When publishing last month’s stats, I’d mentioned that I wasn’t sure how our budget would end up in April.

Our accommodation spending was due to be low, but we were staying in St Louis and Kansas City and had a lot of places we wanted to eat and drink at. As a result, I’d figured that the eating out portion of our spending could end up being much higher than normal and push us over budget.

As expected, we did end up spending much more on eating and drinking than normal in April, but was our lower spend on hotels and Airbnbs enough to offset that? Read on to find out.

Miles Driven

April began with 195,530 miles on our car’s odometer. At the end of the month its reading was 197,414 which means we drove 1,884 miles in April. I’d predicted that we’d drive 2,400 miles, so I way overestimated that.

Looking ahead to our mileage for May, we’re currently due to drive ~1,200 miles based on the various cities we’re staying in. We’ll be doing driving back and forth to various attractions during that time which will add extra mileage, so I’ll guess we’ll drive 1,950 miles in May.

Money Spent

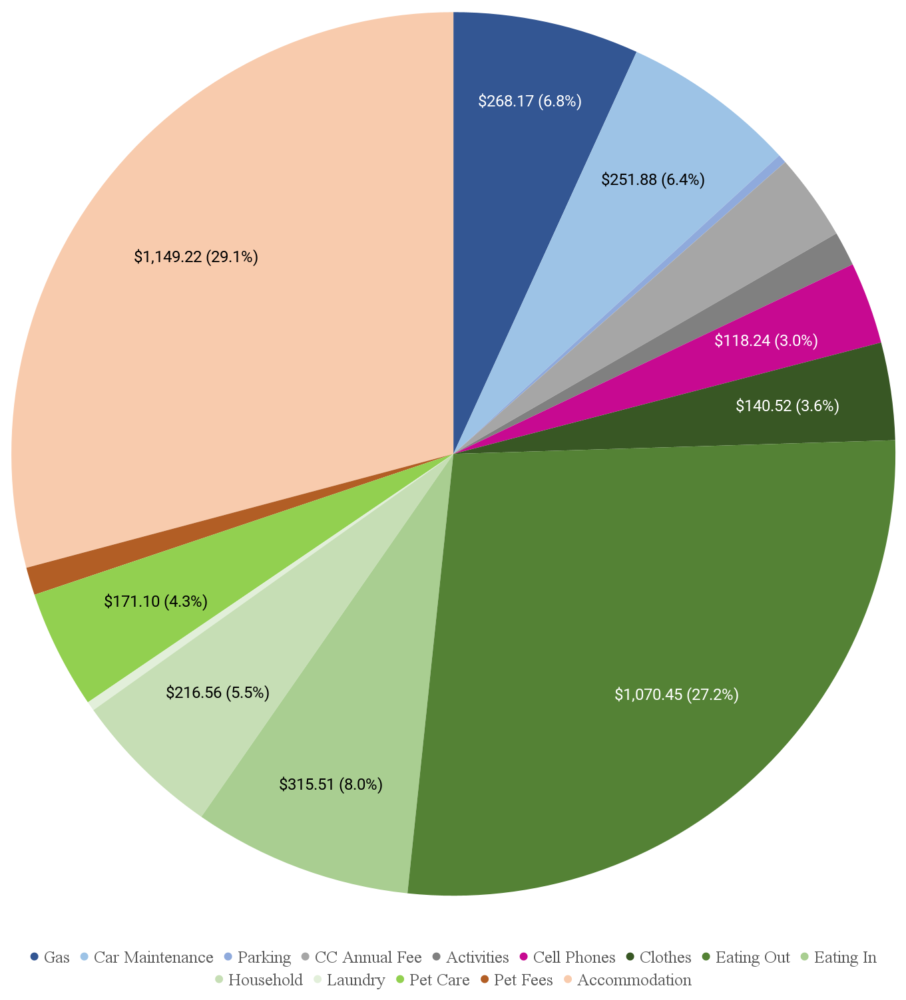

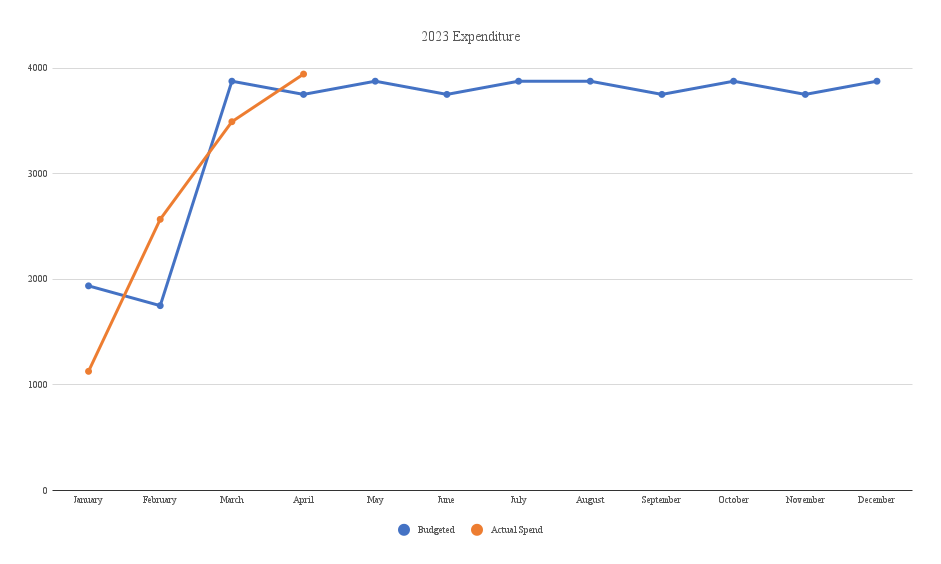

Our road trip budget is $125 per day which covers everything – accommodation, food, gas, activities, etc. With 30 days in April, that meant we had $3,750 to spend. By the end of the month we’d spent $3,942.45 which means we went $192.45 over budget.

As expected, it was our eating and drinking out that pushed us over budget. We spent an obscene amount on that – $1,070.45 – but funnily enough it ended up not being St Louis or Kansas City that was the eventual cause. We did spend a decent amount on food and drink in those two cities, but after arriving in Sioux Falls, SD we discovered that there were lots of pet-friendly breweries and distilleries in the city and we wanted to visit as many as possible.

One afternoon we went for what was meant to be a quick drink at a distillery. We’d planned to just do a tasting, but we had such a great time we stayed for a drink. And another. And another. And another. Shae and I ended up staying until closing, with that one afternoon (and evening!) accounting for pretty much that entire $192.45 overspend. Oops! Still, we had a great time and were glad that our hotel was only a five minute walk/stumble away 😉

Here’s a breakdown of our spending for April…

…and a chart tracking our spending this year so far.

Looking ahead to our spending for May, I’m not at all optimistic about our chances of staying under budget. We’re planning on not spending as much eating out, but our accommodation spending will be much higher than normal. That’s because most of our stays this month will be paid for with cash rather than points. We’ve booked paid stays as they’ve been good value, but it’s still a larger proportion of paid nights than normal which means we’re almost guaranteed to go over budget. Hopefully we can reduce some of our other spending so that we don’t vastly overshoot our budget though.

Accommodation Cost

We stayed in six different places during May – here’s how we paid for all those stays.

April 1-3: Holiday Inn Little Rock-Presidential-Downtown, AR (see my review here). We stayed here a total of four nights, with two of those nights falling in April. IHG One Rewards points were used to pay for our stay, with the 4th night free and 10% points rebate once again coming in handy. As a result, we redeemed an average of 17,550 points per night which had cost us $87.75 per night to buy those points.

April 3-14: Hyatt Regency St. Louis At The Arch, MO (see my review here). Shae and I stayed at this great hotel for 11 nights and redeemed 8,000 World of Hyatt points per night.

April 14-21: Airbnb in Kansas City, MO. We booked an 8 night stay at this Airbnb but left a day early because between the creaking floorboards above us and the highway construction going on outside which was literally shaking the building throughout the day, Truffles was barking like crazy and we couldn’t take it anymore.

It had cost $132.52 per night, but we paid with Airbnb gift cards bought at a discount which made the net cost $112.64 per night.

April 21-22: Hilton Garden Inn Omaha Aksarben Village, NE. Our next stop was Sioux Falls, but leaving Kansas City a day early meant we needed to find somewhere to stay overnight. We booked a night at this Hilton Garden Inn because it was around the corner from Kinkaider Brewing’s taproom in Omaha. We redeemed a Hilton free night certificate for the stay which was awful value because that certificate can be used at any Hilton worldwide – even one costing $1,000+ per night. However, it was due to expire a week or two later and we didn’t have any other use for it, so at least it didn’t go completely to waste.

April 22-30: Holiday Inn Sioux Falls-City Centre, SD. We booked this stay using IHG One Rewards points. IHG uses dynamic pricing which means the number of points needed per night can vary. For our dates, the costs ranged from 23,000 to 34,000 points per night. My IHG Premier credit card gives us every 4th night free on award stays, so both the 4th and 8th nights were free. We also get 10% of the points back thanks to having the IHG Select credit card, so the net cost was 17,888 points per night. We bought those points for 0.5cpp (cents per point), so the stay effectively cost us $89.44 per night.

April 30-May 1: Baymont Pierre, SD. We paid for this stay rather than redeeming points because it only cost $72.73 per night with tax.

Hotel Points Earned

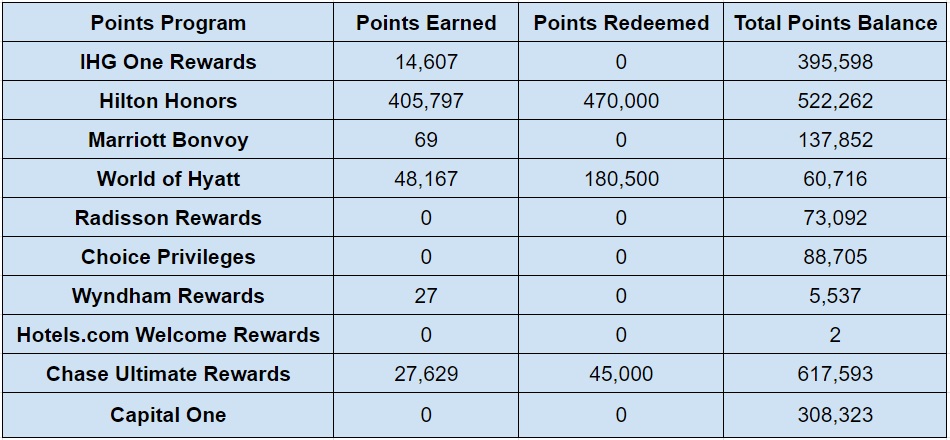

We didn’t earn a huge number of points in April, but the numbers below make it look like we did. With Hyatt, most of those points were transferred over from our Chase Ultimate Rewards balances.

For Hilton, most of the increase was due to me taking advantage of the 30% bonus American Express was offering last month when transferring Membership Rewards to Hilton. While that’s not always the best use of Membership Rewards, we were also redeeming a bunch of Hilton points and knew that we might need to redeem quite a few more in a few months time. We might need those points at short notice, so I figured it was better to transfer Membership Rewards now with the 30% bonus rather than needing to do that later without the bonus opportunity.

Here’s a breakdown of the points we earned and/or transferred in:

- IHG One Rewards – 14,607

- Hilton Honors – 405,797

- Marriott Bonvoy – 69

- World of Hyatt – 48,167

- Radisson Rewards – 0

- Choice Privileges – 0

- Wyndham Rewards – 27

- Hotels.com Rewards Credits – 0

- Chase Ultimate Rewards – 27,629

- Capital One – 0

Hotel Points Redeemed

We booked quite a few upcoming award stays in April, so here’s how many points were redeemed last month:

- IHG One Rewards – 0

- Hilton Honors – 470,000

- Marriott Bonvoy – 0

- World of Hyatt – 180,500

- Radisson Rewards – 0

- Choice Privileges – 0

- Wyndham Rewards – 0

- Hotels.com Rewards Credits – 0

- Chase Ultimate Rewards – 45,000

- Capital One – 0

Total Hotel Points Balances

As a result of those changes, here’s how our points balances ended up at the end of April:

- IHG One Rewards – 395,598

- Hilton Honors – 522,262

- Marriott Bonvoy – 137,852

- World of Hyatt – 60,716

- Radisson Rewards – 73,092

- Choice Privileges – 88,705

- Wyndham Rewards – 5,537

- Hotels.com Rewards Credits – 2

- Chase Ultimate Rewards – 617,593

- Capital One – 308,323

Here’s all that information in table format:

Hotel Free Night Certificates

We redeemed that Hilton free certificate in April, but also received another one from the renewal of one of our Hilton Aspire credit cards. We also earned another Hyatt category 1-4 free night certificate from the renewal of one of our Hyatt credit cards.

- IHG (up to 40,000 points per night) – 3

- Hilton (any property worldwide) – 3

- Marriott (up to 35,000 points per night) – 1

- Marriott (up to 40,000 points per night) – 0

- Hyatt (category 1-4) – 1

- Hyatt (category 1-7) – 1

Blog Stats

Shae and I did a better job of publishing new posts last month, so we managed to get 14 done; hopefully we can get even more written in May.

- Number of blog posts published – 14

- Page views – 23,001

Final Thoughts

It was disappointing to go over budget in April seeing as we were on course to stay under budget until the last few days of the month. Still, at least it was only a couple of hundred bucks over and not even more than that!

[…] publishing our stats for April, I’d mentioned that our spending for May would likely be higher than normal seeing as nearly […]