We normally publish our Road Trip Stats posts every month, but there’s been a two month gap since our last installment. Shae and I spent a month in Europe from early August to early September, so it didn’t seem worth publishing a standalone stats post for August given we were only in the country for a few days of it.

That time out of the country also left us with a bit of a dilemma as to how we’d account for our budget over the course of those two months. We don’t stick to our road trip budget when traveling overseas, so we weren’t going to include those costs in our stats. Somewhat conveniently though, our length of time out of the country made it easier to calculate our stats.

Shae and I traveled overseas for exactly a month during August and September, so what we decided to do was put together this joint Road Trip Stats post for both August and September. We’d then calculate our budget based on us being on the road trip during half that time.

Here’s how our spending worked out over the course of those two months, along with all our other road trip-related stats.

Miles Driven

We ended July with 185,064 miles on our car’s odometer. By the end of September its reading was 187,504 which means we drove 2,440 miles over the course of August and September.

We’re spending the month of October in Pennsylvania, so our mileage shouldn’t be too high this month. We’ll probably be taking a few days trips a little further afield, so I’ll predict that we’ll drive 1,400 miles in October, but it could well be several hundred miles fewer than that.

Money Spent

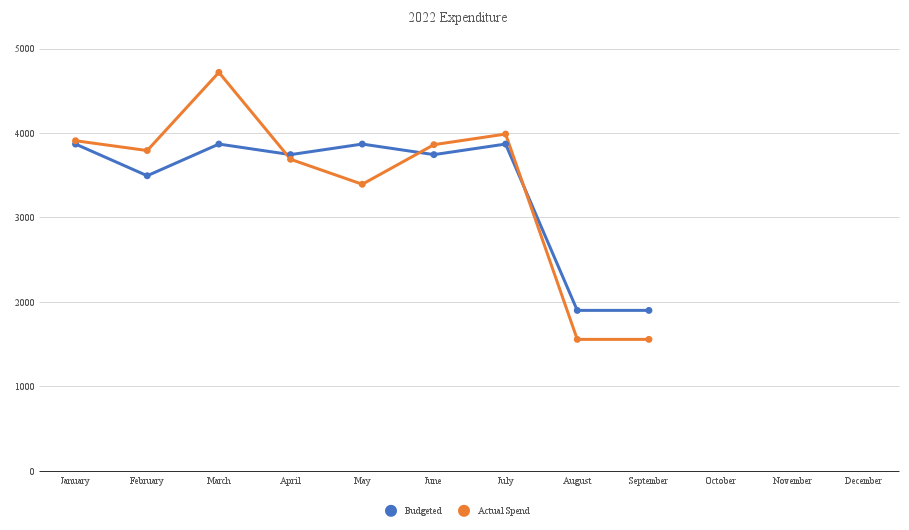

Since the start of 2022 we’ve been working on an increased road trip budget of $125 per day (it was $100 per day for the first four years). With us being out of the country for half that time, we halved the 61 days in August and September and calculated our budget based on that which meant we had $3,812.50 to play with.

By the end of September we’d spent $3,127.17 which means we stayed $685.33 under budget. This was primarily due to the fact that our accommodation spending was so low. Most of the time we spent in the US in August and September was either at hotels paid for using points and free night certificates or when we stayed with family and friends.

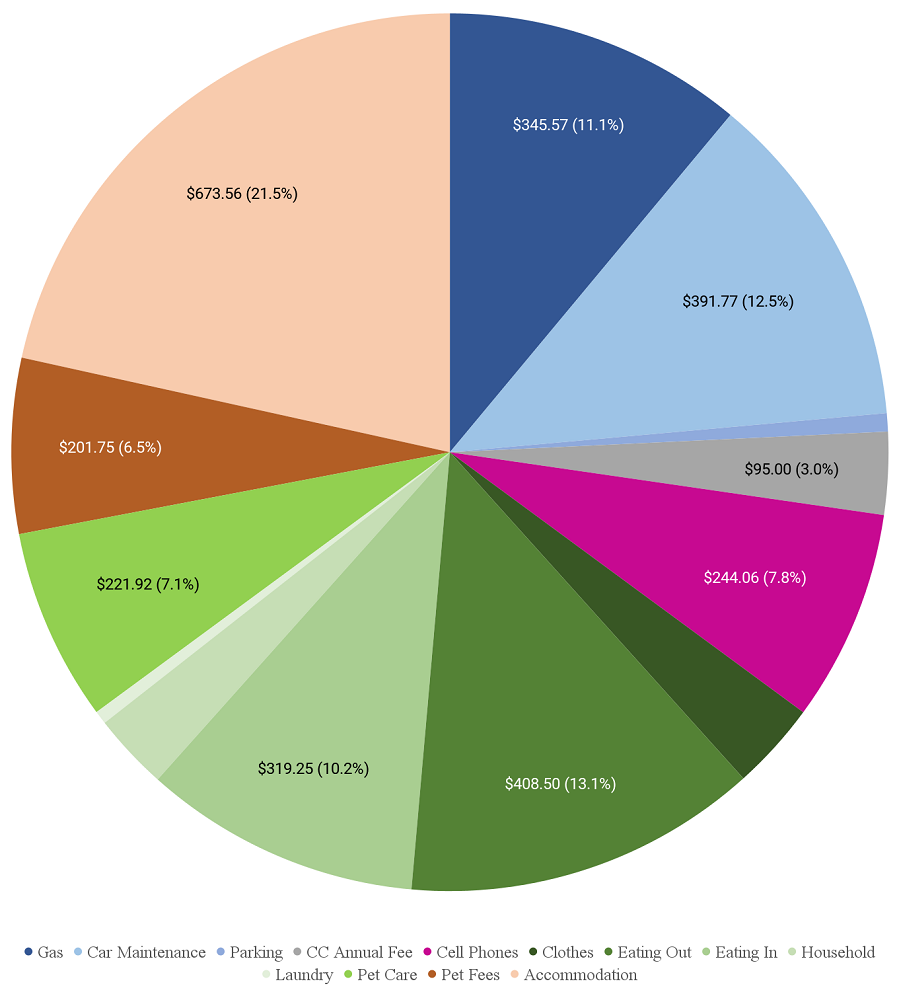

Here’s a breakdown of our spending in August and September…

…along with a chart tracking our spending so far this year.

Looking ahead to our spending for October, I’m unsure as to how well we’ll do on our budget. Our accommodation spending will be a little higher than average, but we’ll be mostly staying in hotels that have a kitchen in our suite which should reduce how much we spend on eating out.

It might all come down to whether the hotels we stay at charge us pet fees. Those are due to come to $325 which is more than normal, but some hotels fail to charge the pet fees listed on their websites, so I’m hoping that’ll be the case for at least some of our stays this month.

Accommodation Cost

Here’s a breakdown of all the places we stayed in August and September in the U.S., along with how we paid for them.

August 1-6: Hyatt House Chicago/Oak Brook, IL. I booked this using World of Hyatt points; due to Hyatt now having off-peak, standard and peak pricing, four nights cost 5,000 points per night and the other night cost 6,500 points.

August 2-5: Thompson Chicago, IL. While I stayed at the Hyatt House, Shae met up with her mom in downtown Chicago to celebrate their birthdays together a few days early and to see Elton John live during his farewell tour. They stayed at the Thompson Chicago which we booked with three category 1-4 free night certificates. I forget how these particular certificates were earned, but two were most likely certificates received when renewing our Hyatt credit cards which have an annual fee of $95, with another certificate likely coming from spending $15,000 on one of those cards.

August 6-8: New York Hilton Midtown, NY. Just before flying to the UK we spent a couple of days in New York to celebrate our anniversary and because I’d gotten Shae tickets to Hamilton for her birthday. We stayed at the New York Hilton Midtown as that was only a short distance to the Richard Rodgers Theater. We redeemed a couple of free night certificates for our stay because the alternatives were redeeming 80,000 points per night or paying $464.80 per night.

One of the free night certificates was earned by spending $15,000 on one of our Hilton Surpass credit cards, while the other free night certificate came with one of our Hilton Aspire credit cards which has a $450 annual fee but has a number of benefits like the free night certificate, Diamond status, $250 in airline fee credits and more.

September 8-9: Hampton Inn South Bend, IN. We flew back into Chicago from Europe, picked up Truffles from her dog sitter and drove on to South Bend, IN. This was booked using 31,000 Hilton Honors points which wasn’t amazing value, but we have plenty of Hilton points and so decided to save cash by redeeming some of those.

September 9-10: Homewood Suites Fort Wayne, IN. Shae had been booked to teach one of her Traveling Teach classes in a school in Fort Wayne, so we stayed there overnight. Similar to the previous night, we booked using Hilton Honors points – this time 30,000 points – which once again wasn’t amazing value but saved us cash.

September 10-12: Cincinnati, OH. From Fort Wayne we headed down to Cincinnati where we stayed with friends for a couple of nights which was free.

September 12-13: Fairfield Inn Charleston, WV. I’d headed off on the 3 Cards, 3 Continents challenge for Frequent Miler by this stage, so Shae continued on by herself (well, with Truffles too). On her way back to Virginia she stayed overnight at the Fairfield Inn in Charleston, WV which cost 18,000 Marriott Bonvoy points.

September 13-14: Longacre of Appomattox B&B, VA. The next night she stayed at a bed & breakfast in Appomattox we’d booked via Hotels.com for $103.24.

September 14-15: Portsmouth, VA. The next night Shae stayed at her mom and stepdad’s.

September 15-22: Vacasa property in Wilmington, NC. Shae and her mom then headed down to Wilmington, NC for a week away together. We booked that one bedroom apartment via Vacasa using Wyndham Rewards points. It was supposed to cost 15,000 points per night, but the net cost was 13,500 points per night as I booked it on my account and I get a 10% discount when booking with points due to having the Wyndham Rewards Earner Business credit card.

September 22-October 1: Portsmouth, VA. Their visit to North Carolina ended on this day and it’s also the day I got back to Virginia from my round-the-world trip. We stayed the rest of the month at Shae’s mom and stepdad’s which once again helped us reduce our accommodation expenditure.

Hotel Points Earned

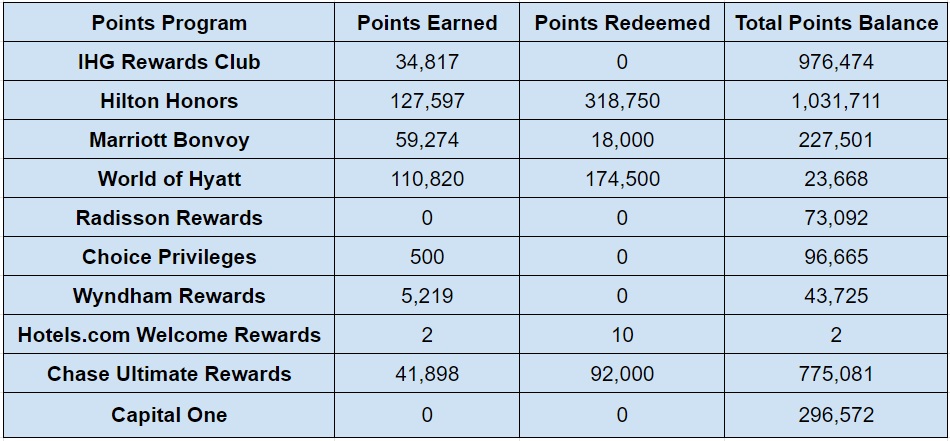

We earned quite a few hotel points in August and September, but not all of these were truly “earned”. Some points – such as quite a few of our Hilton and Marriott points – came about as a result of cancelled award stays. The bulk of our “earned” Hyatt points came about as a result of us transferring in Chase Ultimate Rewards points which is accounted for in the ‘Hotel Points Redeemed’ section next.

Here’s a breakdown of the points we earned the last couple of months:

- IHG One Rewards – 34,817

- Hilton Honors – 127,597

- Marriott Bonvoy – 59,274

- World of Hyatt – 110,820

- Radisson Rewards – 0

- Choice Privileges – 500

- Wyndham Rewards – 5,219

- Hotels.com Rewards Credits – 2

- Chase Ultimate Rewards – 41,898

- Capital One – 0

Hotel Points Redeemed

I booked quite a few Hyatt and Hilton award stays this last couple of months which is why those programs are showing a high level of redemptions.

- IHG One Rewards – 0

- Hilton Honors – 318,750

- Marriott Bonvoy – 18,000

- World of Hyatt – 174,500

- Radisson Rewards – 0

- Choice Privileges – 0

- Wyndham Rewards – 0

- Hotels.com Rewards Credits – 0

- Chase Ultimate Rewards – 92,000

- Capital One – 0

Total Hotel Points Balances

Based on our earning and redeeming, here’s how our hotel points balances were looking at the end of September 2022:

- IHG One Rewards – 976,474

- Hilton Honors – 1,031,711

- Marriott Bonvoy – 227,501

- World of Hyatt – 23,668

- Radisson Rewards – 73,092

- Choice Privileges – 96,665

- Wyndham Rewards – 43,725

- Hotels.com Rewards Credits – 2

- Chase Ultimate Rewards – 775,081

- Capital One – 296,572

Here’s all that information in table format:

Hotel Free Night Certificates

We redeemed quite a few Hyatt free night certificates in August and September, so here’s how many hotel free night certificates we now have:

- IHG (up to 40,000 points per night) – 2

- Hilton (any property worldwide) – 4

- Marriott (up to 35,000 points per night) – 3

- Marriott (up to 40,000 points per night) – 1

- Hyatt (category 1-4) – 0

- Hyatt (category 1-7) – 0

Blog Stats

Due to the fact that we were so busy in August and September traveling overseas or driving from one place to the next, we only published 13 posts over the course of the two months. That’s about half of what we’d normally publish during a two month period, but many of the posts we did publish were 4,000+ words and had ~100 photos, so they took much longer to put together than normal.

- Number of blog posts published – 13

- Page views – 51,036 (average of 25,518 per month)

Final Thoughts

August and September were pretty good months for our stats. We stayed well under budget which makes our budget for the year as a whole much more healthy. We’re still over budget for 2022 so far but only by about $200, so hopefully we can make up for that in the last few months of the year.

Hope you are better. what did u see in my hometown-Philly?

I’m feeling a bit better now – thanks! I haven’t had much of a chance to see things in Philly yet due to being ill, but we’re heading back downtown tomorrow to try to see as much as possible 🙂