi ThankYou – 2,220

Hotel Points Redeemed

We didn’t need to make many redemptions in October. The World of Hyatt redemption was from a rebooked award stay, while the Hilton redemption was our (relatively) last minute booking at the Whitney Peak hotel in Reno.

- IHG One Rewards – 0

- Hilton Honors – 184,000

- Marriott Bonvoy – 0

- World of Hyatt – 41,000

- Choice Privileges – 0

- Wyndham Rewards – 0

- Hotels.com OneKey – $0.00

- Chase Ultimate Rewards – 0

- Capital One – 0

- Citi ThankYou –0

Total Hotel Points Balances

Based on those changes above, here’s how our hotel points balances ended up at the end of October.

- IHG One Rewards – 270,543

- Hilton Honors – 283,200

- Marriott Bonvoy – 253,562

- World of Hyatt – 83,036

- Choice Privileges – 24,251

- Wyndham Rewards – 100,428

- Hotels.com OneKey – $31.14

- Chase Ultimate Rewards – 454,735

- Capital One – 269,956

- Citi ThankYou – 77,286

Here’s all that information in table format:

Hotel Free Night Certificates

We received a couple of new hotel free night certificates in October. A new IHG cert was from the renewal of an IHG credit card, while a new Hyatt certificate was from spending $15,000 on a Hyatt credit card this year.

- IHG (up to 40,000 points per night) – 2

- Hilton (any property worldwide) – 0

- Marriott (up to 35,000 points per night) – 2

- Marriott (up to 40,000 points per night) – 0

- Hyatt (category 1-4) – 3

- Hyatt (category 1-7) – 0

Blog Stats

October was a better month for catching up on some of the blog posts that I wanted to get published, so there was an increase from 8 posts in September to 12 in October.

- Number of blog posts published – 12

- Page views – 9,028

Final Thoughts

Staying under budget by more than $1,500 last month was an awesome result which made our overall expenditure for 2024 look much healthier than it had been looking. If we manage to restrain our spending in November, there’s a slight chance that we’d be able to make up a little more of the gap in December to end up under budget for 2024 overall at the end of the year.

[…] month it was at 237,150 miles which means we drove 693 miles in November. I’d predicted in last month’s stats post that we’d drive 1,300 miles, so I was way off with my guess. To be fair, we’d initially […]