We have a (sort of) bumper edition of our road trip stats for you today because rather than covering one month like normal, we’ll be covering two months – July and August.

The reason for this is that Shae and I paused the road trip back in mid-July to go visit the Finger Lakes region in New York, then went to the UK and then on to the Maldives for our 20th anniversary. We picked back up in mid-August which meant that we were gone for almost a month in total. As a result, we decided to merge both July’s and August’s stats into this one post.

Miles Driven

We started July with 225,499 miles on our car’s odometer. The start of July involved driving back down to the lower 48 from Alaska, so that put quite a bit of mileage on the car. Since then we’ve moved on to Montana, although the amount of driving we did in the second half of August was much lower than the amount we did in the first half of July.

At the end of August, our car was at 230,593 miles which means we drove 5,094 miles over the course of the two months.

I normally predict ahead of time how many miles I think we’ll be driving in the forthcoming month and for July I’d predicted we’d drive 3,100 miles. What I forgot to do though was predict how many miles we’d drive in August and I’ve no idea how accurate that guess for July ended up being.

Looking ahead to our mileage for September, we’re currently in Montana and will then be moving on to North Dakota and Wyoming after that. That alone is due to be ~1,850 miles, but adding on additional driving while we’re in each place means I’ll predict we’ll drive 2,350 miles in September.

Money Spent

With us being away for almost half the time in July and August, that meant our $125 per day road trip budget gave us $4,625 to play with over the course of that time (i.e. 37 days out of the 62). However, there are some expenses we incurred twice during that period like cell phone bills, car insurance, etc. We decided to leave those in the budget even though a case could be made for only including one of each.

Not helping matters either is the fact that driving back down from Alaska through Canada was expensive. Hotels aren’t cheap, gas was more expensive (and we were using more of it), food was more expensive, etc.

All that to say that we went over budget again! As mentioned above, our theoretical budget over July and August was $4,625, but we ended up spending $5,111.53 – $486.53 over budget. In reality though, we didn’t really go quite that far over budget; it’s just hard trying to decide how to account for everything seeing as we were away for almost four weeks but there were expenses we still had to pay.

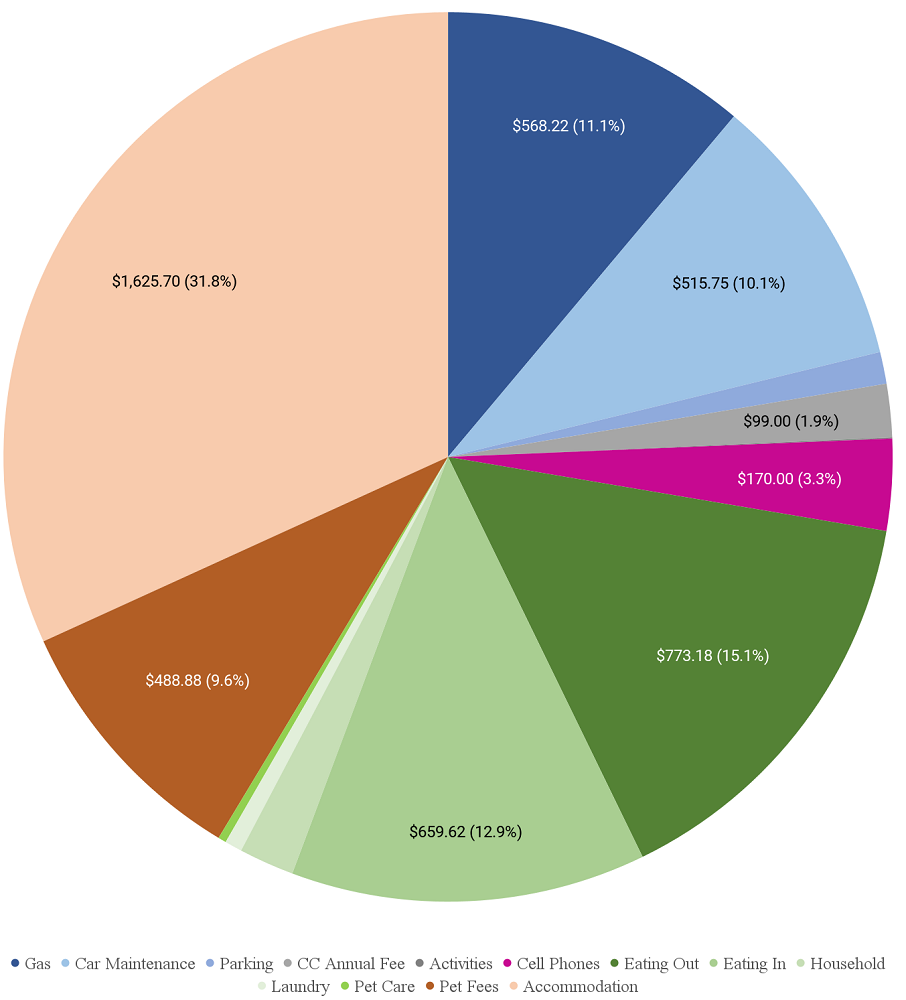

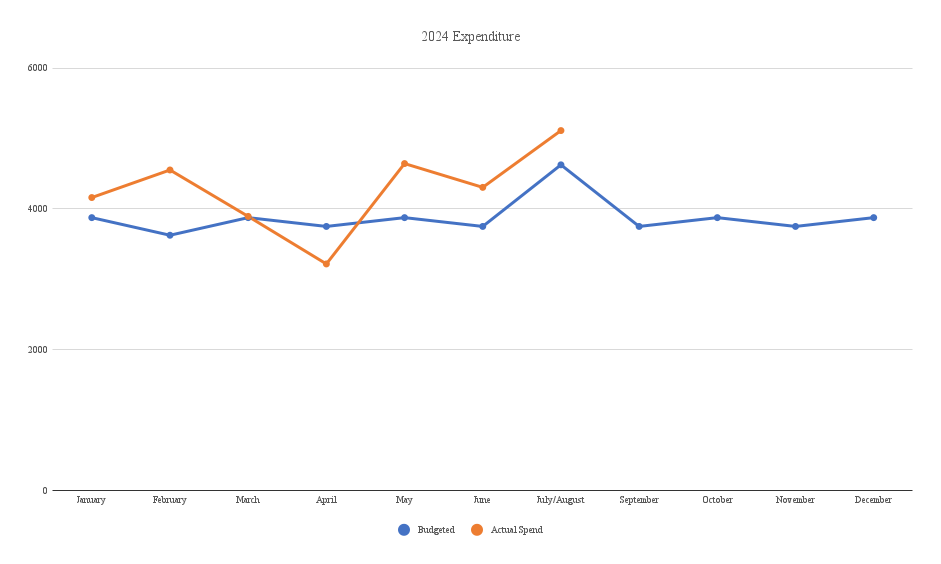

Here’s a breakdown of all that spending….

…along with a chart tracking our spending so far this year.

Looking ahead for our spending in September, in theory we should end up staying well under budget. Nearly all our accommodation for this month is being paid for with hotel points, so that’ll decrease our overall accommodation expenditure. We are being tempted by all the breweries, cideries and distilleries in Montana though, so hopefully there’s fewer of them in North Dakota when we get there next week to remove temptation.

Accommodation Cost

Due to this covering 37 days and the fact that we moved nearly every day when driving down from Alaska, this is a longer list than normal. I’ll therefore try to keep it as concise as possible:

July 1-6: Airbnb in Seward, AK (this one). This cost $121.45 per night, with us reducing the cost to $109.31 per night, by paying with Airbnb gift cards we bought at a discount.

July 6-7: Airbnb in Tok, AK (this one). This cost $135.80 per night, but paying with discounted Airbnb gift cards reduced that to $118.83.

July 7-8: The 98 Hotel in Whitehorse, Canada (see review here). This cost $91.87 for the night.

July 8-10: Northway Motor Inn in Dease Lake, Canada (see more here). This cost $144.37 per night.

July 10-12: Historic Hotel Bayview in Stewart, Canada (see more here). The nightly rate was $92.08; we booked through Hotels.com and paid with a Hotels.com bought at a discount though, so our net cost was $73.66 per night.

July 12-13: Ramada in Prince George, Canada (see more here). This cost 15,000 Wyndham Rewards points for the night, but I have a Wyndham Rewards Earner Business credit card which gives a 10% discount on award stays and so it ended up costing only 13,500 Wyndham Rewards points.

July 13-14: TownePlace Suites in Bellingham, WA. We booked this using a Marriott free night certificate that could be redeemed for up to 35,000 points.

July 14-15: Whidbey Island, WA. We stayed with a friend this night, so this was free.

July 15-18: Garner in Auburn, WA. Garner is one of IHG’s new brands and we booked all three nights using IHG free night certificates.

July 18-19: The Duniway in Portland, OR (see our review here from when we stayed there several years ago). We booked this through the American Express Fine Hotels & Resorts (FHR) program. The Amex Platinum card has a benefit giving a $200 credit on stays at FHR properties, so with this hotel costing $269.43 for the night, our net cost was $69.43.

July 19-20: La Quinta Inn & Suites Seattle Sea-Tac Airport, WA. Similar to the Ramada in Prince George, this would normally cost 15,000 points per night, but having a Wyndham credit card meant we only had to redeem 13,500 Wyndham Rewards points.

August 14-17: Hyatt Regency San Francisco Airport, CA. After getting back from the Maldives, we spent a few days in San Francisco as I was meant to go to a Stone Temple Pilots/Live concert (that didn’t work out unfortunately due to rental car issues). For the stay itself, we redeemed 15,000 World of Hyatt points for the first nights and 12,000 points per night for the next two nights.

August 17-18: The Historic Davenport in Spokane, WA (see review here from when we stayed there a few months ago). This cost 37,000 Marriott points per night; we used a Marriott free night certificate that was redeemable for up to 35,000 points and topped it up with 2,000 points.

August 18-25: Vacasa property in Whitefish, MT (this one). Wyndham Rewards has a partnership with the vacation rental company Vacasa. It costs 15,000 points per bedroom per night for properties that cost up to $250 per night nowadays (it’s more points for more expensive properties cash-wise – see more here). The 10% discount from having a Wyndham credit card applies to Vacasa rentals too, so our net cost was 13,500 Wyndham Rewards points per night.

August 25-30: DoubleTree in Missoula, MT (see our review here). This hotel cost 60,000 Hilton points per night, but Hilton has a 5th night free benefit on award stays. With this being a 5 night stay, that reduced our cost to an average of 48,000 Hilton Honors points per night.

August 30-September 1: Residence Inn in Helena, MT. Residence Inn is one of Marriott’s brands and they have a ‘Stay 5, Pay For 4’ benefit on award stays which deducts the cost of the cheapest night. Marriott also uses dynamic pricing which means points prices can vary by night. We stayed a total of five nights and points pricing ranged from 23,500-26,500 points per night; with that cheapest night deducted, our net cost was 20,200 Marriott Bonvoy points per night.

Hotel Points Earned

The numbers below make it look like we earned tons of points in July and August, but that wasn’t entirely the case. Most of the increase in Marriott points was due to a cancelled award booking, while much of the World of Hyatt increase was from transferring in some Ultimate Rewards points. Much of the Hilton increase was from earning the welcome bonus on a new Hilton credit card.

- IHG One Rewards – 11,418

- Hilton Honors – 157,389

- Marriott Bonvoy – 110,952

- World of Hyatt – 129,311

- Choice Privileges – 0

- Wyndham Rewards – 17,330

- Hotels.com OneKey – $8.49

- Chase Ultimate Rewards – 125,375

- Capital One – 872

- Citi ThankYou – 6,790

Hotel Points Redeemed

I went on a bit of a booking spree in July and August, so now we have pretty much all our hotels booked through the end of the year. Here’s what we redeemed to finish that off:

- IHG One Rewards – 73,260

- Hilton Honors – 183,000

- Marriott Bonvoy – 101,500

- World of Hyatt – 121,000

- Choice Privileges – 0

- Wyndham Rewards – 108,000

- Hotels.com OneKey – $0

- Chase Ultimate Rewards – 90,000

- Capital One – 0

- Citi ThankYou – 0

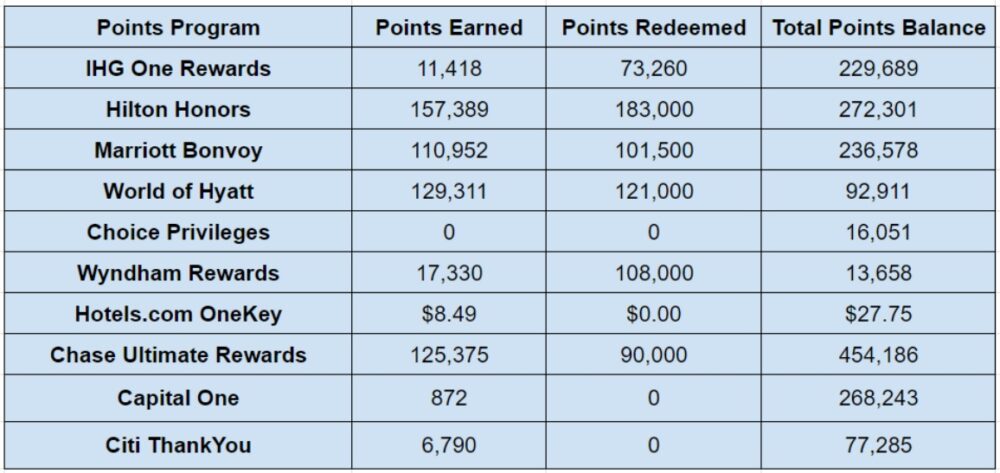

Total Hotel Points Balances

Based on those changes, here’s how our hotel points balances ended up at the end of August:

- IHG One Rewards – 229,689

- Hilton Honors – 272,301

- Marriott Bonvoy – 236,578

- World of Hyatt – 92,911

- Choice Privileges – 16,051

- Wyndham Rewards – 13,658

- Hotels.com OneKey – $27.75

- Chase Ultimate Rewards – 454,186

- Capital One – 268,243

- Citi ThankYou – 77,285

Here’s that information in table format:

Hotel Free Night Certificates

We had a number of changes to our lineup of hotel free night certificates over the past couple of months. On the redemption side of things, we redeemed a Marriott 35k night certificate and a Hyatt category 1-7 certificate. On the earning side, we got another Hyatt certificate (from renewing a Hyatt credit card) and earned four more Hilton free night certificates – one from getting a new credit card and three from upgrading three existing Hilton credit cards to Aspire cards.

- IHG (up to 40,000 points per night) – 1

- Hilton (any property worldwide) – 5

- Marriott (up to 35,000 points per night) – 2

- Marriott (up to 40,000 points per night) – 0

- Hyatt (category 1-4) – 2

- Hyatt (category 1-7) – 0

Blog Stats

We published a similar number of new blog posts to normal in July and August, while the number of page views increased compared to recent months which was nice to see.

July

- Number of blog posts published – 10

- Page views – 10,425

August

- Number of blog posts published – 9

- Page views – 10,512

Final Thoughts

This was a slightly different set of stats to normal seeing as it (sort of) encompassed both July and August. Although we went over budget, I’m feeling somewhat confident about our ability to stay under budget for September and October, so hopefully these next two months can help our spending for the year overall get closer to being back on track.

Leave a Reply